The best answer is two-fold:

- it has a better APY

- the value prop for growing the Hive ecosystem is superior

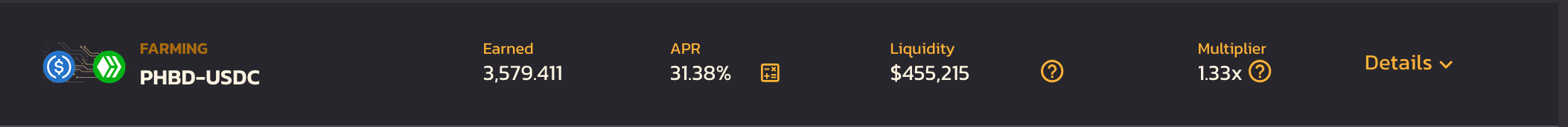

#1 is the selfish reason to do it. You can earn 31% APR right now for staking pHBD-USDC.

You also have the benefit of it being 100% liquid (if you stake HBD on-chain, there is a 3 day unlock period).

11% more might not sound like much, but it is a big deal in the stablecoin world.

#2 is the altruistic reason: it cannot be relied upon as we must assume that everyone will do what is in their best immediate interest. However, if nobody provides liquidity for HBD on exchanges (pHBD-USDC on Sushiswap being an example of an exchange), then HBD and the Hive ecosystem will struggle to gain outside adoption - which is the ultimate goal of HBD in the first place

Posted Using LeoFinance Beta

Explained in a way even I can understand. Superb answer, especially the second part.

Thank you very much for taking the time and best wishes fella :-)

No problem! Glad to help :)

Posted Using LeoFinance Beta

Why, 11% is a very solid increase in salary and I doubt it that all banks can provide you with 11% per annum in stable currency.

Posted Using LeoFinance Beta