Tokenization has always caught my eye as one of the most exciting aspects of the crypto industry. Going all the way back to the days when we were obsessed with SMTs and the prospect of creating tokens on this blockchain.

Today, we have tokenization on Hive through awesome second-layers like Hive-Engine. We also see other blockchains riding the Tokenization wave. Whether you're on Ethereum, BSC, Avalanche, Hive or really any blockchain, there is some aspect of tokenization happening.

Tokenization is happening in all sorts of formats and for all sorts of assets. We saw a major crazy for Non-Fungible Tokens (NFTs) by the general public and this trend of "normies" coming into the space for various token use cases will continue.

The Tokenization of Everything: Trillions to Flow Onto Blockchains

Investment Bank Citi just published a massive report. In it, they outline their vision for the future of DLT (Distributed Ledger Technology) and the tokenization of real-world assets.

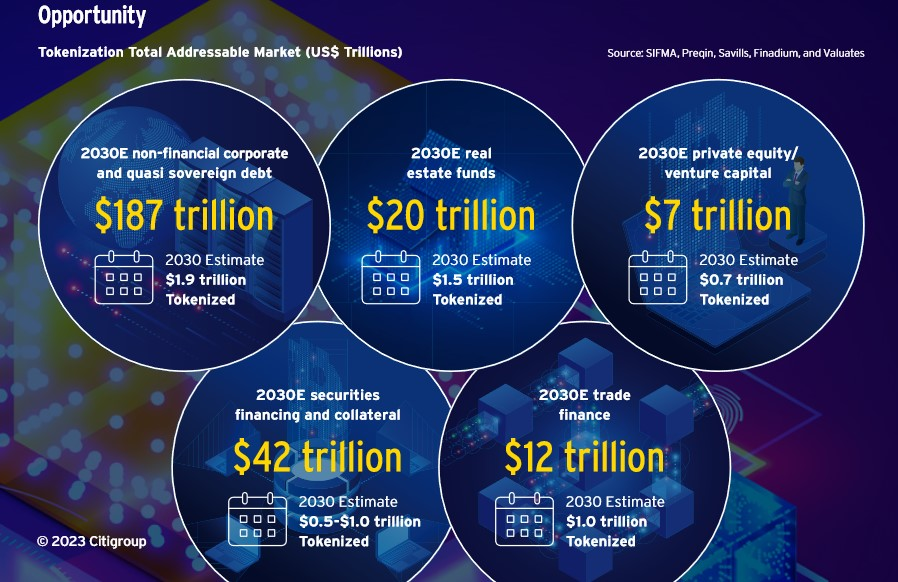

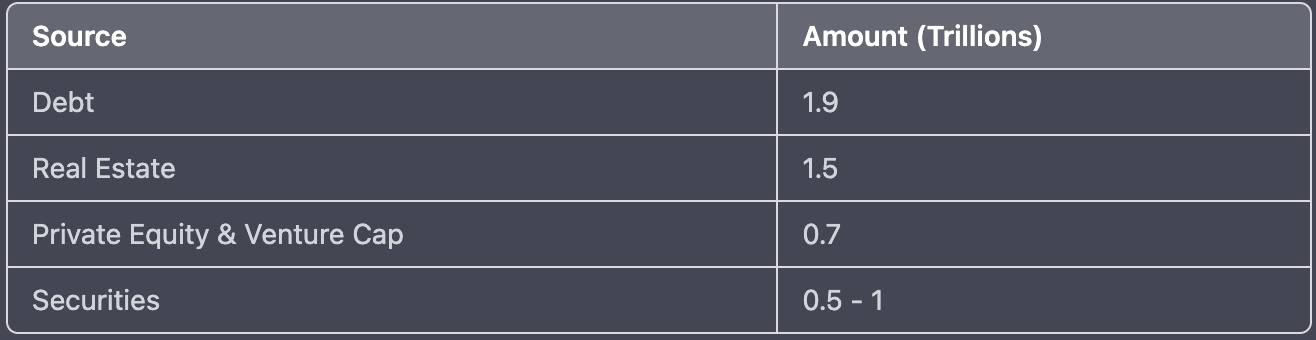

They believe that by 2030, $4-$5 Trillion in real-world assets will be tokenized on the blockchain. That's an 80 fold increase.

The above 4 categories are where they believe these trillions of dollars will flow. While it might seem like a large amount of capital, it's actually somewhat small when you evaluate the total value of these categories:

(source: citi)

Why tokenize? Here's what Citi says:

"“Traditional financial assets are not broken, but sub-optimal as they are limited by traditional systems and processes,” it said. “Certain financial assets — such as fixed income, private equity, and other alternatives — have been relatively constrained while other markets — such as public equities — are more efficient.”"

Why Tokenize?

From my point of view, tokenizing has always been the logical next step for assets.

A great example is looking at businesses and the yellow pages. It used to be important for a business to be listed in the yellow pages. That's how people could find you.

Then the internet came along. Businesses both small and large rejected the idea that it "mattered" to have a website on the internet.

They couldn't see the next logical step of evolution for listing their business. They adopted yellow pages, why is the internet any different?

Technology tends to do this to us. It keeps us in the dark. We don't know right away that something is going to be a big thing that you need to use. From the perspective of the moment, we're limited in our breadth of seeing what's next.

In my opinion, Tokenization is like that internet moment. A lot of businesses and corporations don't yet see the need to tokenize. We haven't hit that critical mass of adoption yet where the tipping point causes people to be forced to tokenize or become irrelevant.

The points made by Citi are valuable: TradFi is not broken (although I don't fully agree with that) but they are sub-optimal.

They're sub-optimal in relative nature to tokenized assets. If you've used crypto for even one day to move BTC from one exchange or one wallet to another, then you know the power of tokenization.

If you dive deeper and use tokens like HIVE or LEO, then you see a whole other world open up in front of you. Mini-economies form and you start to see a much different version of the future. Start layering in more complex version of tokens like NFTs or Soublound NFTs... Now you're starting to see the true power of tokenization: the ability to layer in contracted rules for tokens.

You can imagine a whole new global landscape for assets. Instead of being landlocked by TradFi, you can be globally accessible as a token.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter

Discord

Whitepaper: https://twitter.com/FinanceLeo: https://discord.gg/E4jePHe: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3

Microblog on Hive:

LeoMobile (IOS)

LeoMobile (Android)

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats

LeoDex

LeoFi

BSC HBD (bHBD)

BSC HIVE (bHIVE)

Earn 50%+ APR on HIVE/HBD: https://leofinance.io/ https://leofinance.io/threads: https://testflight.apple.com/join/cskYPK1a: https://play.google.com/store/apps/details?id=io.leofi.mobile: https://hivestats.io: https://leodex.io: https://leofi.io: https://wleo.io/hbd-bsc/: https://wleo.io/hive-bsc/: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC)

PolyCUB (Polygon)

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://cubdefi.com: https://polycub.com: https://wleo.io

Posted Using LeoFinance Beta

Sub-optimal is a good term to describe the tradfi system. It can't keep up with the complexity of the digital era. Tokenisation unlocks many capabilities that couldn't exist in the traditional system. I'm waiting for the when tokenised real estate becomes mainstream and easy accessible to many of us.

~~~ embed:1642084833559019520 twitter metadata:MTQ3MjY5MzcwMDkzMzM0NTI4Nnx8aHR0cHM6Ly90d2l0dGVyLmNvbS8xNDcyNjkzNzAwOTMzMzQ1Mjg2L3N0YXR1cy8xNjQyMDg0ODMzNTU5MDE5NTIwfA== ~~~

The rewards earned on this comment will go directly to the people( @seckorama, @kalibudz23, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

The rewards earned on this comment will go directly to the people ( seckorama ) sharing the post on LeoThreads,LikeTu,dBuzz.https://leofinance.io/threads/@seckorama/re-leothreads-aavtu6ko

Excelente post amigo. Crees en una tokenizacion globalizada?

Sometimes I imagine what a tokenized world would be like in real life, with all our daily activities being paid according to our daily performances, haha!

Anyway, that's a nice overview about the future of blockchain.

I totally agree with this opinion of yours boss. Just like the internet moment you where still talking about, even when the internet provides valuable stuffs and less stress gap, some still preferred doing it manually. It's a normal thing for one not to believe what the future holds for crypto on the other hand it is still a normal thing for one to miss thee goodies attached to it.

!PGM

!PIZZA

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

$PIZZA slices delivered:

torran tipped khaleelkazi (x1)

(1/5) @stefano.massari tipped @khaleelkazi (x1)

The exception was Thomas Edison. :)

Posted Using LeoFinance Beta

I'm becoming increasingly a believer in the tokenisation of real-life assets. Though some issues are still to overcome one of the biggest is the link between the digital token and the real-life asset, without the possibility of compromising this.

A year or two ago, LCX launched this Tiamonds asset. Digital (NFT) tokens representing real diamonds. Real diamonds are held in a physical vault in a Liechtenstein-based bank, with official government documents for 1) the link between the NFT and the diamond, and 2) the company holding the keys to the physical vault. All under the Liechtenstein blockchain and financial laws.

Recently an initiative launched to do something similar to Tiamonds, but for luxury goods. Similar setup wrt laws (EU in this case) and all, though they are still building their service. It's Galileo Protocol. Super interesting what they try to do, though I believe they have to overcome a whole lot of hurdles still. For instance, they started out stating they like to tokenise real estate. However, in many of the EU countries (maybe all, don't know to be honest), a real estate transaction needs to be signed by a notary. For trading of real estate by eg NFT trade only, this is simply not allowed by law. I mean, the system needs to be changed.

Satishi Island is another project that is exploring the tokenisation of real-life assets. In this case, it's physical land one can acquire by buying land NFT. In this case not virtual land, but real land. The organisation driving this Satoshi Island project made deals with the government for them to be allowed what they are doing. Essentially a private island is bought (well, more or less long-term rented) from its original owners, and is now in transition to become a fully crypto-based island, with its own currency, its NFT-based land ownership and a DAO to govern the island society.

80x growth seven years from now. That’s great! Good to hear from an influential bank like Bank Citi a confirmation about the direction of DLT and tokenization of those four assets.

I !love that!

First time to hear here about micro-investing, and then later micro-earning, and now micro-economies. Really a different vision of the future of finance. I love the concept of digital nations providing real economic inclusion for everyone from any part of the world via tokenization.

!CTP

(1/1) sent you LUV. | tools | discord | community | HiveWiki |

HiveWiki |  NFT | <>< daily

NFT | <>< daily

Congratulations @khaleelkazi! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 24000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!

Amen brother. Tokenization will become the norm. I remember first learning about crowdfunding real estate investment. At the time, several years ago, it was unregulated, there was a high risk of default, and there was no liquidity. If we tokenized those real world real estate asset and created a secondary market for trading those tokenized (NFT) assets, liquidity would become less of an issue, since people could theoretically sell their stake in a property and gain capital immediately, rather than wait for the market to find a buyer (which could be an undetermined amount of time).

Tokenizing utilities is another thing that Citi didn't seem to mention. Electricity, Water, Natural Gas, Internet Service/Bandwidth, and Gasoline, Crude Oil - holy shit - you're looking at way more than just a few trillion. That's the backbone of the entire global economy. You could theoretically cut the government out of ALL utilties ownership entirely. The death of the monopoly is coming..it just needs time to mature.

Posted Using LeoFinance Beta

In this post you write that tokenization has always been the next step for assets for you. I think the same. Tokenization would make buying and selling any asset much easier around the world. So I also believe that it is a natural transformation that will happen in the future. !PIZZA

Posted Using LeoFinance Beta

I jut wish the in real world, tokenization will be copy and every human efforts would be rewarded, the Idea here is really helpful.

I share your love of Tokenization.

I think Tokenization is the future.

Trad-fi is full of rent seekers, people who add no value but extract value by using power and influence to be designated gate keepers. They find money streams created by the hard work of others and stick a straw into it. Then they suck off money like a mosquito or flea. They also cause delays in executing transactions. They need to be cut off at the straw.

The Tokenization of real estate is more efficient, by which I mean faster and cheaper settlement, by several strategies, one of which is bypassing all the men/women with straws.

Another word for that is disintermediation.

Posted Using LeoFinance Beta