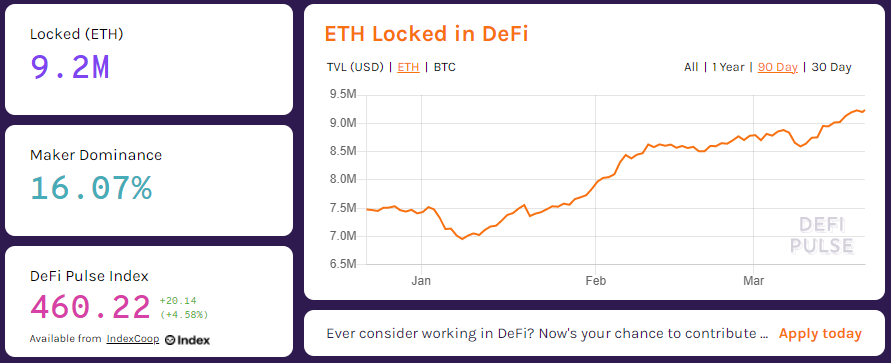

More than 9 million Ethereum is locked in the Decentralized Finance (DeFi) sector, due to the large number of locked Ethereum numbers, Ethereum will keep its price appreciating again, and of course this is a positive impact of DeFi.

Ethereum Locked On DeFi Touches Record High

DefiPulse, the data provider company, stated that the number of Ethereum locked in DeFi has reached 9.2 million Ethereum.

If we look at the Ethereum price at $ 1,829 then the Ethereum as much as 9.2 Million is worth around $ 16.8 Billion, that number has around 8.3% of the total Ethereum supply which is more than 115 Million Ethereum.

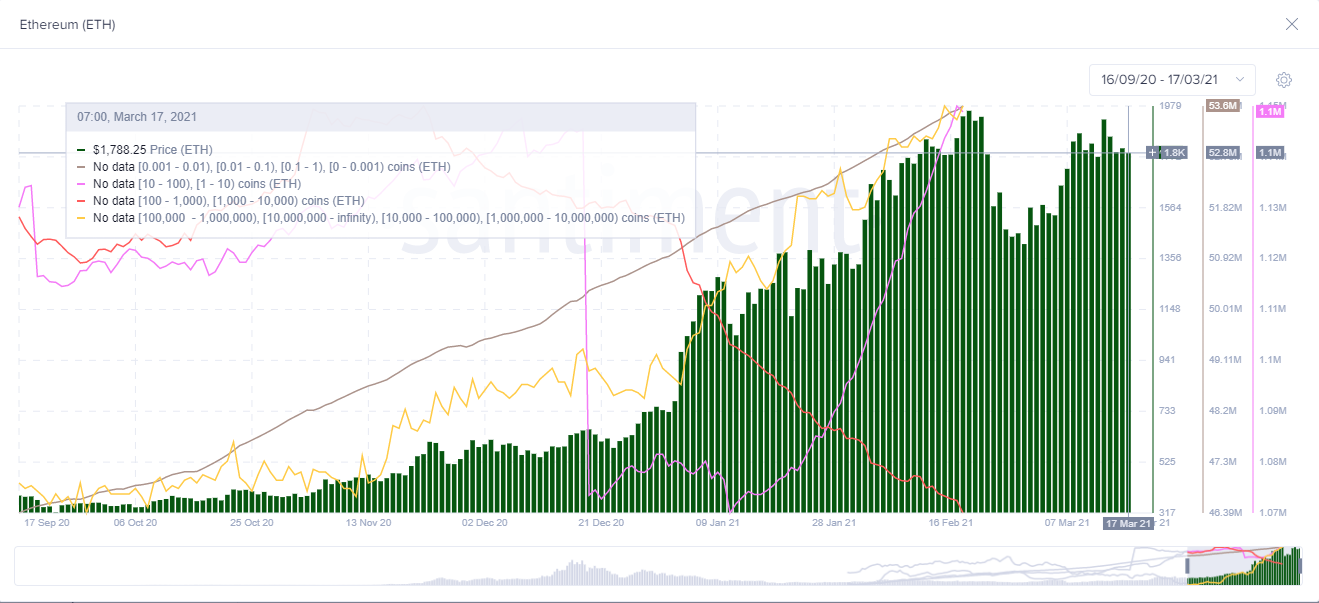

According to a report from Sentiment, the number of accounts holding 100 Ethereum to 1000 Ethereum has decreased by about 7% since Ethereum hit its recent high.

Chris Cable, party from FlamingoDAO, also commented on the amount of the account, noting that the drop was due to DeFi, stating:

The majority of 100 to 10,000 Ethereum accounts move their Ethereum to DeFi to "work".

Data from Glassnode also shows the number of Ethereum locked in DeFi has been growing steadily in the last three months, the average growth has grown to 9.6% per month, with the highest growth occurring on February 17, 2021 with a growth of up to 11.2%.

An increasing number of institutional investors

The sentiment also states that if the majority of big players with the number of Ethereum over 10,000 still have deposits and have not planned to sell them, speculation is growing, if Ethereum is part of institutional investors who are from companies, exchanges, or financial institutions managing funds.

Anthony Sassano, a professional analyst also commented on this, he stated that many companies are eyeing Ethereum as a safeguard for their funds after Bitcoin. He stated:

“Ethereum is slowly becoming the goal of big companies as a safeguard for their funds. One example is Meitu which owns more Ethereum than Bitcoin."

One of the reports this month reported that the Chinese tech company Meitu had purchased 16,000 Ethereum worth $ 28.3 Million as part of their crypto investment.

It seems that confidence in Ethereum is increasingly looking to be increasing, and it is likely that it could cause its price to continue to rise.

However, since March 16, 2021, it seems that Ethereum has begun to consolidate again, possibly a result of the global financial market impact, but it does not rule out the possibility for Ethereum to rise again and maybe even to continue its appreciation which occurred at the end of February 2021.

Read more about cryptocurrencies and blockchain here @khezcute

Posted Using LeoFinance Beta