The volume of decentralized exchange liquidity (Dex) in the Decentralized Finance (DeFi) sector has just reached its current peak, all this could have happened as a result of one ruler who has dominated the DeFi sector with the amount of trade that took place on the DeX.

DeX Volume Is At Its Highest

The volume of liquidity that continues to increase at this time is due to the large number of collateral deposits provided for DeX, the majority of users of the collateral are traders who carry out margin trading or lavarage using debt, so that the positions that can be opened become even bigger.

By now DeX has reached the $ 10 billion mark, and the majority of this increase is only in 2021, this data has been recorded by the Messari website which also issued a statement that the majority of the liquidity of all that DeX gets, comes from one ruler.

This ruler is Uniswap which seems to continue to dominate DeX which is moving on the Ethereum Blockchain, Uniswap has also been seen to have won the title, which Uniswap had lost competitiveness in Volume by PancakeSwap, but now Uniswap has managed to reclaim it as a whole.

Uniswap Which Dominates

Uniswap presenting more than half of the trading volume in the DeFi sector on a weekly basis, Rahul Rai, a researcher, stated that the volume of DeX trading has increased to reach $ 72 billion.

A report from DappRadar, if Uniswap already has more than half of the locked liquidity in the entire Dex with a total locked up of $ 5.4 billion, Rahul Rai also added that some of these DeX have several problems that hinder the growth of this DeX,

"Several problems such as non-permanent losses, insufficient funds, accuracy of opening and closing positions (slippage), transaction fees, transaction speed, and openness to too many tokens are obstacles to the growth of the majority of Automated Market Maker (AMM)"

-based DeX

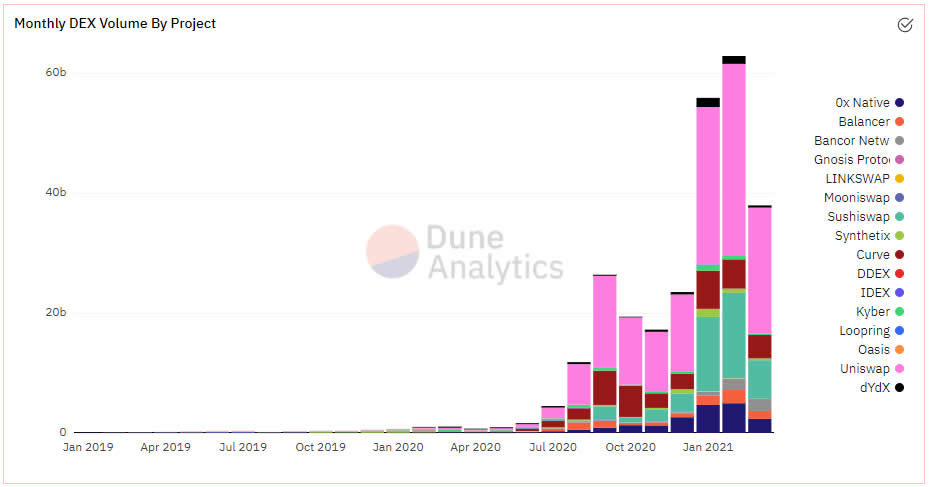

According to data from Dune Analytic Uniswap can occupy the first position because Uniswap's dominance on Ethereum-based DeX is still growing, this can be seen from the weekly transaction volume of $ 6.5 billion, which is **62.2% **of the total Ethereum-based DeX volume.

In second place SushiSwap, with weekly volume of $ 1.6 Billion or 15.2% of the overall Ethereum-based DeX.

And in third place, Curve Finance with $ 647 Million weekly transaction volume or 6.2% of all Ethereum-based DeX.

However, Uniswap is not always on top, because currently the domination of Uniswap is threatened due to 1INCH which has a transaction volume of $ 1 billion in the last seven days.

Seen as a whole in March 2021, the trading volume owned by DeX has reached $ 44.3 billion, for now the dominance is held strongly by Uniswap, and is likely to continue, and this condition certainly provides a positive sentiment for UNI tokens.

Read more about cryptocurrencies and blockchain here @khezcute

Posted Using LeoFinance Beta