J.P.Morgan has reported to the Securities and Exchange Commission (SEC) to issue new instruments.

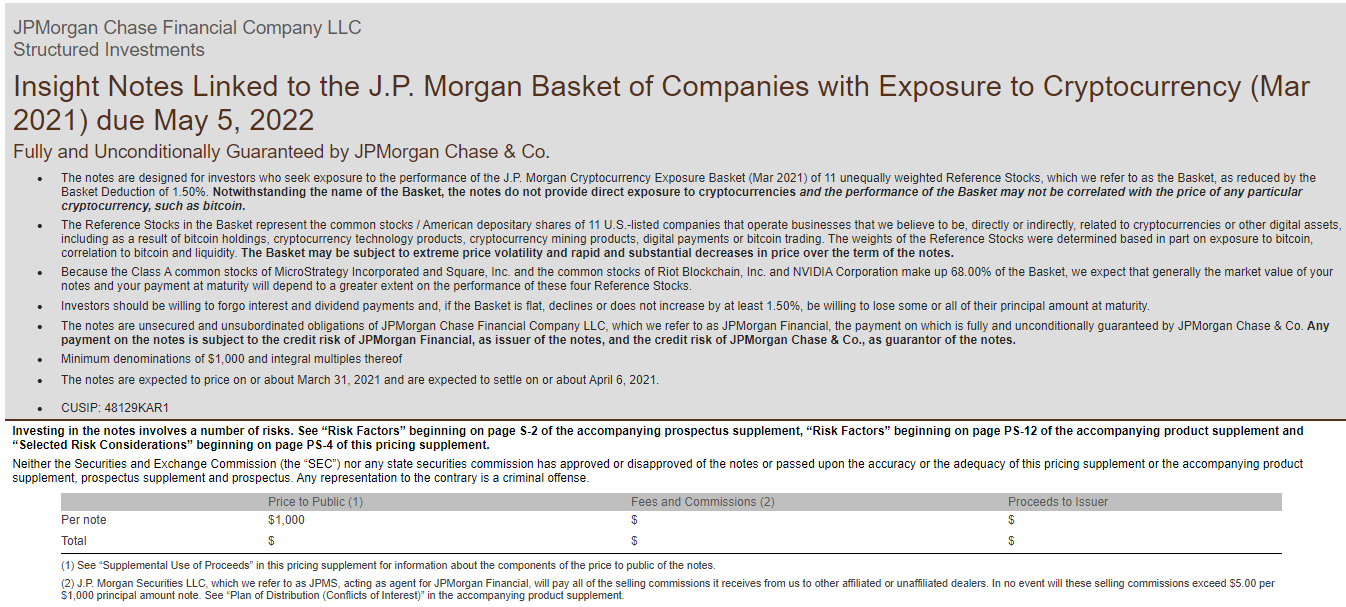

This new instrument is a debt financial instrument which will be tied to 11 company stocks in the crypto field.

J.P.Morgan Issues New Instruments

J.P.Morgan has created a new debt instrument which gives investors access to several stocks in the crypto field.

This news is obtained from the published license which is used to be submitted to the SEC by the company J.P.Morgan in order to issue this new instrument.

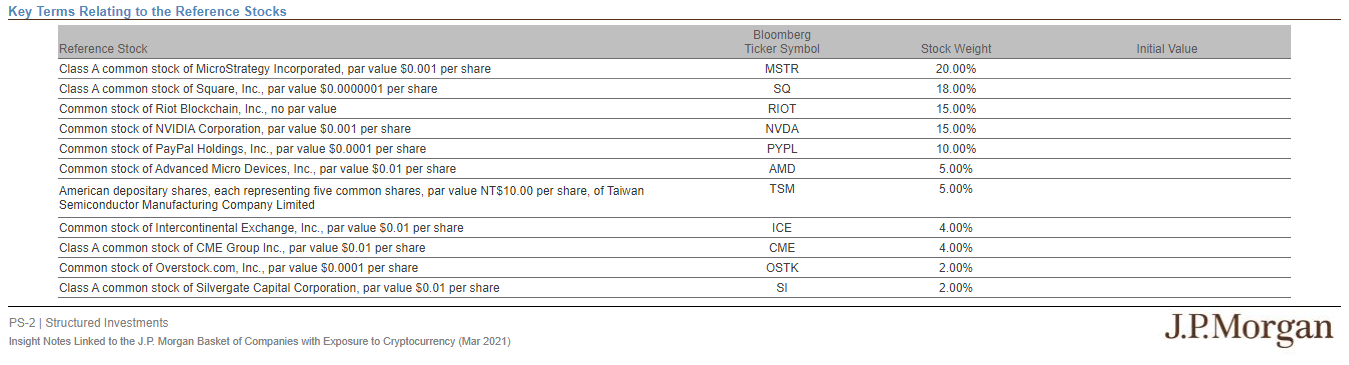

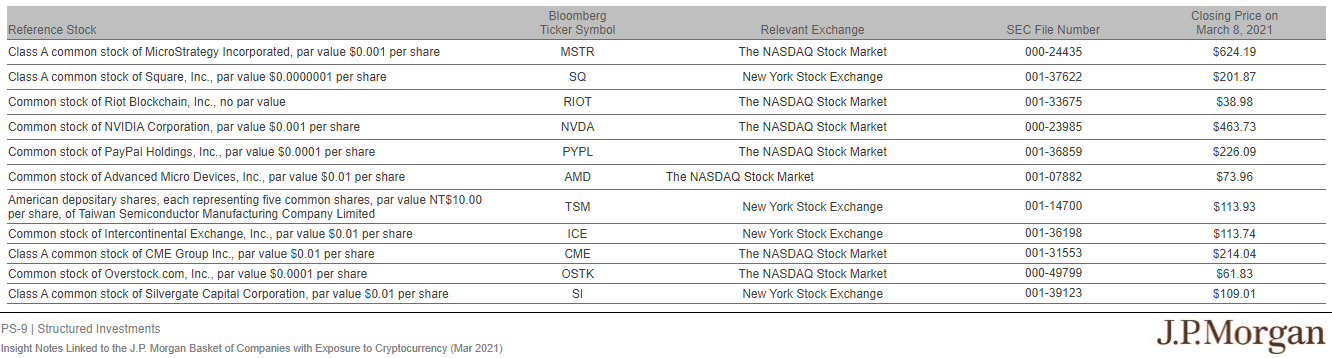

In this instrument, it is described as a financial instrument containing 11 shares of American companies whose diversification is spread unevenly.

This financial instrument has allocated 20% to the shares of MicroStrategy, this company already has around 91,064 Bitcoin(BTC) in the company's financial statements.

The allocation of these funds was also given to the Square company shares by 18% and for Riot Blockchain by 15%, these two companies are companies with a very significant number of Bitcoin(BTC) adoption.

Then the allocation of funds will also be distributed to the shares of the PayPal and Nvidia companies, each of which will receive a load of 15%.

The 6 other companies included in this fund allocation are Silvergate Capital, CME Group, Taiwan Semiconductor, Advanced Micro Devices, Intercontinental Exchange and Overstock.com shares of these companies are also included in the instrument.

Regarding this instrument, the J.P.Morgan company has officially provided a statement, wherein their company states that:

"The weight of the selected shares is determined based on the company's openness to Bitcoin. This is due to the determination of the correlation with Bitcoin and liquidity."

The company J.P.Morgan also stated that the yield on the instrument would be based on the performance of the shares of the companies mentioned in this instrument.

J.P.Morgan Supports the Crypto World

The company J.P.Morgan also stated that the minimum investment was $1,000, ending in May 2022.

"This instrument can be likened to a corporate bond but has slightly different characteristics as a result of having the characteristics of a mutual fund in it."

The most important thing in this instrument is proof of the ease with which institutional investors can enter and access the crypto world.

Until now, the average company on Wall Street has started to enter significantly into the world of crypto, and the majority of other companies are also starting to be interested in entering this crypto world.

It may also be due to these factors that seem to have kept Bitcoin from managing to stay above $40,000 to $50,000.

And this instrument is also one proof of J.P.Morgan's support for the crypto world, which, as we know, during this time J.P.Morgan still looks uncertain in its view of the crypto world.

With this new instrument, it is clear evidence that the crypto world will continue to grow with the many types of financial instruments that will exist in the crypto world.

This instrument is likely to be a great instrument for the crypto world and will probably support several other large crypto instruments, one of which is the Bitcoin Exchange Traded Fund(ETF) in Canada.

Read more about cryptocurrencies and blockchain here @khezcute

Posted Using LeoFinance Beta