The loss of $500 million worth of Bitcoin (BTC) within 1 hour resulted from a buy position using debt funds or commonly called leverage, this happened on several major crypto exchange exchanges.

As we know, Bitcoin (BTC) recently touched its highest price, making about $500 million of liquidated leverage position.

Bitcoin Lost Due to Leverage

Bitcoin (BTC) has just refused to go up to a price higher than around $60,000 on March 15, 2021, the correction has resulted in a significant loss of Bitcoin (BTC) due to the use of enormous leverage.

Jan and Yann, the founders of Glassnode, they emphasized that if this correction was the biggest in 1 hour, they also said that if more than half of the long positions were occurs in the futures market, it appears that it has been liquidated through a margin call or by force.

This liquidation occurs because there is leverage or debt funds of 20 times the majority used by the position, namely the buying position using debt funds.

pic.twitter.com/Negentropic_

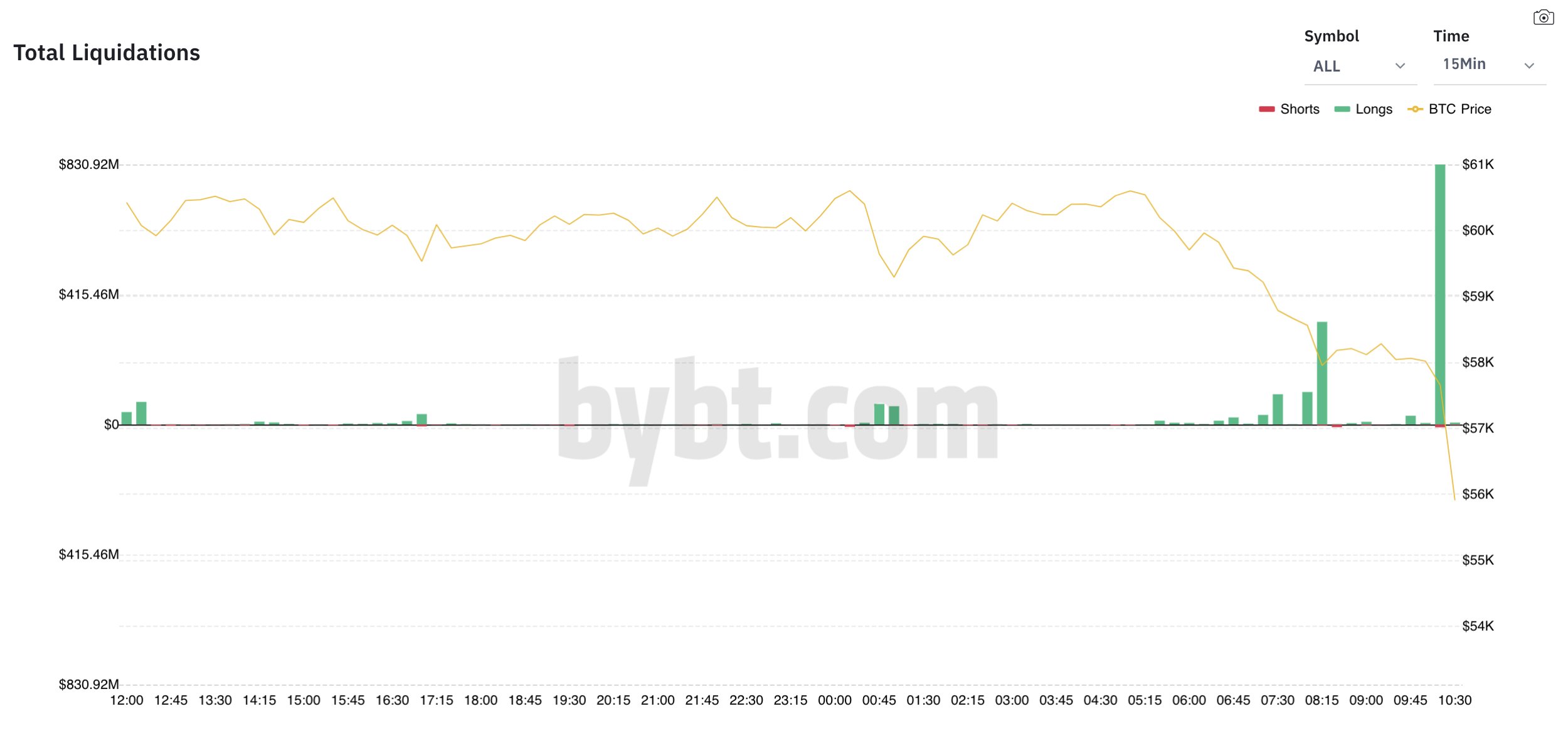

But data from Bybt, reports that about $800 million Bitcoin (BTC) liquidated occurs within 15 minutes of the correction.

pic.twitter.com/cryptounfolded

To be one of the biggest corrections

Data from Datamish shows that in the last 24 hours there have been 292 buy positions on the derivatives market of the BitMEX exchange worth $95 million.

This also happened to the Bitfinex exchange, where 488 positions were liquidated worth $100 million, which occurred simultaneously with BitMEX.

The second largest liquidation occurred on February 22, 2021, where Bitcoin (BTC) experienced the highest fall from $58,000 to $47,000.

The Cointelegraph report of around $5.9 billion appears to be liquidated at the time of the correction that occurred on February 22, 2021.

Since hitting a high of $61,000, Bitcoin (BTC) has seen a 12.3% correction towards $53,000 until the trading session on March 16, 2021.

Currently Bitcoin is trying to get back on track but of course it still has a few barriers. This correction becomes the third downward movement when conditions are positive.

Data from Bitcoin Fear and Greed also shows that currently market conditions are becoming very uncontrollable, and are becoming very "greedy" or filled with an impulse to buy.

However, this correction has brought the index to return to “greedy”, which indicates the potential for quite high selling pressure. Currently Bitcoin (BTC) is hindered by several negative sentiments, especially because the price has just gotten to its highest point.

In addition, Bitcoin (BTC) also experienced a difficult time where sentiment was hindered by American bonds whose profits continued to rise until it depressed Bitcoin (BTC).

Read more about cryptocurrencies and blockchain here @khezcute

Posted Using LeoFinance Beta