Hello LBIers, today we take a suggestion from one are investors who asked last week what is the difference in APY between LEO and LBI and if holding LBI would earn more than holding LEO. At first, I thought, what? Of course, LBI produces a better ROI than LEO does but then I thought I can't actually prove that until I post the evidence to the blockchain and maybe other people would like to know the answer to this so let's have a look and see.

We'll start with LEO because it's easier. LEO can be used for a few things, off the top of my head i can think of 2 things that is LEO only and 2 things that require LEO to be paired with another asset. Let's look at LEO on its own first. It's worth noting that to use LEO to produce a return requires you to power it up.

1st and most popular way to use LEO is to curate content on the LeoFinanace frontend. We all know about this, I dont need to explain how it works. LeoFinance has a set curation reward so there is no peak time to upvote like there is with HIVE content. This is a good thing I think as it's not possible to upvote content at 4-5 mins after upvote considering alot of posts take longer than that to read. Another advantage to this is your curation rewards are more stable and predictable, in the world of crazy crypto, this is nice. The ROI for LEO curation range's from 16-19% depending on how many other users are actively curating and sharing the reward pool at any given time. We'll call it 17% which I think is fair but to get that 17%, you need to maintain a 90%+ voting power balance and you will have to use 1000% of upvotes every day so your not wasting any voting power. To earn the max from curating, there are no days off.

The 2nd way to use powered LEO is to head over to LeoFi and provide a LEO lease for another user that is looking to (i guess), increase their curation rewards. This is a semi-passive income because you need to maintain your leases. You'll need to know when leases are ending so you can recycle your LEO into new leases. On a daily basis, your input is not required and the work involved in leasing LEO overall is very slow. The current APY is 12.5% which is lower than curating but the time required to lease is much less than curating. I think 12.5% is very good when you can fill leases for 26 weeks and basically do no work for 6 months.

Next, we look at ways to earn LEO when it's paired with another asset. All of these ways to earn from LEO require it to be liquid and used as part of an LP token. IL will play a huge factor here. As an example, if you had put 1000 LEO into the LEO/BNB LP on Cubfinance when LEO was $1, right now you would have way way more LEO in that LP Token and your harvested CUB, when converted to LEO, would be a small percentage of your LEO gain so it's hard to guess ROI. The best I can do is go off the advertised APY for harvests.

1st way is you can wrap your LEO to BLEO on the BSC and then pair it with the same value of BNB on pancake into an LP token that can be staked on Cubfinance in the farm's section. There are 2 ways to do this. You can convert half your BLEO into BNB are you can match it off with BNB you already have. This will earn an APY of roughly 60% paid in CUB tokens. From my POV, if you converted half your LEO in BNB, your APY is 60% on your LEO but if you matched your LEO with BNB you already hold, your APY is 30% for LEO and 30% for BNB. I'd assume most people will convert half their BLEO into BNB so we'll call it 60%. Im not going to get into BNB fees, you should as it'll most likely surprise you how much you actually pay in fees when compared to your profit.

The 2nd LP token that LEO can be used for is on Beeswap. LEO can be paired off against HIVE to create an LEO/HIVE LP token. When staked on beeswap, this will earn a roughly 20% APY in the form of BXT tokens that are paid out daily. The same as above applies here in regards to how you invest, if you convert half your LEO in HIVE are not. For talk's sake, we'll call it 20%.

There might be other ways to earn from the LEO token but im not aware of them. Of the 4 ways to use LEO from above, the best return is 60% but it's on BSC and not HIVE. The best return for the HIVE blockchain is 20%. There's is nothing wrong with 20%, that is what LBI aims to achieve but just to be nice, we'll factor in weekly compounding. This would be powering up your earned LEO from curation are reinvesting BXT rewards back into the LEO/HIVE LP. This turns 20% into 22%. I guess that is the answer for LEO. You can earn 65% off-chain or 22% on-chain assuming you compounding weekly.

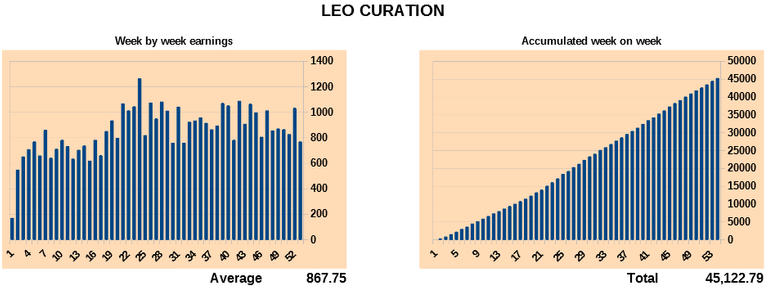

Righto, it's time to look at LBI and see how its dividend APY and token growth compares. As we are only a few weeks into a new year, I am going to base LBI's numbers on year 1's results and im going to say that most people invested in LBI when the price was 1 LEO per LBI token. Based on LBI issuing 233k tokens, we can use 233k LEO as our base number to give us APY's. We earned more in the second half of the year so i'd expect year 2's results to be a little bit better but having full of stats is great to give a good ballpark figure.

LBI earned from curating with its 255k staked LEO = 19.3% ROI

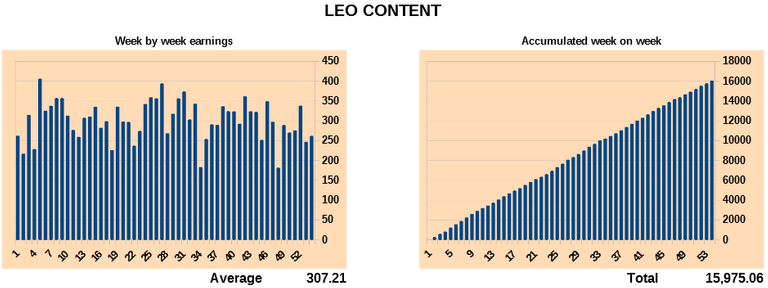

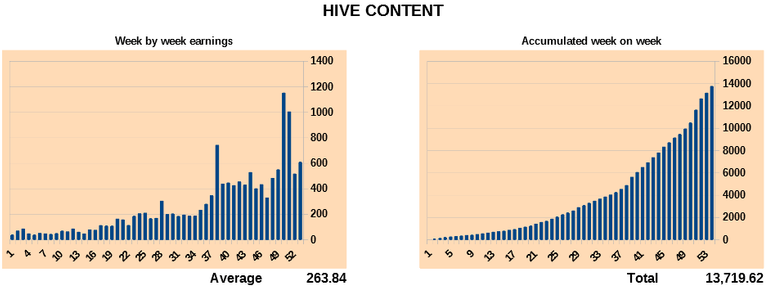

LBI earns from producing daily content = 6.8% from LEO and 5.9% from HIVE

These are our 3 biggest forms of LEO income for LBI. We have a few other small things listed below

- Leo-voter = 0.007%

- CUBlife = 6.8% (Based on full year)

- HIVE curation = 0.006%

- HIVE inflation = 0.002%

- HE dividend tokens = 0.002%

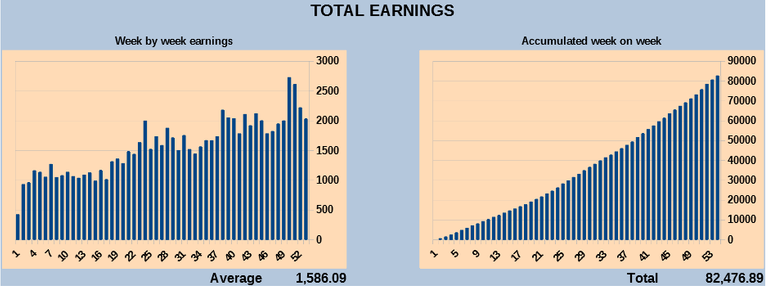

All in all, LBI earned just over 82k LEO in its first year. This represents a return of 35.4% on 233k LEO

It's not a return of 35.4% to investors, it's more like 17.7% to investors as dividends as 17.7% into growth. We'll call the APY for LEO earnings to be 17%

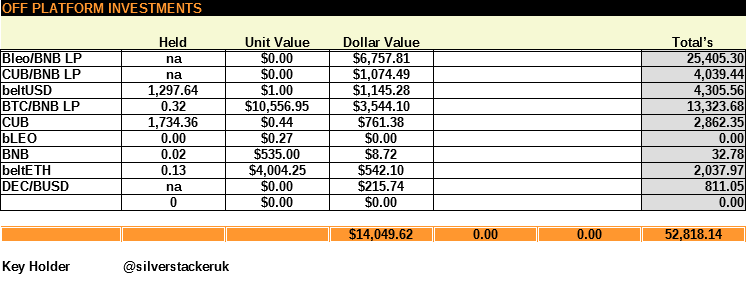

LBI is a core is a growth fund token. Dividends are a novelty to keep investors happy. I cant show you charts or even give you numbers from year 1's CUBfinance holdings because I had issues with a HDD and lost alot of work. What I can do is show our holdings at year-end.

I like to play the drum to the same beat so every week, every Saturday I harvest CUB's from our farms and convert the harvest into a kingdom investment. Everything to see above that is not BLEO/BNB is something we have got for free from harvests so 100% profit no whatever the prices.

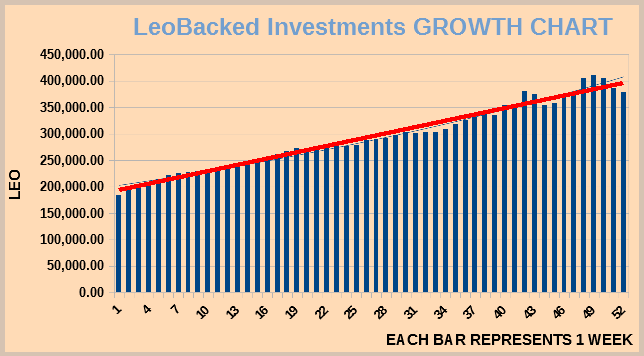

Let's finally look at the LBIs growth chart for year 1.

Look at that chart, is that not the perfect chart to be able to show investors? We can see a few bumps and dips but overall, we've grown very consistently and this can be seen by using the red trending line as a guide. GOD DAMN, that's a great looking chart. Ok, numbers at the end of years were.

- Total assets worth in LEO = 378,979.64 LEO

- Total LBI tokens circulating = 233,097.88

- LBI token price = 1.63 LEO

So you can easily see that LBI's increased by 63% in their first year. When we add the 17% that's paid out as LEO dividends we get a nice round of 80% which blows doing it on your own out of the water and 100% passive as well.

This number could be over 100% every year if people got involved. The content team earned us near 30k LEO last year. CUBlife earned us around 7k LEO and there's stopping anyone from getting involved and growing LBI's returns even quicker.

Round-Up

There you have it. If you had 10k last year and you did your own thing, you might have 12,500ish now. If you bought 10,000 LBI's with that LEO, those LBI's would be worth 16,300 today and you'd have received roughly 1700 LEO in dividends (based on a full year). This results in a 5,500 LEO difference or LBI to put it in broader terms, you would have earned x3.2 times more LEO.

Posted Using LeoFinance Beta

I am not surprised CubDefi's bLEO/BNB is has the highest APR but LBI is definitely doing a great job of getting over 35%. Even at half at 17.5% or so, its an amazing return. It makes me wonder how everything will turn out though. Either way, LBI is a great token to hold and I get a little over 1 LEO each week.

Posted Using LeoFinance Beta

For many people is hard to maintan DEFI.

LBI IS EASY TO UNDERSTAND.

Compare DEFI with knowledge of people on Twitter etc. not aware of keys .... owner, active, post...and no way to gain access if you lose the key.

DEFI is a big step further.

Posted Using LeoFinance Beta

While I agree that LBI is easier to understand than Defi, LBI also has an issue as most people are not use to having crypto keys. Although I think they can just set things up in keychain and remember from there.

Posted Using LeoFinance Beta

Wow! Such an eye-opener. The profits margin between holding LBI and hodling LEO is sure large and appealing. But for now, I'll just stick to holding $LEO. Subsequently, as income expands, hodling LBIs will be a sure option. But remember, you can get some airdrops for hodling LEO tokens. Is that same for LBI hodling?

On the whole, fhere are indeed many ways to earn in the Hive ecosystem. First, you earn on the first-layer and concurrently earn on the second-layer. However, LeoFinance makes it more interesting by giving us multiple ways of earning.

Posted Using LeoFinance Beta

Well, LBI is holding a lot LEO and will also benefit from the airdrops. The big question here is: what will LBI be doing with the airdrops? Trade them for more LEO, use them for more whatever the purpose of the new tokens is? But we will benefit from the airdrops thats for sure

The likelihood is we will be using the #ProjectBlank airdrop to curate content on there. It is a Proof of Brain token so we can create another revenue stream there.

Also, if that app takes off, LBI will be one of the largest token holders there also, making it a very valuable entity on that platform also.

Posted Using LeoFinance Beta

I think only @lbi-token can answer this because I don't know what they'll be doing with the share of their airdrops.

Posted Using LeoFinance Beta

It's not their share of the airdrop, it's from all of us who are hodling lbi tokens.

Maybe there was already a post for the airdrops and I missed it xD

We are not talking about any particular Airdrop. It's just a general discussion

Posted Using LeoFinance Beta

hello Dera, which airdrops? I have not heard of any for $LEO Holders.

Posted Using LeoFinance Beta

Projectblank and polycub

Polycub I think is on Cub holders no LEO.

But I could be incorrect on that. LBI is holding some CUB but nothing like LEO.

Posted Using LeoFinance Beta

oh, great. Now I have another excuse to acquire more $LEO :)

Posted Using LeoFinance Beta

There are a lot of ways that things are enhanced. The idea is to keep building and compounding. It all feeds upon itself.

So yes the different layers is what is ideal. You are learning there are numerous ways to be rewarded. With a project like LBI, the distribution keeps spreading out.

Posted Using LeoFinance Beta

Is it that to earn with LBI, you simply just buy and hodl? Or you will have to stake? Or anything else?

Posted Using LeoFinance Beta

LBI is a POH token (proof of holding), no staking required :)

Yeah, people like their airdrops. Many people told me 1 year ago they were holding off on investing into LBI waiting for airdrops.

Airdrops are added into holding but they are very overrated in my POV. I look forward to seeing how the ecosystem expands and more earning opportunities come :)

Posted Using LeoFinance Beta

The expansion is underway and certainly more earning opportunities will come but we have many opportunities on ground. I won't say airdrops are overrated, I'll just say that people love valueabu freebies.

Posted Using LeoFinance Beta

Airdrops are extremely overrated since the majority of projects are garbage. That is why the idea of positioning oneself for all of them makes no sense. Of course, if one unloads a lot of them quickly, money can be made. But most dont operate like that.

With Blank, we are aware of what is taking place and the potential. For that reason, we can see things really starting to take off with that application. To me, it might be the "Killer DApp" the industry was waiting for.

Posted Using LeoFinance Beta

Yes, it's true that most airdrops don't have a tangible project but if gotten and offloaded at the right time, some free money could be made.

I equally perceive #projectblank will be mind-blowing so, keeping my fingers crossed.

Posted Using LeoFinance Beta

The fact that LBI is priced in LEO and the end of Y1 price is 1.63 LEO when it started at 1 tells the entire story. That is a 63% return in 12 months. Since we are not dealing with conversion to USD or EURO, it is a simple exercise.

The goal is 20% growth. We overshot that by more than 3X (excluding dividends). This is nothing more than basic math.

Hence the purchase LBI tokens far outperforms the "doing it on your own" method. Of course, this is the value of community. Each token has a piece of every upvote and post given to LBI.

As stated, the numbers would grow quickly with more involvement. If others stepped up we could see more projects feeding money into LBI and converted to LEO. That would really enhance the stake.

Posted Using LeoFinance Beta

I'd like to see this same comparison done vs the HBD savings because the price of LEO and HIVE move so drastically.. had a person invested 10K USD into LBI and 10K USD into HBD which would hold more value. I remember LEO being well over $1 where as it's now around 20 cents. So although you may have gained more LEO you actually lost money? Those are great returns if the price of LEO remains the same or does better. But when it tanks... so does your net worth. HBD on the other hand has little variance in price so you increase your value every month.

Yeah totally get where you are coming from. In terms of dollars, LBI is down.

but...

LBI was set up to use LEO as the base currency and increase in LEO value. On the flip side, if LEO were to go back to $1, the LBI token price would decrease.

Im never gonna do an HBD comparison because LBI is not valued in $'s and i dont wanna be...

If you're investing in LEO, LBI is a great option to get involved passively.

Posted Using LeoFinance Beta

I wouldn't shoot ya. Besides I already packed up the guns

That is true but LBI is priced in LEO, nothing else.

Why not compare it to the Venezuelan Bolivar or the Turkish Lira?

You can also find better returns elsewhere if you want depending upon the market.

Of course, just off the top of my head, since the 12% wasnt in hand all year with HBD, the net payout for the year was probably 7%. That is about 1/10th the return of LBI. Even if the price dropped by 4/5ths, the return still might exceed the HBD.

And your theory goes to all hell if the price of LEO takes off. HBD is great to get a consistent return and remove volatility. However, if you are going to play the time the market game, then that is one approach. However, most cannot do that successfully so the comparison holds no weight.

Posted Using LeoFinance Beta

I'm only bringing up the point because I'm fixing to take about 5K of the money from my house sale and invest it.. obviously I want the best ROI possible..

That is a tough one. At these prices, something like HIVE might be a better options. But LEO could be good too.

HBD is a lest risky move, but not going to get the return.

Always comes down to your risk tolerance. Very little downside to the HBD though.

Posted Using LeoFinance Beta

Awesome breakdown. Thanks for doing that. At first it was looking like Leo might be the winner, but at the end things really came together for LBI. I guess in the end we all win no matter what as long as we keep growing.

Posted Using LeoFinance Beta

LBI has the ability to grow based upon the people involved in it. This is something LEO can do of course but the impact requires a lot more people since we are dealing with a much bigger pie.

Posted Using LeoFinance Beta

Yeah man, we really cant lose in terms of LEO. Well we can but we dont focus on that, lmfao

Posted Using LeoFinance Beta

Ssshhh. You cant post things like this. I like to buy a little more LBI on the dip here and there when the folks lose confidence! ;OD

Markets make people lose confidence no matter what is posted so I think you are safe.

Keep stackin' that LBI. You will be happen you did.

Posted Using LeoFinance Beta

Lol, it is very true and I certainly will!

It is pure true. One have to decide onself.

Posted Using LeoFinance Beta

baaa-hahaha

My bad 🙄

Posted Using LeoFinance Beta

:OD

It's cool to see you break down all the numbers this way. I think it should be an eye-opener for many that are wondering about buying into LBI. The real amazing thing is to be getting it at these prices. I know some commenters talked about first buying into LBI when LEO was at $1 so the overall value is not what it would be with LEO at $1. To me, that just means it's on sale right now. Buying LBI here means that when LEO goes back to that $1, you'll have LBI worth close to $2. And you'll still be getting LEO dividends into your account every week. Win/win.

I've said it before and I'll keep saying it: I plan on holding LBI for years, quite possibly the rest of my life. These returns are insane and as the Leo ecosystem builds out and hits it's stride, LBI will just continue to pay huge dividends as well as increasing in value 20% or more above what LEO brings every year.

Do the math. Everyone should own some of this in my opinion. Then we'll all be able to "Get Rich Slowly....Fast".

Posted Using LeoFinance Beta

I dont have the clout to reach far and wide :'(

If the price of LEO increase's back to $1, the LBI price would decrease some but not a huge amount.

But your right, as long as LeoFinance is expanding, LBI will continue to earn good returns and payout decent dividends. In 2022, we'll get a massive PB airdrop and we'll see where things go from there :)

Thanks for the awesome comment and support my friend.

Posted Using LeoFinance Beta

This is not true after the last hard fork. The voting time on Hive is now within 24 hours of the post. After that it declines a bit.

Also curation is not impacted by who votes before of after you. It is the same as LEO now.

Posted Using LeoFinance Beta

I'm glad you clarified this as we have spoken about this previously. I think this is a way better voting system then how it was previously for HIVE!

Posted Using LeoFinance Beta

You learn something new everyday 😃,

Thanks for sharing that, sharing is caring

Posted Using LeoFinance Beta

Honestly I'm not a crypto or market expert to suggest someone to hold coins or not. But somewhere deep in my heart, I do believe! We should hold our coins for now with the hope for upcoming better days!

I'd suggest to hold a few LBI tokens but hold the bulk of your own LEO yourself. Trust is always a big thing and with small projects like LBI.

Posted Using LeoFinance Beta

I love dividend investing, my regular stock portfolio is based on that idea. So many great opportunities here on Hive, so little money to invest 😕

Posted using LeoFinance Mobile

I know exactly how you feel. Now where did I put that ski mask, !LOLZ

lolztoken.com

count as resistance training?

Credit: marshmellowman

$LOLZ

Use the !LOL or !LOLZ command to share a joke and an $LOLZ. (3/6)@buzzgoblin, I sent you an on behalf of @hhayweaver

steal some :)

Posted Using LeoFinance Beta

New to the token,but with the little have heard about it, I sincerely believe that it Worth holding

Thanks for the nice comment, welcome

Posted Using LeoFinance Beta

This is a great post and wonderful break downs. Reading between the lines and pulling the only way to be taken serious is being consistent line. LBI is not here to compete with Leo its here to grow investor holding and broden the ground for gaining as we go about our daily Hive activities

Damn right, we're built on LEO. LEO is the base currency and this post is just highlighting that LBI can earn more LEO for you than you can earn for yourself 100% passively.

Thanks for checking out the post and glad you enjoyed

Posted Using LeoFinance Beta

Holding LBI was a no-brainer to me. Can't believe we are already over a year in. Time flies. !1UP

Yeah man, 1 year already. Went in fast, let's hope this year LEO gets back to over 50 cent 🤑

Posted Using LeoFinance Beta

I bought and powered up Leo and invested in Leo-BNB LP on Cubdefi last week. I also made the same calculations :) I wasn't aware of the LBI return rates though.

CUBfinance played a big part in LBI's first year. The great thing is it's involved with everything on LEO.

Posted Using LeoFinance Beta

thanks so much for putting this all together! This is fantastic!!

Posted Using LeoFinance Beta

No worries my man, it was a good topic to write about. I knew I could create a good thumbnail and the post would bang. Im 95% sure you suggested it? so thanks bro and glad you liked it.

Posted Using LeoFinance Beta

yes, it was me :)

Posted Using LeoFinance Beta

-mic drop.

Posted Using LeoFinance Beta

thought it was a nice way to finish the post

Posted Using LeoFinance Beta

Just that leo is know by many people here and is easy to get on leo finance.

Posted Using LeoFinance Beta

Yep, it's not hard

Posted Using LeoFinance Beta

K

Posted Using LeoFinance Beta

Bought some LBI mere moments ago at market price.

!PIZZA

Posted Using LeoFinance Beta

Take my money! Good post I learned a lot from it and I didn't really have much of an idea about what was happening except I wanted to throw cash at LBI as I am going heavy into Leo again

Posted Using LeoFinance Beta

I release the holding report every week but i guess posts like this help to break things down more.

I do read it but it goes over my head at times lol

Posted Using LeoFinance Beta

This is a great program and I am only hearing of it today, well I guess better late than never, let me go acquire some for myself

🏃♂️

Posted Using LeoFinance Beta

Cool, glad you like the good of the setup

!LUV

😀

Posted Using LeoFinance Beta

You have received a 1UP from @flauwy!

@leo-curator, @ctp-curator, @pob-curator, @vyb-curatorAnd look, they brought !PIZZA 🍕 The following @oneup-cartel family members upvoted your post:

Delegate your tribe tokens to our Cartel curation accounts and earn daily rewards. Join the family on Discord.

🥰

Awesome post thanks man

Posted Using LeoFinance Beta

Your very welcome, glad you liked it and hope you know a little more about LBI

It's very detail analysis.

I have more reason to invest in LBI in 2022

Posted Using LeoFinance Beta

Thank you, that's 2022 sorted. I'll release another post like this and hope the numbers are as good for year 2 to sort 2023 out :)

Glad to have you anboard

Very interesting. I need to get into all this deeper. It's tough with so much info out there, but I'll get it soon. Thanks for that info!

Posted Using LeoFinance Beta

I'll be releasing this weeks earnings and holding report within the next few hours. It's a little dry and mostly tales and charts but everything we hold is included. LBI will always do its best to be as transparent as we can.

Thanks for checking us out

Great info! Coming from a traditional investment background, I must say that the consistency of returns is unusual for a "risky" investment. Most of these have lumpy returns. In good times and in bad.

Must admit that the smoothness of the week-on-week returns is baffling.

Informative and clear, as always, thanks a lot.