A few people have asked this question and many are misconstruing the value prop of POLYCUB. In this post, we'll talk about a tweet storm we put out addressing the questions about the long-term value prop of POLYCUB.

Some people get it and some people don't. The core mission that we focused on when we built POLYCUB was building a sustainable and long-term yield optimizing platform.

POLYCUB isn't designed to be predictable in price in the short-term - as we see now, there is a lot of volatility - but it is designed to be predictable in price in the long-term.

The value prop of POLYCUB is enormous. Imagine holding a long-term, scarce asset like BTC but being able to generate 30-50%+ APY on it in the long-run. Now combine that with the ability to collateralize your stake in the asset and take out an instant loan against it. Now you're earning 30-50% APY on the asset + have instantaneous liquidity in the form of a self-paying loan. Since the loan is earning APY and you're paying interest to the protocol liquidity, the interest owed is MORE than covered by the APY generated.

Make no mistake, POLYCUB is a game-changer in the Yield Optimization game. We're calling it the first in a line of next-generation yield optimizers for a reason. I think many people don't understand the way that it works and many still confuse scarcity for dropping emissions rates.

Dropping the emissions rate is one thing but planned scarcity that is combined with deep utility is a completely different concept.

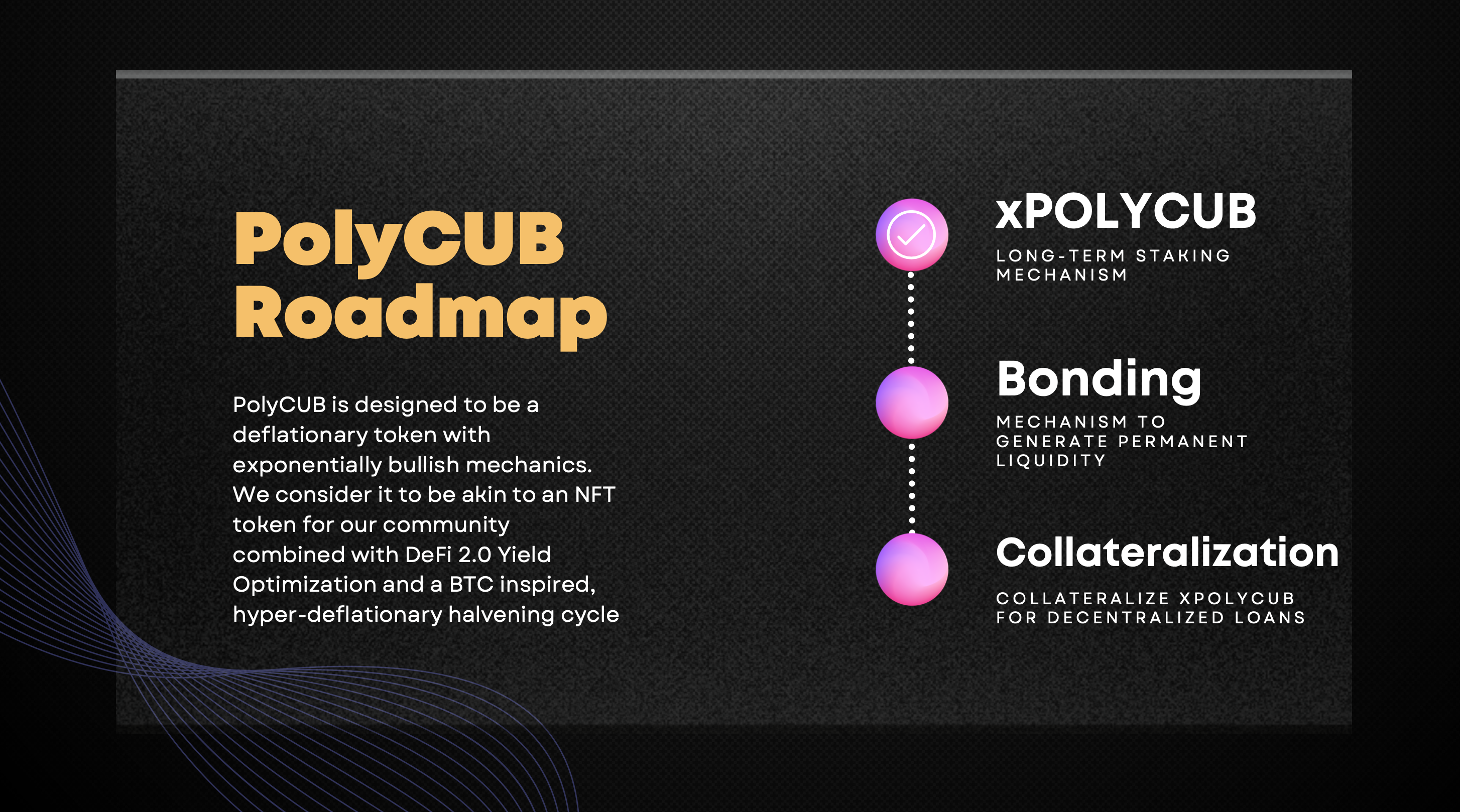

The long-term roadmap of POLYCUB is clear. We've launched xPOLYCUB as the ultimate staking vault for the long-run.

Want to make a long-term, leveraged bet on POLYCUB's future? Buy POLYCUB and stake it as xPOLYCUB. You'll be earning a scarce asset (POLYCUB) while holding an ultra-scarce asset (xPOLYCUB). @taskmaster4450 has put out countless posts talking about the scarcity and extremely deep value that xPOLYCUB provides.

POLYCUB Changing the Idea of Scarcity and Utility in DeFi

Most people are still viewing POLYCUB with a "DeFi 1.0 Lens", let me take you through why this is the wrong way to view POLYCUB.

We are currently in the early days of POLYCUB. Emissions rate is high and the halvenings are just starting to take effect.

While many view this as a rote and unnecessary exercise - having high inflation and dropping it over time - others understand the purpose. The point is to incentivize capital to enter the POLYCUB ecosystem. Bring that capital in by having high yields and then retain that capital by offering a long-term value prop.

The other purpose is to spread POLYCUB to as many hands as possible. We want to see the radical distribution take place in the early days of POLYCUB.

In this thread we gave a brief overview of things to come. POLYCUB is an absolute game changer in the DeFi space.

While many may miss the vision now, they'll circle back 3 months from now, 6 months from now and 6 years from now and see that they missed out on the opportunity of a lifetime to buy POLYCUB, stake it as xPOLYCUB and "mine early, mine often" to accumulate a scarce asset with massive long-term yield and value capture mechanics.

Protocol Owned Liquidity

Here you can see the upcoming Protocol Owned Liquidity page which will show the breakdown of assets held by POLYCUB's protocol liquidity. This protocol liquidity is leveraged to generate yield. 100% of that yield buys POLYCUB and deploys it back into the LP Incentive Pool. This is how long-term LP Yields are generated once the emissions rate hits near 0 (around July/August 2022).

Bonding

Bonding is going to add a whole new dynamic to https://polycub.com. Bonding adds massive liquidity depth to the PolyCUB Protocol Liquidity. The deeper that protocol liquidity becomes, the higher the risk-free value of POLYCUB becomes along with the speculative multipliers surrounding:

- Earning yield on xPOLYCUB

- Collateralizing xPOLYCUB Stake for a loan

- Dynamic earnings rate on Kingdoms stake

Collateralization of xPOLYCUB

We've been trying to drive this point home for the past week. Many didn't see this aspect of the POLYCUB protocol coming to light.

There is a lot to unwrap when it comes to collateralized lending on xPOLYCUB stake. The key things to understand are:

- Never sell your xPOLYCUB - instead of selling, you'll leverage it to earn 30-50% APY on your xPOLYCUB stake while simultaneously being able to take an instantaneous collateralized loan against your position

- The collateralized loan is self-paying as a small % of your yield on xPOLYCUB will auto-pay the daily interest for holding the loan

- The rest of the yield accumulates in your xPOLYCUB position even while it's collateralized in the vault

- The entire Protocol Liquidity benefits - and by effect, you as an xPOLYCUB holder benefit - as the protocol is able to earn yield on its treasury of assets while stacking that with the additional interst it earns on the assets it loans out. It's loaning out synthetic assets to users that are 1-to-1 backed by the treasury reserves. This means that it's essentially earning double yield on its assets. Imagine $1M USD in stablecoins held by Protocol Liquidity. It's earning 20% APY on the $1M from protocols like Curve while also lending out <$1M in synthetic stablecoins - PCUB.USD - to xPOLYCUB holders. Those synthetics are generating "8% yearly interest" which means the protocol is earning 20% + 8% APY on the $1M in stablecoins

The protocol is generating stacked yield and using all of that yield to drive daily demand of POLYCUB tokens as it buys them to deposit into long-term LP Incentives

Dynamic Earn Rate

We haven't discussed this feature much yet as it won't kick in until normal POLYCUB Emissions per block are near zero in the coming months.

Once that happens, a dynamic earn rate will kick in. This can be seen on popular platforms like Curve where holding the Curve governance token allows users to earn higher yields than other users who don't have a certain % of their portfolio staked in Curve.

This can also be seen in other platforms like Nexo - you need to hold a % of your portfolio in the native asset to earn the full yield offered by vaults.

On Kingdoms, a dynamic earn rate will take hold. For example, if you hold $100k in Kingdoms vaults and don't have any POLYCUB staked as xPOLYCUB, then you will only earn partial yield. That yield is likely to be higher than any other yield optimizer but it will still be significantly less than fully optimized yield which can only be earned if X% of your portfolio is held as xPOLYCUB stake.

This adds yet another long-term reason to buy and hold POLYCUB. As you deposit more and more assets into Kingdoms (or they autocompound / grow, etc.) your need for POLYCUB stake will continue to grow to ensure that a % of your portfolio remains staked as xPOLYCUB to earn full yield.

The popular Anchor protocol on Terra is gearing up to release this feature as well. It is a core utility in the DeFi 2.0 landscape and POLYCUB has it built-in for when the emissions rate gets to near-zero rates.

Yet another reason someone would buy POLYCUB 1 year from now.

PolyCUB: A Radical New Platform in the DeFi Yield Optimizer Game

We don't expect everyone to understand POLYCUB at the jump. Just as with the first few days of the xPOLYCUB vault, it will blow everyone's minds when you see just how incredibly well-designed the mechanics of POLYCUB are in the long-term.

If there is one thing to say about LeoFinance and our Web3 Ecosystem it is this: the long-term is always the focus.

So while we don't know what will happen in these few weeks during the launch of POLYCUB and initial halvenings, we do know that the long-term sustainability will take over and POLYCUB will be a forever number-go up asset.

The risk-free value creates a floor of the POLYCUB price and this combined with the radical dynamics of scarcity and deep utility for buying and hodling POLYCUB to further optimize your yield are what will drive buying demand now and in the future.

Posted Using LeoFinance Beta

This was a missing puzzle that I wanted to see... :)

Btw. Thanks for this post as it explained many things that were uncertain until now...

Posted Using LeoFinance Beta

That means the more the X% of your portfolio held in the xPOLYCUB vault, the more your earnings.

Posted Using LeoFinance Beta

Collateralized Xpolycub is the way to go. Love it.

This one line is enough to understand that Polycub is a game changer and there are many reasons to buy the tokens as much as possible. I am impressed with the kind of attention by the people on the platform and media as well. More power to the Leo team. Kudos to the wonderful team

I hadn't heard about POLYCUB until reading this post and now I want to buy some.

!PIZZA

I still have a lot of ideas and questions about the collateralized loan feature. Imagine I stake XPolycub, take loan in UDSC form, buy polycub with my USDC loan, stake it and get another XPolycub and collateralize it again to increase my chances of getting more loans. Is that actually possible? Will it be like cheating the system?

Posted Using LeoFinance Beta

It would help the system by generating more fees, and it would increase your exposure to the loan.

Posted Using LeoFinance Beta

I'm waiting to see how this all helps Leo and Cub, I know people should hold Cub to get the drops and also it compounds your Cub at a nice rate. I guess Leo will get more popular from all of this so it may go higher from that. It seems that they are a little stagnant right now. I'm not worried and it's just an observation. Keep up the great work team!

Posted Using LeoFinance Beta

It is a feeder system. We will see the value realized at the Polycub level first, and then pushing back to Cub especially as more project roll out. Over time, that will also end up filtering to Leofinance.

The idea is to start leveraging it all against each other. Lending on POLYCUB, as an example, could be used to buy CUB on BSC. Here is how one can improve one's position there while also providing some buying pressure.

Posted Using LeoFinance Beta

PolyCUB has so many mechanics intended to give it strength like no other DeFi cryptocurrency out there. So instead of being small-minded and trying to take short-term profits, why not think about a long and sustainable term??? That's what I am doing and I am simply glad when putting more and more PolyCUBs in the bag.

Posted Using LeoFinance Beta

👍 You get it!

Posted Using LeoFinance Beta

The upcoming features of bonding, lending is something to look forward. Polycub DeFi certainly the way to go even though it's currently undervalued. I believe the future will be a bright one

Posted Using LeoFinance Beta

The more I read about the mechanics and features of polycub, the more bullish I get. unbothered about the current price, my eyes set on the long term performance of the project

Posted Using LeoFinance Beta

Cub has been quite the successful project on Hive Blockchain and it's good to see movement and development continuing to occur. Well done!

Posted Using LeoFinance Beta

Damn all these surprise features are such bangers. The requirement of staked xPOLYCUB to earn the full yield is yet another amazing use-case for POLYCUB that's going to drive tons of value. Awesome work guys.

Posted Using LeoFinance Beta

Just like any project I invest in, it's the long term for me. Polycub has all the making to be the best. Highly anticipating collateralized lending to go live

Posted Using LeoFinance Beta

It's a lot to take in. You have it so well understood, and you explain it all really well. Some thing I get some go right over my head....!!!

But so far so good, and perhaps I don't need to know how the engine in my car works to use to my advantage. I can't wait to stat borrowing against my xPolycub!!!! I want to start getting my feet wet in the world of crypto backed loans, so thanks for that!

Posted Using LeoFinance Beta

Really interesting how things are unfolding around the PolyCUB DeFi. Indeed, its an entirely new generation in DeFi delivery. The most beautiful part for me is taking a loan to sort your immediate financial need and having your staked xPOLYCUB payback automatically.

Really Terrific!

Posted Using LeoFinance Beta

The lending feature is brilliant for xPolycub holders. Really, didn't knew it before this deep.

The future is bright with polyCUB and more Cubs need to be staked as each day passes for a better and bigger benefits in the future Which I believe is non stop at the moment

Posted Using LeoFinance Beta

Waiting to see how these things play out in the long run. Still bullish on polycub. I don't even check the price anymore. Holding for the long run.

Posted Using LeoFinance Beta

There are rare projects who has got 10 million TVL in so less time and polycub has made it possible. This is not all as we can't ignore the media coverage and this is something I have seen for the first time happening with Polycub. I believe that polycub has everything that is needed to bring revolution in DeFi.

Polycub has so much to offer. It's so vast, now with the collateralized xpolycub loan, it's self paying. It must be a first to actually borrow but more or less, it's self contained you just let the loan pay itself. The polycub ratio at 18, it's absolutely incredible !

Posted using LeoFinance Mobile

When POLYCUB was launched It got to 5$ looking at it 1year from now I’m sure it will be more than 10$. In the long run I know it will be the most wanted token given it’s scarcity and utility.

Now the real functionality of xPOLYCUB just reveal to many that yet understand.

In DeFi, you only stake to receive your staking reward, staking POLYCUB gives xPOLYCUB which thereby generating POLYCUB as staking reward. I can also see some amazing features attached xPOLYCUB, brilliant ideas from the team.

Thanks team for bringing in xPOLYCUB and building what can stand the test of time.

what are the parameters to send the next satellite to the next EVM chain?

I mean it's impossible to say how it works in 1 year.

Btw, I really like some ideas around polycub.

Holding all in xPOLYCUB for my dream car.

Im not worried about short term price action as im in for the long-term benefits.

Those selling polycub now will definitely cry when they see polycub booming.

Posted Using LeoFinance Beta

I bought more Polycub today 😛

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

killerwot tipped leofinance (x1)

@ykretz.leo(3/5) tipped @leofinance (x1)

Please vote for pizza.witness!

This.

Posted Using LeoFinance Beta

❔ Is it common for the POLYCUB-USDC LP STAKES count to read "0" even after staking and as it is still harvesting POLYCUB earned?

Curious if there is something I could update to correct this.

👍 Very interesting project. Well done with the progress.

Even though the emissions eventually taper down, there would be emissions for the bond right. Where will that come from ? That should still lead to inflation ?

Posted Using LeoFinance Beta

That is what makes it absolutely amazing ! Can't wait !PIZZA

Posted Using LeoFinance Beta

Very deep analysis and I am so excited for the collateralisarion of Polycub! Now we need more people to believe and at some point we might be the new Bitcoin hehe 😉. (Just kidding ofc).

Posted using LeoFinance Mobile

Polycub is a game changer especially this bonding they are creating now,is going to make the community to be sustainable.

Posted Using LeoFinance Beta

Sincerely, I am not a fan of hypes or marketing but i must be sincere that I am willing to give a bet on Polycub. The scarcity of Polycub and the demand is one reason why I will be willing to buy anytime for a long-term. Moreover 50% APY is very impressive.

Posted Using LeoFinance Beta

Not done reading this post yet but I wanted to point out that promoters should probably lead with this. Don't just start talking about profit, sell at least one of the benefits first. Anyone can promise profit and 404...