Economy is a tough race where we have so many of the variables and parameters that work together to make a befitting combination of success. Once we get wealthy, we set newer benchmark and thats a full cycle that moves on.

Quite a few days ago, I have talked about how economic progress of a person influences the whole of the market. At one point, market can be volatile and prices of a share can enlarge or decrease from time to time, but we must be cautious at to resolve the loses.

Thats how the system goes and the truth remains is, winners win and losers lose.

Capitalism is one good example of what one can build wealths at a lifetime, if everything becomes alright. Those of us who have normal to mediocre wealths, they think of the whole project from the views they hold of their project and economic goals and journey.

We look at benefits from a single job, business or new experiments in the market. Some of them are national and the other are international . Lots of them, the companies complete exchanges in the multinational level, so as the revenues of the company settled .

On an average, the thought process is to grab the available profits with 5-10 years of time and sometimes due to market crashes or capitals start to decrease, the enterprise or journey stops on the midway.

Perhaps, you have seen it in our own observations and experiences made over the years. In the economic cycle or the market is a tough turf, I have explained that for far too many times. Once we look at the losses, and the profits start to follow as well.

The thing is, too much capitalism is not good for the whole community and the socialism was follwed by so many other countries in the past, like the soviet union. If the country sets the standards of economic and wealths distribution, the grabbing of wealths by undefined limit is not possible to implement.

Regardless, of the economic position of the country, there are always the scope of grab and possess the wealth as we need and want. Its a game or an adventure, and most of us dont understand how to make advancement in this field.

One question,if I ask you - whats the difference between the successful investor or the top billionaire to the person with average financial knowledge ?

The answer is maybe, in the thought process we make. Its upto taking decisions and knowing when to implement the better plans one by one. Because, from the level of $2B Wealth as the net investment, the person wouldn’t think to start from the bottom and add the revenue of billion dollar each in a short time or limited time.

Its not and the examples are many, perhaps we could get to see popular examples of that.

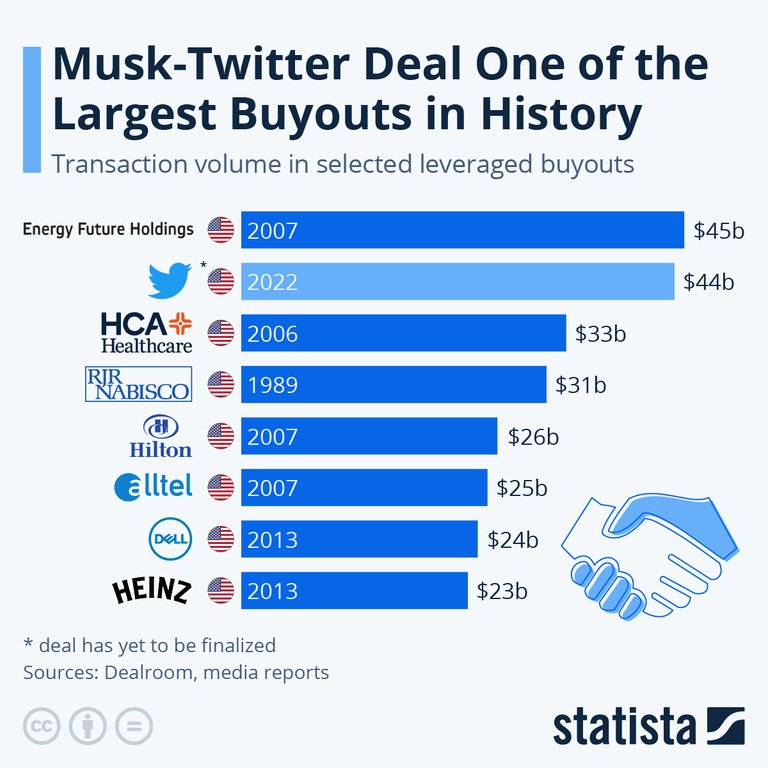

Year or two ago, we saw Elon Musk to buy Twitter which was rebranded as X, the second best social media site. He bought the whole company and the 100% share, by just exchanging $8B to the owner of the company and grabbed the whole ownership to his name.

He was a smart folk, he knew and he had plans what to do with the gift that he has in his hands.

When we talk about the fact that, we have to be this, or we have to be that. The financial literacr or a smart mind, but more than that a clear mind to do what in the correct time, the timely innovation can make a big big difference to how we grow wealths time to time.

Elon started to transform the twitter and it followed what leothreads did as adding microblogs or threads, the similar feature of tweet in the past. All was quite typical, unlike one feature - the micro-monetization.

What monetization did ? It just held and handed the user a chance to earn some small amount of dollars, by threading each time. Each time a thread is added, it started to generate micro-earning. So as the threads we see at inleo currently.

Now, after all this adoption of technology, Elon's X have much more stocks and market value, than the time when he bought the company with $8B revenue. The net worth of the company may 3× than the initial value.

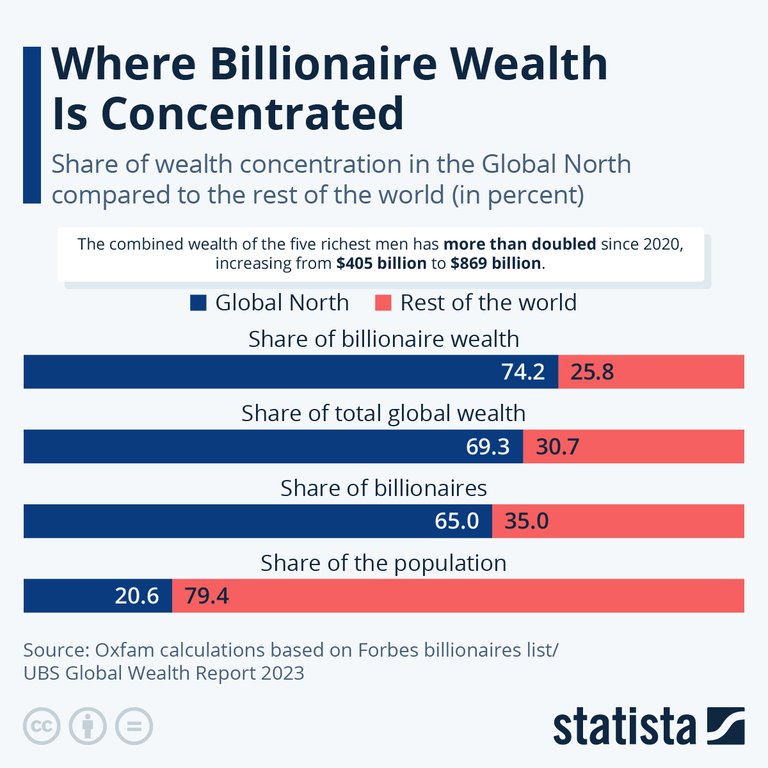

Europe would be on the greater position, most of the times. And the number of European Billionaire would be much bigger than the rest of the world. As of the first chart I added, you could see the truth of it by the statistics and reporting made by the Agency.

So, what that adds up ?

It all comes down to being wise at decisions, whether in crypto or the other markets. Patience and constructively building a project would ensure people to go a long way and increase value and net worth to a nee dimension, most of the time in staying of the market.

Whats your opinion ?

Posted Using InLeo Alpha