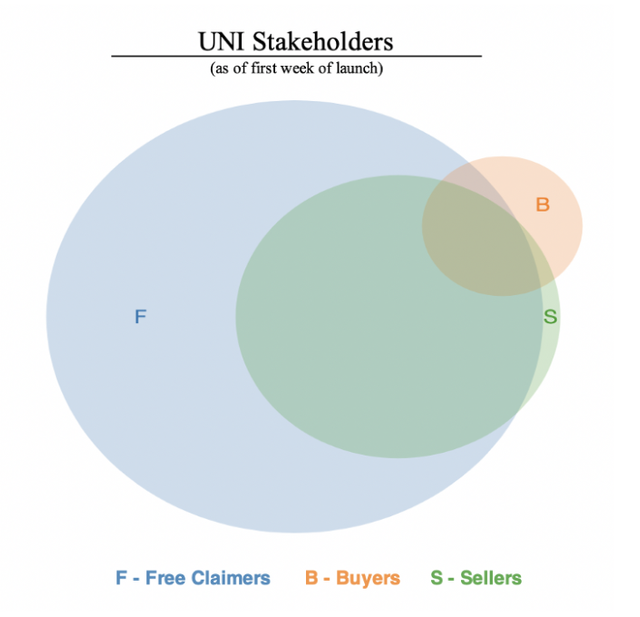

As you saw with the UNI Airdrop, UNI tokens have some value. As I mentioned in a previous post, a large portion of UNI holders have not sold their airdrop.

UniSwap promises a lot of good things with the version 3 release that is due around the beginning of 2021. UniSwap recently raised over $11 million USD to build out version 3.

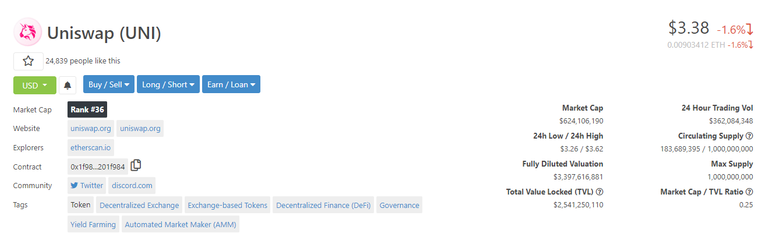

I sold my UNI tokens from the airdrop at around $4.80. The price ended up peaking around $8 but is now settled around $3.40. Just a few days ago it was as low as $2.70.

I had mixed feelings about selling UNI tokens, I felt confident they would go up, and held off until they went up to around $5. I thought they would settle around $5 to $10 range, but kicked myself in the ass for selling at $5. Free money is free money though right?

Since then, I have been taking advantage of their incentive to provide liquidity to their pools.

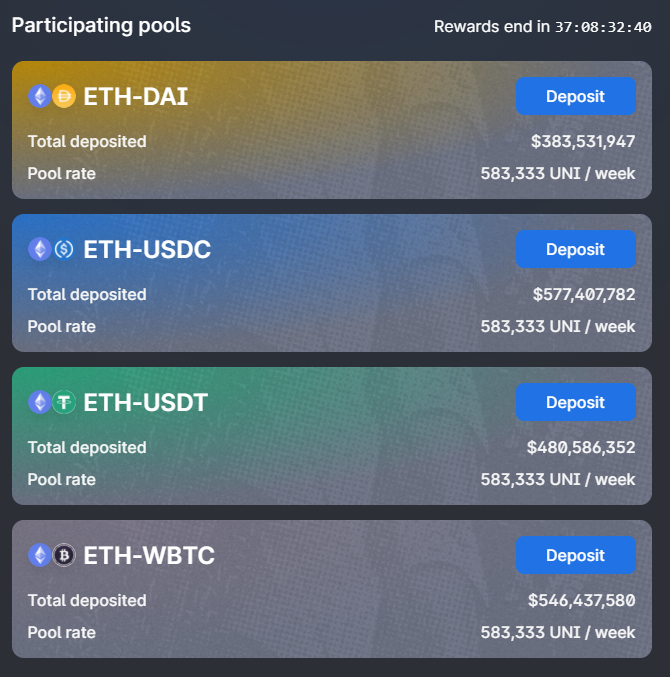

If you go to their app and then click on UNI, you can see the four pools available.

There are 37 days left to provide liquidity and take advantage of the 583,333 UNI being distributed to the liquidity providers. The more liquidity you provide, the more UNI tokens you can earn during this period.

The most popular pool is ETH-USDC which has $577,407,782 liquidity. This is the pool I provide to, for a while it had the least amount of competition but has since gone up. The more competition, the less UNI you will make on a daily basis.

Currently, the most attractive pool is the ETH-DAI, in regards to the potential UNI to be earned.

If you want to provide liquidity for one of these pools and ultimately earn UNI tokens, you need to first authorize the contract on your wallet. There is a fee for this, you then have to deposit liquidity (both ETH and the 2nd token you want to pair with in equal amounts), and finally you need to stake the liquidity tokens you get for your pair.

Expect to pay around $20 in fees to do all this, depending on what the current gas fees are. They are currently very low but changes by the minute.

You will earn UNI tokens throughout the day but will be unable to sell them until you "claim" them or withdraw your balance. There is a fee to do either of these options so it is ideal to just let it ride until you are ready to withdraw your liquidity. It will cost around $10 to claim or withdraw, so don't bother claiming prematurely.

As always, this is not financial advice and merely my unprofessional opinion, always consult your mom.

Posted Using LeoFinance Beta

oh i didn't know there was a special bounty for LPs

well you did a good job selling as you can buy back lower

i held onto mine, but i'm excited for v3

Posted Using LeoFinance Beta