The blockchain industry with its new projects coming out daily is growing at an incredible pace. Since there are not any regulations, huge risks are involved. Fortunately, there are some token features that can be observed to mitigate these risks and one of them is token metrics and their variables. Sure there are more fundamental data you have to observe to evaluate any project like use case, competition, etc.

What are the token metrics?

Token metrics is the science of the token economy which can be also compared to a monetary policy in the micro economy scale enabled by the blockchain network.

Any company can set up a list of internal rules using their own token in a decentralized manner to manage their company.

What exactly we should look at?

Transparency

There are a couple of signs any investors should look at to avoid losses via market price manipulation. The clear token metrics means trust and transparency and we are going to describe some of the simple concepts which are worth to be followed:

Transparent token distribution, Time lock,Diversified token distribution,Token variables ..

Transparent token distribution

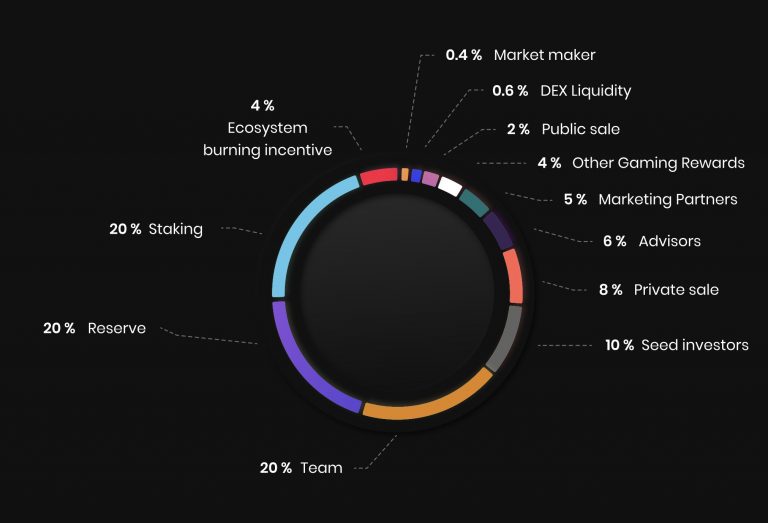

Transparent token distribution means that is a clear way how the tokens are distributed among the team, marketing purposes, ecosystem, or private investors. There is no doubt for the outside audience that all tokens are distributed and visible on the blockchain public address and there is no hidden address whatsoever.

Let’s see the example of the Trade Race Manager

Trade race manager is a fresh new NFT project and recently they have also burned 50 % of their total supply. This made their token supply much more transparent and fairly distributed. None of the items has more than 20 %.

Time lock

One of the significant features when observing any token metrics to prevent losses or price manipulation is the time lock. It is quite common that the team is selling their tokens in huge volume and dumping the price. This is a red flag for many projects and progressive time lock for the team and private investors tokens has to be applied visible in the smart contract.

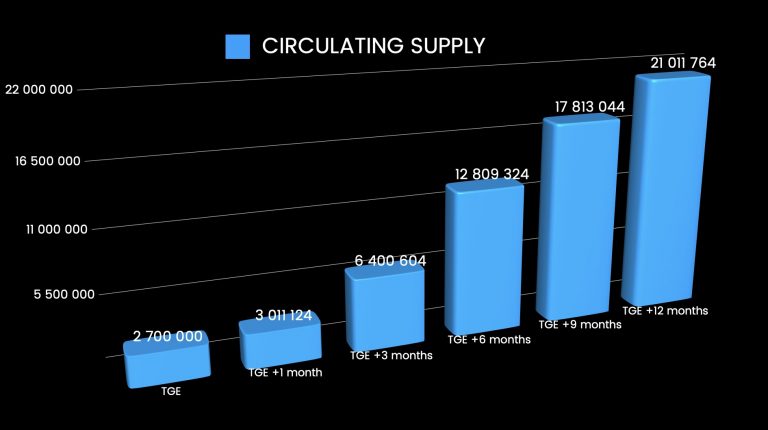

There is a gradual time unlock during the first year and until 2024 in the case of the Trade Race Manager. The community is protected from any unexpected price dumps. See the vesting schedule during the first year after TGE.

Following the next four years there are mostly gaming rewards depending on the players organic growth added into the circulation which is proof that the IOI Corporation is building long-term projects.

Diversified token distribution

Smart investors always manage their risk and diversification is one of the tools how to do it. This can be applied also from a token distribution point of view and according to unofficial rules not more than 50 % should be assigned to one token purpose. We have already explained the distribution and in the case of the Trade Race Manager, none of the items has not even more than 20 %. The token supply is fairly distributed.

Token variables

There are many variables that can be evaluated but briefly the most important are the total supply, circulation supply, burning ratio, the velocity of the token. Be aware that too big supply like 1 billion tokens in circulation can cause price inflation. If there is no velocity or there are not any transactions hence the token does not have any real utility.

The more the protocol provides for the use of tokens between the members of the network, the more the circulation of these tokens and therefore the velocity will be important for the future value as well.

These are the variables of the IOI Token:

Token supply – 50 Mil

TGE Token circulation supply – 2,4 Mil

End of 2021 circulation supply – 13,5 Mil

Burning ratio – maximum 4 % supply

Utility – token has more utilities and mostly gaming also ..

We think that the Trade Race Manager project from the token variabiles point of view is fairly valued without any sign of overvaluation. This was a very brief introduction to the token metricks and now lets have a look at the competition analyses.

Competition analyses

The Trade Race Manager is currently launching their token at the public listing price of 0,4 USD per token. Comparing to some similar projects already live on the market, even without a finished product, the Trade Race Manager market capitalization still has huge room to grow. See the simple comparison chart. The estimated market during TGE is below 1 Mil USD and 1 year after only 8 Million USD. This was calculated with the public sale price and 21 mil IOI tokens in circulation. The project has huge upside potential know that they will release a new NFT game very soon.

Posted Using LeoFinance Beta