Putting your DEC into Liquidity Pools will DOUBLE your SPS Airdrops! Do you know what a Liquidity Pool is and which ones are qualified?

Introduction to Liquidity Pools

Disclaimer: If you already know what a Liquidity Pool is and how they work, feel free to go directly to "Splinterlands SPS Aidrop". This introduction was written to explain what's a Liquidity Pool and bring some basic principles of the DeFi ecosystem.

Liquidity Pools or Diesel Pools

Liquidity Pools are an important part of the DeFi Ecosystem. DeFi means "Decentralized Dinance": financial products that works on a public decentralized blockchain network, like Hive (the same blockchain in which Splinterlands is based on).

According to the Binancy Accademy:

A Liquidity Pool (also known as Diesel Pool) is a collection of funds locked in a smart contract. Liquidity Pools are mainly used to facilitate decentralized like trading and lending.

When you’re executing a trade on an Liquidity Pool, you don’t have a counterparty in the traditional sense. Instead, you’re executing the trade against the liquidity in the liquidity pool. For the buyer to buy, there doesn’t need to be a seller at that particular moment, only sufficient liquidity in the pool.

The liquidity has to come somewhere, and anyone can be a Liquidity Provider, so they could be viewed as your counterparty in some sense.

If you're not used to this technical jargon, it can be kinda difficult to understand what's going on. But, in simple terms, a Liquidity Pool is a collection of two different assets, put together by a group of people (Liquidity Providers), allowing other people to trade one asset for the other.

For example, a DEC:ETH Liquidity Pool has two assets: DEC (Dark Energy Crystals, the in-game currency of Splinterlands) and ETH (the Ethereum cryptocurrency). Several people had DEC and ETH, and they all decided to put those assets together to form a Liquidity Pool. Now, you and me can use this Liquidity Pool to exchange DEC for ETH, or vice-versa (exchange ETH for DEC).

I won't get into the financial details and how their algorhythm works, but the main point of a Liquidity Pool is that you can exchange assets without having to find someone willing to do the exchange with you.

Traditionally, when you exchange one thing for another, there has to be a counterparty, someone willing to do the inverse transaction with you. For example, if you have US Dollars (A) and want Euros (B), you go to a currency exchange shop (your counterparty!): they'll have Euros (B) and will exchange them for your US Dollars (A). You're going A => B, they're going B => A.

To offer you this service, the exchange shop will charge you a fee.

In the other hand, and this is the groundbreaking part of Liquidity Pools, you can trade assets on Liquidity Pools without having a counterparty, as the whole pool will be your counterparty. You can exchange DEC to SWAP.HIVE using a SWAP.HIVE:DEC Liquidity Pool, for example.

If you want to understand more about how Liquidity Pools works, I do recommend this article from Finematics and the already-linked article from Binance Academy.

Rewards and Risks of a Liquidity Pool

Liquidity Provider is the name given to the people who put their assets on Liquidity Pools.

They have to invest both assets on the pool at the same time, proportionally to their value. If you want to put your assets on a SWAP.HIVE:DEC pool, you have to deposit both SWAP.HIVE and DEC at the same time. And if SWAP.HIVE is worth 100x more than DEC, you have to deposit 1 SWAP.HIVE for each 100 DEC.

In other words, you have to deposit both assets to keep the Liquidity Pool perfectly balanced, as all things should be.

But why would you become a Liquidity Provider, putting your own assets on a Liquidity Pool?

The main reason is that Liquidity Providers receive part of the trading fees from all the exchanges done on that Liquidity Pool.

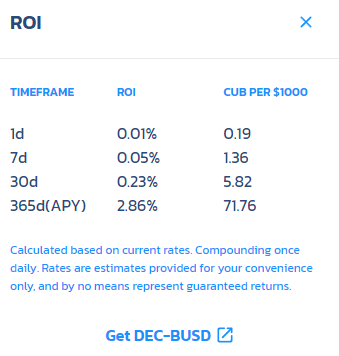

CubDEFI DEC:BUSD Pool - Current ROI

These trading fees are usually shared between all the liquidity providers, proportionally to the amount of liquity each of them provided. If a Liquidity Pool has 100 USD on assets and you have 20 USD of assets on this pool, you have 20% of the total liquidity (20/100 = 20%). If this pool generates 1$ of fees in a day, you'll receive 20% of those fees: 1$ * 20% = 0.2$

Besides the trading fees, pools can offer extra rewards to Liquidity Providers. For example, some pools in TribalDex are paying daily rewards to the liquidity providers (the SWAP.HIVE:DEC Pool, for example, currently have daily rewards in four different tokens: BEE, STARBITS, LUV and BATTLE). Other platforms offer "Yield Farming", in which you stack ("lock") your assets into the Liquidity Pool and receive extra rewards.

But, as always, there is NO free lunch: those earnings aren't free of risk. The risks of being a Liquidity Provider are beyond the scope of this post, but you can read more about Impermanent Loss here in the Binance Academy. Just be sure to understand all the risks before doing anything with your money because, yes, you CAN lose assets that you've put in a Liquidity Pool.

Splinterlands SPS Aidrop

Airdrop is a crypto-jargon that means giving free coins/tokens to people in order to promote something. For example, a new Crypto Broker can create an Airdrop to attract new users: "If you create an account today, you'll receive THESE coins for free!". And people will signup on the website because who doesn't like free money?

The important thing is: there is a SPS Airdrop going on Splinterlands right now; you can access the Airdrop page by clicking on this green button at the top right corner of Splinterlands. According to the Official Documentation, the idea of this Airdrop is to promote the ownership of Splinterlands assets:

400M SPS tokens, or 13.33% of the total token supply, will be airdropped to players based upon the amount and type of Splinterlands assets held in their account.

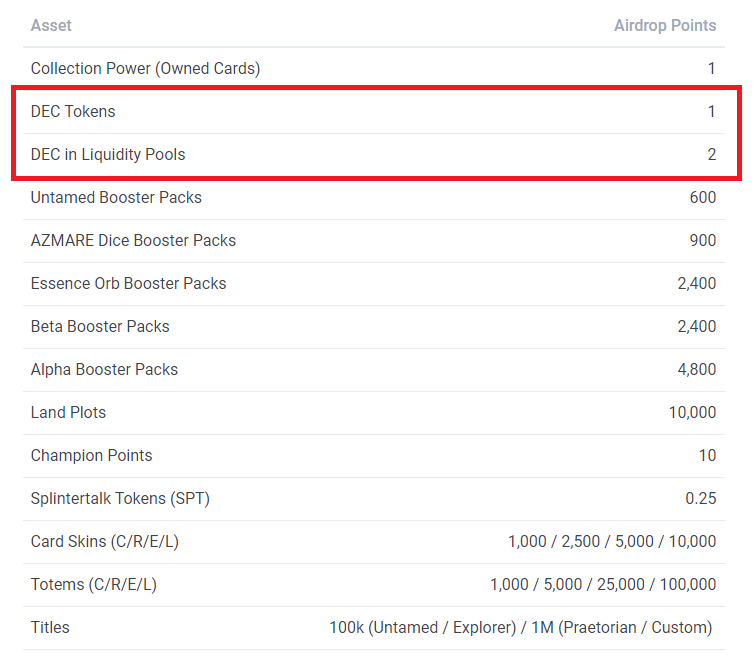

Nearly every Splinterlands asset will be eligible to earn SPS tokens in the airdrop. Each type of asset will be assigned a specific amount of "airdrop points" that it is worth.

SPS (Splintershards) is a governance token which will be integrated into the Splinterlands game. Players that own SPS tokens will be able to vote for or against proposals that will change the game and the whole ecosystem around it: tournaments settings and prizes, card balance updates, quest/season rewards, etc.

At the time of writing, the SPS Token is worth 0.62 USD on Hive-Engine. Good money!

Ok, now let's talk about the SPS Airdrop Points!

SPS Airdrop Points

As you can see, almost all Splinterlands assets that you own will count towards your Airdrop Points. If you own cards, you'll receive 1 Airdrop Point for each Collection Power it gives. If you have SPT tokens (earned by blogging on www.SplinterTalk.io), you'll receive 0.25 Point for each SPT.

But let's talk about DEC!

You can earn DEC by winning Ranked Matches, depending on several factors like your current League, your DEC Capture Rate, win streak, etc. If you're interesting in increasing your DEC earnings, take a look at this post I've written in the past.

For each DEC you have in your wallet, you'll receive 1 Airdrop Point.

But if you put those DEC in Liquidity Pools, you'll literally double your earnings and receive 2 Airdrop Points per DEC.

Supported DEC Liquidity Pools for SPS Airdrop Points

It wasn't easy finding out all the DEC Liquidity Pools that are qualified to count towards the SPS Aidrop Points. The information available across the internet is old, incomplete, or just plainly wrong.

all the supported DEC Liquidity Pools:After some messages here and there, Splinterlands Team Member and Developer @fbslo confirmed to me

- CubDEFI.com: DEC:BUSD

- TribalDex.com: SWAP.HIVE:DEC; BEE:DEC and DEC:SPS

- UniSwap.org: DEC:ETH and DAI:DEC

- PancakeSwap.Finance: DEC:BUSD

Attention!

- The PIZZA:DEC pool on TribalDex is currently NOT supported and will NOT count Airdrop Points. <Sad 🍕Pizza🍕 Noises>

- There is an old DEC:BUSD Liquidity Pool (called 'V1') on PancakeSwap (ID 0x4c79edab89848f34084283bb1fe8eac2dca649c3) that's also qualified for Airdrop Points, but I couldn't find it on their website. I'll assume that it is deprecated and shouldn't be used anymore.

Conclusion

I hope that this post will help you understand how you can use the Decentralized Finance (DeFi) Ecosystem on the Hive Network to increase your SPS Airdrops Splinterlands.

The game is booming and everyday there are thousands of players creating new accounts. But, even then, there's still huge opportunities to grow your strenght in-game and, hence, grow your daily profits. Putting your unused DEC into Liquidity Pools can help you achieve your goals.

Thanks for reading this article, and until next time!

New Player Bonus Offer

If you're a new Splinterlands player that still haven't bought the 10$ Summoner's Spellbook, you can help both you and me by creating a new account using my Referral Link. If you create an account using my link and then buy the Summoner's Spellbook, leave a comment here and let me know.

Once I have verified the referral, I'll send you some cards for free to use on your first weeks in the game to help you progress faster through the Bronze League! Using my Referral link doesn't cost you anything extra and will make both of us stronger 💪!

If you're looking for other NFT games to play, I'm also on Rising Star and dCrops.

Unless stated otherwise, all images are 1) created and owned by me or 2) from the game featured in the post.

Also, this is definitely NOT a financial advice. Cryptocurrencies are very volatile, so don't invest what you can't afford to lose.

Posted Using LeoFinance Beta

Good guy, great you included the pools that actually do and do not count towards the airdrop. There was some confusion earlier as some posts claimed pizza was included and there's no official list anywhere which ones are supported.

so, well done :-)

Thanks for your support! Indeed, I wrote this article mainly to share the official pool list. It was incredibly difficult to find the official information, so I wanted to share with the rest of the community.

Yeah, I'm with you on that, had some trouble with it myself and did some trial and error, asking around etc. So we can now refer people to your post.

There's a bunch of us that enter those TribalDex pools at around 16.55 and then out by 17.10, whenever the snapshot is done.

That way you minimise your IL.

A friend of mine figured out that you can see the snapshot progressing in the background - behind where it says 'snapshot in progress' you can see the numbers completing one by one for the different asset classes.

It's annoying the Hive price has dropped, I'm going to struggle to cover my entire DEC stake - having to keep some SPS liquid for the purpose ATM, my fault for selling some HIVE at $1.20!

That's actually an incredibly smart usage of the Airdrop Points rules, thanks for sharing. If the user is able to be online around this time, it's a nice strategy doing this deposit/withdraw from the liquidity pools just before/after the snapshot.

It's worth around 100 SPS to me a day. I had a guest over today during the window, had to pause the conversation twice to get in and out of the pool, maybe a bit rude, but there you go, I can't talk and remember my crazy passwords at the same time!

This is great information. I recognized the value of these pools early and staked a bunch in the CubDefi DEC/BUSD pool. I've been suffering some of that Impermanent Loss you referred to but my DEC is also worth a ton more than when I put it in. Plus I've been receiving CUB as a bonus (which I happen to think is going to do VERY WELL over the next few months). I'm also pretty sure that DEC will go back down at some point after the Chaos vouchers are divvied out so I'm thinking I'll end up with most, if not all, of my DEC back when I exit the pool towards the end of the year-long airdrop.

In the meantime, I've been struggling to figure out which pools actually qualify for the SPS pts. THANK YOU VERY MUCH for figuring that out. It's been hard to get solid answers.

You're not the only one: there is no official information about which pools qualify for Airdrop Points. The Splinterlands team itself didn't knew the answer, and I had to keep asking lots of team members on Discord until someone was able to get me the full list.

In the other hand, I do understand their situation: the game is growing much faster than anyone could have predicted, it's normal to let those small quality-of-life stuff at the end of the "to-do list".

DEC count double in liquidity pool, but you have to put the equivalent amount of another token in the pools. So if someone only has DEC, he will have to sell half of it first. Nice post!

The DEC:SPS Pool is a good alternative in this case, as Splinterlands players end up with SPS due the daily airdrop itself.

indeed, nice tips! I read your post too fast

nice info i have 1 month on the game, pay 10$ for the spellbook an make son bad movements on rents and buying cards, now im trying to improve my DEC income and airdrops rate to get out of bornze and this info helps me a lot, i will put part of my decs on this pools, thanks for the info, keep the good work, greetings from venezuela!!

I'm glad that I was able to help you a bit!

Awesome post, @luizeba 👏 i've been wondering how to stake dec in pools for a while now, and you've answered my questions before i even asked them anywhere 👏

I'm extremely glad that I was able to help you!

Yay! 🤗

Your content has been boosted with Ecency Points

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more, by @luizeba.

Great explanation and certainly an interesting option to explore. You've been upvoted by solaito.

Your post has been manually curated by @monster-curator Team!

Get instant cashback for every cards purchase on MonsterMarket.io. MonsterMarket shares 60% of the revenue generated, no minimum spending is required. Join MonsterMarket Discord.

Awesome post

Thanks for your support! I'm glad that I'm being able to help the whole Splinterlands community with my posts!!

Thanks, yes I think so too

Thanks for sharing! - @cieliss

Done

Awesome and useful post

Thanks for your support!

Thank you for the information. I didn#t know that this was possible.

The problem I have is that I would have to trade half of my DEC in order to put it into the pool. Meaning that I would have half of my DEC but get 2x points. So it would be the same as without pool. correct?

Any link to sps pools that count?

In my post I link to all the Official SPS Pools that counts towards the Airdrop Points :D