The Money Printing Machine.

The world around finance and financial services is changing with crypto and leofinance is not shying away from those changes. I've been trying to wrap my head around polycub for days now, even though some things are still unclear, there has however been major green flags that points at sustainability.

We're looking at a money printing machine being built right in front of us, crypto enables for the creation of value out of thin air, but few people know how to do it, so I'd say with polycub, it's a win win win game theory.

Let's Dive In…

Ok, let's ignore the token price market, let's ignore all that and focus upon the asset itself (polycub) with the mechanics built around it.

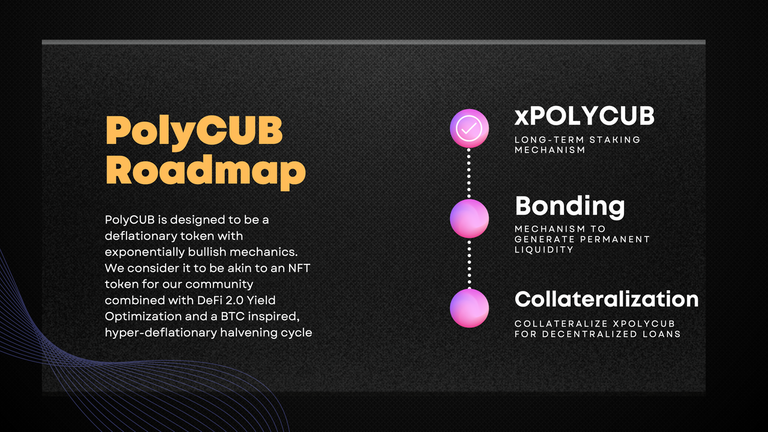

First thing you're looking at is the Xpolycub

I'd confess that I was quite skeptical as to how sustainable it would be to participate in this single asset vault when the days of the early selling penalties are over. Because looking at it now, the higher point of income is driven by this, more money is likely coming from the penalties than the yields.

Xpolycub is a goldmine, it's the money printing machine that just gives you endless abilities.

Over Collateralized Loans Explained.

The next phase of the polycub economy is bonding and Collateralized Lending on xPOLYCUB Tokens. There's a thin difference between CL(Collateralized Loans) and OCL(Over Collateralized Loans), and that is the introduction of the rule of thumb

The rule of thumb is an amount provided to increase the credit profile of a loan. So in a nutshell, over collateralized Loans are given with an additional amount of maybe 10 or 20% collateral to mitigate the risk of asset price fluctuations or losses. This is a protective measure, that in case a user decides to forfeit his collateral maybe due to changes in market value, the system isn't hurt much because of the rule of thumb.

The Benefits Of Taking A Loan

I see a little bit of reverse Securitization( similarities, but better) with the existence of Xpolycub. It acts as a collection of another asset (polycub), bearing interest, that instead of investors facing an underlying asset risk, there's rather an increment of underlying assets, meaning there's only a win with this regardless of price changes, it all levels up.

Now the benefits of taking a loan is quite simple;

"Self paying interest"

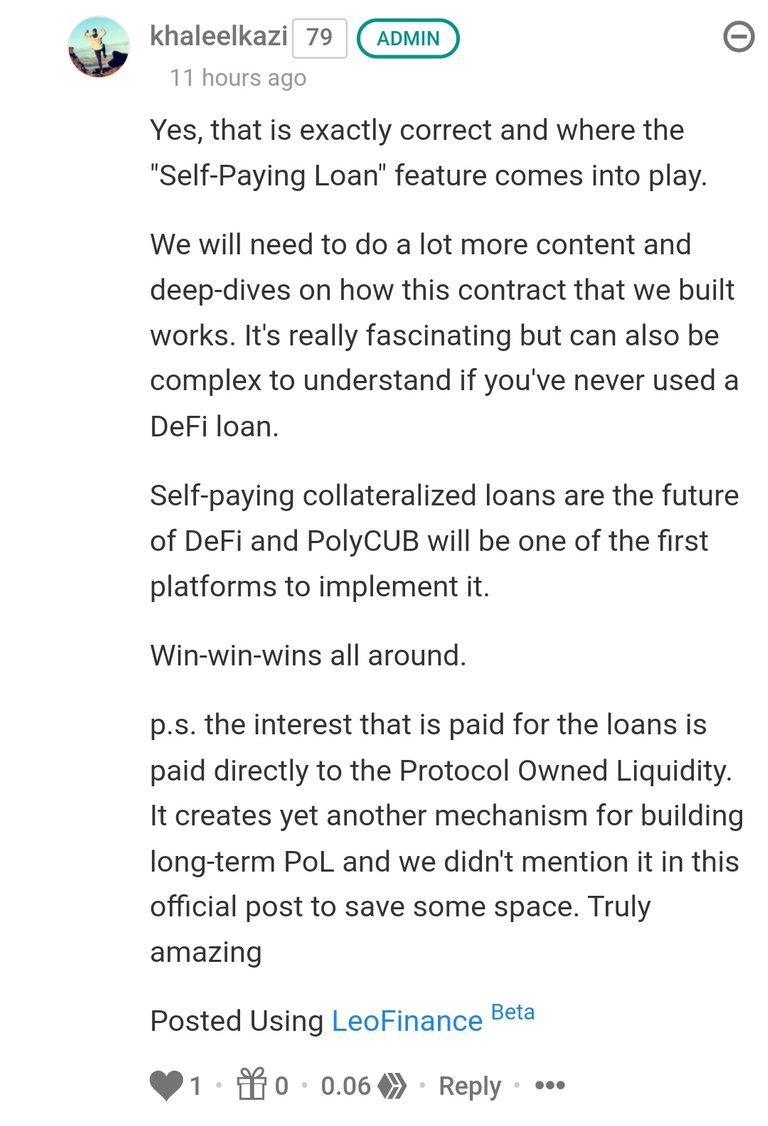

One thing is to take a loan, another is to pay with the interest, the interest is the most difficult part of it all. Now, with Xpolycub, you're looking at a framework designed to enable users to take loans with their interest bearing assets, whereby the loan interest is paid off autonomously with the interest earned from the asset vault.

Now I don't know if anyone else have noticed the possibilities of taking these loans aside from a self paying mechanism. With a protocol as polycub, you're looking at endless financial services, so taking a loan to earn yields on top of it, is the wiser thing ever*

Simply buy polycub, stake to polycub vault, further stake to its over collateralized contract, receive a loan, deposit it to some other pool and earn in two ways. And if you look at the design closely, you'd realise that as a spread investor, the charges incurred, somehow runs back to you, it's quite a system designed to distribute wealth.

Posted Using LeoFinance Beta

Read how this all have started with Toruk

Posted Using LeoFinance Beta

Thank you Toruk :)

Congratulations @malopie! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 1000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Awesome post, the first "self repaying" loan I heard of was Alchemy. Polycub's self repaying loan mechanism is quite interesting. I'll most likely be trying this ASAP.

Have a good one!

Posted Using LeoFinance Beta