Most of the time I don't have much to say, because I'm rather a silent reader, but currently I have interesting news where maybe more crypto affine people, could be interested.

In the current market situation, it is difficult not to deal with the price, so I try to focus more on the fundamentals and use cases of the blockchain. During such phases, I try to stay calm and try not to rush into action. It is all the brighter if you do not only deal with the charts and mainstream crypto news, but also inform yourself offside from time to time.

In Switzerland, a law has been passed and adopted since August 2021, where a few interesting things will be allowed in Switzerland regarding blockchain and shares.

In September 2020, Parliament passed the distributed ledger technology (DLT) blanket act, which selectively adapts ten existing federal laws. The blanket ordinance that has now been adopted summarises the necessary adjustments to ten ordinances. The legislation improves the conditions for blockchain and DLT companies in Switzerland, thereby making the country an international pioneer in modern regulation of innovative financial market technologies. -- https://www.admin.ch/gov/en/start/documentation/media-releases.msg-id-84035.html

What I want to write about today is the implementation. This law allows you to map shares of Schweitzer companies on the blockchain. This allows whole innovative models, which I will briefly explain.

Platforms that have emerged from it

Two "small" blockchain companies in particular have pioneered these changes.

- daura ( https://daura.ch/en/ ) this platform allows to digitize shares of companies and store them on the blockchain. Unfortunately, this is currently not yet available on a public blockchain, but it is being worked on.

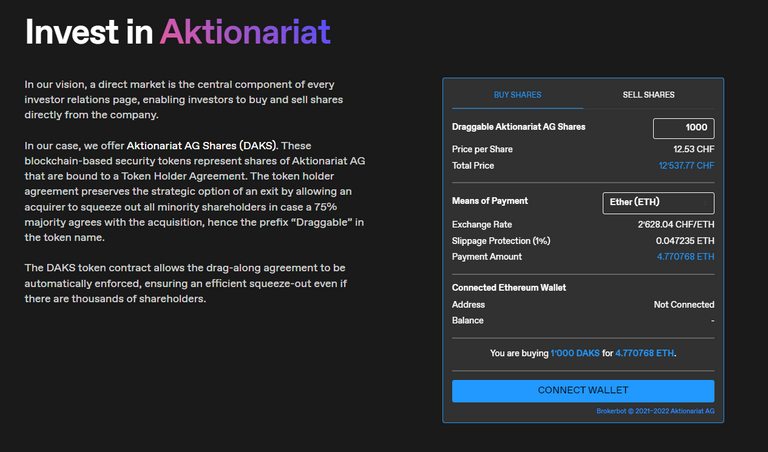

- shareholder ( https://www.aktionariat.com/ ) also a platform that has emerged, but here the Ethereum Blockchain / Optimism is used and is already available.

These two platforms enable existing or new companies to present their shares digitally and participate in the capital market without a large IPO. This is particularly interesting as there are many innovative small to medium-sized companies in Switzerland.

Currently, however, investors do not have an easy way to invest in these companies on a large scale, as the shares are not publicly tradable. I see this as a great advantage of such a digital share solution. In addition, all the middlemen such as stock exchanges and banks are eliminated, which is very important in such an environment, since many banks earn a lot of money with IPOs and consulting. With these platforms and products, the possibility of easily collecting money from investors is now also available to small businesses.

Intended use of such technology

As an investor's point of view, I get an opportunity to invest directly in SMEs and can actively participate in them if I wish. In addition, if someone with large crypto assets decides to use part of his profits to diversify his portfolio, he no longer has to sell them and exchange them via the crypto exchange in to FIAT and then invest in companies, but he can do directly via the platforms with ETH or other crypto. It also allows the small business, in addition to the traditional methods private equity funds or small OTC deals also to raise the money through the crypto market. Which can be very attractive.

Conclusion / Summary

I have gotten to know both companies and consider their ideas more than meaningful, moreover I am convinced that at https://www.aktionariat.com/ the product already runs on the Ethereum Blockchain and they have already integrated Optimism to reduce the fees.

The selection of companies is currently still very limited and I suspect that it will certainly take some time until established companies or more companies issue their shares directly on the blockchain. As soon as the advantages become clear, it is only a matter of time.

I personally think of such companies as https://www.aktionariat.com/ and https://daura.ch/en/ about a 3rd stage of crypto companies/projects. The first stage were the Layer 1 Blockchain itself classic Bitcoin, ETH etc. then from that in my view the 2nd stage emerged. All the great applications like DeFI, Blockchain Gaming etc. emerged. But these projects are more related to their own eco system and do not necessarily meet the average person in the real world.

Currently we see more and more projects that have actual added value on our everyday life. I consider these projects as the 3rd level.

In this category I would put these two presented projects, Aktionariat or Daura. They do not have their own tokens, nor their own blockchain etc. no they simply used the technology to make a very small area of the financial world more accessible to more people.

For transparency reasons, I would like to mention that I do not hold any shares in the companies. At https://www.aktionariat.com/ you can also invest in the company yourself. If the crypto market is doing better again, I can well imagine to deal more with it and read more deeply into this matter.

What is your opinion about it, is there something similar already in your countries? Do you think it makes sense as well or is it just a nice idea but won't find any application in the real world?

Congratulations @mangowambo! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 100 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Congratulations @mangowambo! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!