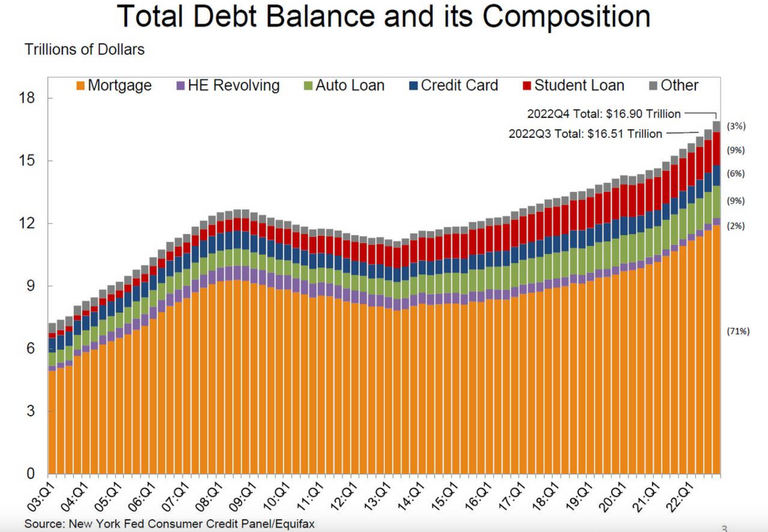

The total household debt grew 2.4% in the last quarter of 2022 to 16.9 trillion US$.

- Mortgages. They stand now at 11.92 trillion US$

- Home equity lines of credit (HELOC). This item grew to 0.34 trillion US$.

- Student loans. They increased to 1.60 trillion USD.

- Auto loans. They increased to 1.55 trillion USS.

- Credit card. This debt grew to 0.99 trillion US$.

- Others. This item grew to 0.51 trillion US$.

Household debt in the United States has been on the rise for several years. This trend has been fueled by a number of factors, including increasing costs of education, healthcare, housing, and other essential expenses. The rise of consumer credit and the availability of credit cards and other forms of consumer lending have also contributed to the increase in household debt.

One key factor contributing to the rise of household debt is the increasing cost of education. As college tuition and other educational expenses continue to rise, many students and their families are turning to student loans to finance their education. Student loans are one of the largest sources of household debt in the United States.

Another factor contributing to the rise of household debt is healthcare costs. As healthcare costs continue to rise, many families are turning to credit cards and other forms of borrowing to pay for medical expenses. This has contributed to the growth of medical debt, which is now one of the leading sources of household debt in the United States.

Housing costs are another major contributor to the rise of household debt. As the cost of housing continues to rise in many parts of the country, many families are turning to mortgage loans and other forms of borrowing to finance their homes. This has contributed to the growth of mortgage debt, which is now one of the largest sources of household debt in the United States.

Overall, the rise of household debt in the United States is a complex issue that is driven by a number of factors. While there are no easy solutions to this problem, there are steps that can be taken to help reduce the burden of debt on American families. These steps include improving access to education and healthcare, addressing the rising cost of housing, and promoting financial literacy and responsible borrowing practices.

For further information, read this article