Anarchist Investor Weekly

Your weekly review of the Anarchist Investor Newsletter

Time to Rally?

A word of caution

THE ANARCHIST INVESTOR

APR 22, 2024

Today’s post is a short one. The casino is rejoicing because we narrowly escaped World War III at the end of the previous week. Risk assets are ‘breathing a sigh of relief’. Don’t be fooled. This was just the appetizer. Don’t go piling into investments buying the dip. Stick to your guns and remain vigilant.

Here are storylines to continue watching that will key you in on the current economic weakness that is growing:

The earnings from Truist this morning point to Bank Net Interest Income continuing to contract. This is because higher interest rates are forcing banks to pay more for deposits and lend less. The regional banking crisis is not over.

https://finance.yahoo.com/news/truist-lending-income-misses-estimates-102018424.htmlThe retreat of Gold and Silver won’t last forever. You might want to make your monthly purchase sooner rather than later. Over the weekend Chinese bank regulators forced precious metals margin accounts to carry more cash. This is creating a short-term liquidation of long positions that were leveraged up too much. The underlying case for Gold and Silver is still in tact.

https://news.metal.com/newscontent/102712803High Yield Corporate Bonds (HYG) are continuing to look weak. The etf is retesting the lower end of the consolidation range it failed. Many companies have lost their advantage in terms of passing higher costs onto their customers. Corporate profits may have topped out which means we will see a jump in corporate restructurings, bankruptcies, and lay offs soon.

The Federal Reserve is still on course to begin cutting rates this year. They are just looking for an excuse (see all of the first three storylines). Jerome Powell will continue to deflect requests to pinpoint a date for the first cut but it is just being done to appear neutral on the market. In reality, the Fed sees the weakening economic numbers and they just need an excuse to make that first cut.

I’ll explore these issues and more in the coming week.

The Catalyst for the Coming Recession

Here are the top 3 candidates to watch out for

THE ANARCHIST INVESTOR

APR 23, 2024

Recessions are normal and regular occurrences in economic cycles. Like a volcano that destroys so that new life can grow, recessions clear out the broken businesses and investments so new ones can flourish. However, they don’t happen on their own. The conditions have to be present for one and then like a chemical reaction, they typically require a catalyst to get going. Here we’ll look at the three most likely candidates for the next recession.

The underlying requirements for a recession are in place. The Federal Reserve has just completed an aggressive interest rate hiking campaign that signaled to the markets and they followed along with dramatic rises in borrowing and credit costs throughout the whole economy. The yield curve has thus been inverted for over a year which means new credit is being created at a loss in long term profitability. Businesses and consumers are finding it more difficult to borrow and thus can afford less investment in expansion or goods and services consumption.

The fields are dry from little rain but there needs to be a spark to set off the recession. What will be that spark?

1. Oil Price Shock

Historically, the most frequent cause of recessions is energy prices. Oil price shocks have been the cause of recessions in the 70’s during the Great Inflation as well as the Great Financial Crisis in 2008-09. The technical recession at the beginning of 2022 can also be attributed to oil price shocks due to the war in Ukraine.

West Texas Crude Price Per Barrel (2004-2024)

While currently elevated, crude oil continues to remain in a manageable range…for now. The fighting in Ukraine continues with a renewed funding bill passed by the US just recently. In addition, the War in Gaza has spilled over into neighboring Middle Eastern countries with Iran and Israel already trading missile and drone attacks. A further escalation in either or both of these conflicts could trip off an oil supply shock that does the deed. Another wild card continues to be the Federal Reserve’s rate signaling policy. Rate cuts could fuel speculation on inflation-linked commodities like Oil and drive the price high enough to tip the scales toward recession.

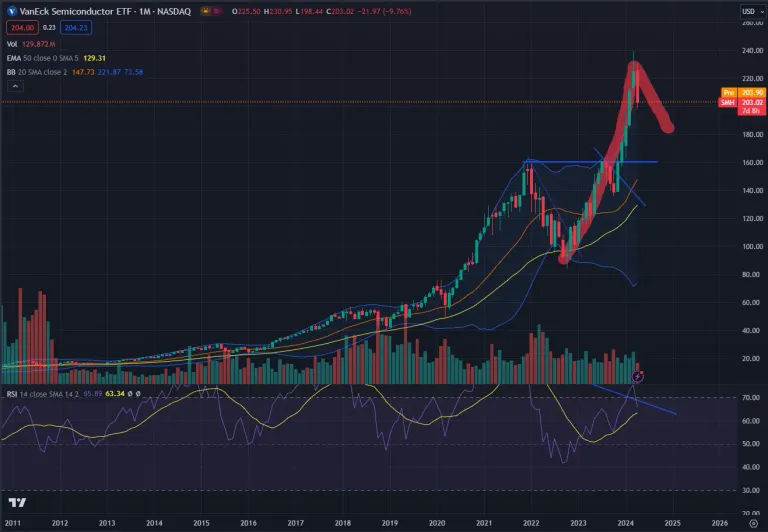

2. Stock Market Crash

At the onset of the 1929 Stock Market crash and ensuing Great Depression was the initial crash from September to November of 1929. The rampant fraud and speculation resulted in a violent correction from the top. This correction set in motion a Tsunami of speculative asset liquidations along with an economic decline that hasn’t been seen since. The bursting of the Dot Com bubble also initiated the 2001-2002 recession. Once again, rampant speculation caused leverage bets to be unwound quickly following the bursting of that asset bubble. The price decline in the Nasdaq set off a system of dominoes in other investment areas.

Nasdaq Index (1992-2024)

The most likely candidates for this catalyst are the AI bubble and the Crypto bubble. Both of these speculative investment categories have grown rapidly in the past 4 years. Returns have been gaudy and it’s my opinion that they have far outpaced sane valuation for some time now. With the increase in digital trading and specifically options trading, the AI or Crypto bubble could burst in hours or even minutes due to a flash crash. That event could snowball into a world-wide sell off and thus a synchronized global recession.

VanEck Semiconductor Index (2011-2024)

3. Black Swan Event

2018 and 2019 I will forever think of as the recession we were supposed to have but never got. The makings of a recession were forming but the Federal Reserve reversed course dramatically and bought enough time for the recession to ultimately be caused by the COVID Pandemic. Most folks will tell you there was no recession because the US GDP didn’t technically decrease for 2 straight financial quarters. However, the dramatic rise in unemployment was enough for me to put a check mark in the recession column. Keep in mind that these are the least likely catalysts and hardest to identify in advance.

A lot of possibilities exist here because it’s the most ‘conspiracy theorist’ heavy option in this article. However, the most credible events I can foresee would be the following:

Large-scale fraud inside of a large, strategically sensitive financial institution resulting in financial contagion (ie - Enron type event)

Large-scale cyber attack and/or network outages caused by a natural weather event like a solar flare/storm

World War 3 or Nuclear exchange which would also trigger catalysts 1&2

United States Government credit event such as a global move away from the US Dollar as the World Reserve Currency or a prolonged Budget Stalemate in Washington DC

How to Play Protect

Here’s a short list of investment and financial strategies that will help you now and into the future:

Get out of bad debt ASAP

Practice good risk management through diversification and controlled entry and exit of investment positions (have an idea of your investments’ target value/price, value average, and rebalance as needed)

Purchase insurance in the form of cash, gold and silver (and if you do have money at work in the Wall Street Casino, a hedging strategy using puts or selling calls)

Diversify your income streams and cash flows (you should have at least three and at least one of those should perform well during an economic downturn)

Limit your tax liabilities and keep powder dry (ie cash) to be able to take advantage of dramatic moves down or up in your investments

Don’t Miss Your Chance At BITCOIN!!! 💰💰💰

I’m giving away $25 in Bitcoin to up to 4 free subscribers on May 1, 2024

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Subscribe to enter: anarchistinvestor.substack.com

Or better yet…Become a paid subscriber to get a chance at $100 IN BITCOIN and:

📚 Access to the full Anarchist Investor Archive

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

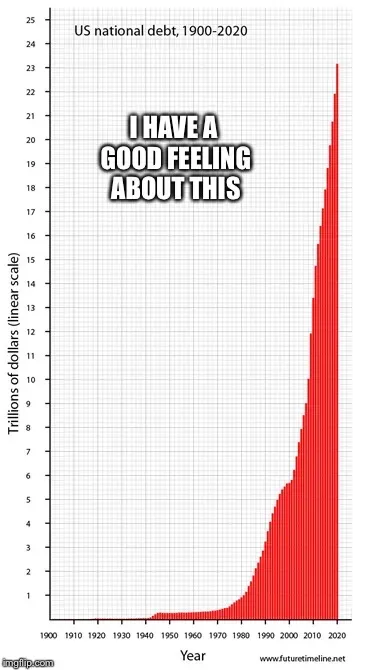

US Government Throwing Good Money After Bad

What have we gotten for our $11 Trillion in excess spending since 2020?

THE ANARCHIST INVESTOR

APR 25, 2024

“We need to shut down now to save lives. We can worry about the economy after.” This was a phrase I heard repeatedly throughout March and April of 2020. It was a worrying time obviously. Folks were dying and the media hype was deafening. I kept coming back to one big issue. You can’t turn the global economy on and off like a light. Supply chain construction/adjustment and capital investment spending happen on the time frame of years and decades. Many businesses are funded on a month-to-month basis. This means even a small disruption would set back long-term projects and threaten the existence of many businesses and jobs. “It’s why we need the stimulus spending!” is something else I was told. It turns out, that the excess US Government spending that was deemed as stimulus totaled $11.2 Trillion as of the end of 2023. What exactly was the result of it?

Financial Repression

Following the GFC in 2008, global governments had huge deficits to fill and took on mountains of risk because of it. They needed an economic recovery while also needing to syphon money out of the private sector to make up for all of the risk they took on. This is where Financial Repression comes in.

Financial repression is a term that describes measures by which governments channel funds from the private sector to themselves as a form of debt reduction. The overall policy actions result in the government being able to borrow at extremely low interest rates, obtaining low-cost funding for government expenditures.

This action also results in savers earning rates less than the rate of inflation and is therefore repressive. The concept was first introduced in 1973 by Stanford economists Edward S. Shaw and Ronald I. McKinnon to disparage government policies that suppressed economic growth in emerging markets.

-Investopedia

Governments artificially kept interest rates low so that savers were penalized. That penalty was a stealthy tax that helped pull private sector money into government coffers to help them offset the fallout from 2008. Unfortunately for them (and the general public) they didn’t anticipate what could throw a monkey wrench in this whole thing. Inflation stayed low and thus reduced the amount the government could syphon. This resulted from a slower economic recovery than hoped as well as a much slower velocity of money. At one point in 2018, it was possible that interest rates at banks would go negative. It was a situation that was getting out of central planners’ control. Then came COVID.

Stimmies

The world needed stimmy checks and they needed them now. That’s how we would keep everyone housed and fed.

It turns out that most of the deficit spending over the past 4 years hasn’t gone to individuals, it went to corporations. However, the focus of the day was checks raining down from the heavens on consumers. Over the four years 2020-2023, the US Government spent $11.2 Trillion more than it was projected to. The national debt in 2012 was about $11 Trillion. This means the US increased the debt in four years the same amount it took the country to accrue in its first 236 years.

What is Government Debt Spending?

Because the Government needs to resort to taxation, financial repression, and induced monetary inflation to fund its’ debaucherous spending habits, deficit spending isn’t a free lunch. What it really amounts to is borrowing productive activity from the future. However, like borrowing for a house or on a credit card, there is a cost. $1 of future economic activity in the present isn’t worth $1. It’s worth much less depending how far out into the future you borrow that activity. This happens because that future activity would require a smaller amount be invested today and the growth of that investment compounded over the years until it would’ve actually occurred. This means the further out into the future that the US government borrows productive activity, the less and less worthwhile it is in the present day.

To put it into context, the US Federal deficit is at roughly $35 Trillion as of the date of this writing. This means the US has borrowed over a year and half of the total GDP. If it was possible (and it isn’t) we would all have to work for a year and a half with no pay and at 100% taxation to pay for that deficit. That amount of time also increases every year where the growth in deficit spending outpaces the real growth (inflation adjusted) in Domestic Economic Productivity.

What Have We Gotten For Mortgaging Our Grandchildren’s Future?

The Real US GDP has grown by about $3 Trillion over the past 4 years. This means the US has borrowed and spent almost $4 for every $1 in Gross Domestic Product it has produced. It gets worse if you adjust for inflation. That number looks more like 5X. This amounts to currency debasement in the future. Keep in mind the inflation of the past 4 years has been mostly driven by Supply Chain disruption. The real monetary inflation has yet to hit. This is quite literally like pushing on a string. Try as you might, the string just doesn’t move very far forward. It just bunches up on itself.

The US Government as well as many of the world’s Western Governments have used the future economic productivity of our children and their children to live luxurious lives in the present. The bill is coming due sometime soon. Expect more taxation, financial repression, and theft via inflation. It’s why I have stacks of gold, silver, and crypto. The solutions for these problems do not reside within the system itself. That system is bankrupt, just not many know it yet. The bill almost came due in 2008 and then again in 2018. 2020 will turn out to be the catalyst for the coming crash and it will be long overdue. The next 30 years are going to be difficult. You can make them less so if you’re willing to make some changes. That’s why this newsletter exists. To facilitate that transition and save at least some folks a lot of pain.

Why Insurance "Inflation" Remains High

An no, it's not actually inflation

THE ANARCHIST INVESTOR

APR 26, 2024

I emailed my broker the other day because my auto and home insurance has gone up by 30% in the past two years. I wanted to know if she could market my coverage and find a more competitive rate. The answer I got back was, “The move your coverage you would have to pay 25-50% more.” I have every reason to believe her as I used to work with her and she is incredible at her job. But that got me thinking. There are pockets of higher prices right now that everyone thinks is inflation but really come down to supply disruption. Insurance is one of those. Let’s take a look at why and how this might rectify itself in the future.

Hard Markets

I worked as a broker and risk manager in the Property & Casualty insurance industry for over 15 years. I still maintain a number of relationships from that sector (some of you are reading this right now). It was the first profession I ever felt at home in. While in that industry I only had to deal with a Hard Market once and it was a bloodbath. Premiums increased by 30-40% on some policies with no claims and even reduced coverage. Some insurer flat cancelled or wouldn’t offer renewal terms to clients. Many insurance companies closed divisions servicing entire sectors of the economy. It was mayhem. As a broker though, the compensation was never better. When you’re paid a percentage commission on the total price tag, you’re in a good place. Everyone else…not so much.

hard market

A hard market is the upswing in the insurance market cycle, when premiums increase, coverage terms are restricted, and capacity for most types of insurance decreases. - IRMI

There are a multitude of reasons why a hard market can occur. The key is to understand how insurance companies work. In the simplest terms, your premiums go into a hat with every other policy holder’s premiums. From that hat, the insurance company pays for expenses (marketing, claims handling, underwriting payrolls, policy maintenance, etc), the actual cost of claims, and what left is the underwriting profit. Part of how insurance carriers keep premiums competitive is to invest those premiums into short or long-term debt securities like high grade US Treasuries, Mortgage Backed Securities, or sometimes Corporate Bonds. The interest paid by those investments goes into the hat. Hard markets hit when the hat isn’t getting filled up enough to cover all of those expenses plus generate a profit for the shareholders.

Pooled Risk

Let me take a quick minute to discuss why insurance is such an important product. Pooling risk is extremely cost effective. You can pay $100 in premiums and get $1,000,000 in coverage in some instances. This is because your money is pooled with others who don’t experience a loss. One of the financial legs of a healthy economy is insurance as it dramatically reduces the societal cost of claims such as fires, injuries, etc. It keeps the injured party and the insured party whole so they don’t lose their home, business, etc.

From an anarchist investor perspective, I can’t stand the Government involvement in the sector. It drives up compliance costs and adds to that ‘expense’ portion of the money in the hat that doesn’t get paid out towards claims. It’s like a charity where your donations get cannibalized by administration fees and very little of it actually gets to the folks that you’re trying to help. I know a lot of folks can’t stand insurance companies and they do their fair share of lobbying so I don’t blame them. Keep in mind they’re not flying solo. The Government has a huge role in driving up the overall cost of insurance as well as contributing to hard market conditions.

The Present Hard Market

Typically hard markets are not caused by any one factor. Usually a confluence of economic influences are required to dramatically restrict coverage and drive up the costs of what remains.

1. Fixed Income Investments

Fixed income (or bond) investments make up a huge portion of the portfolio that insurance companies create out of the pooled premiums. In 2022 and the beginning of 2023, bond prices dropped dramatically as The Federal Reserve raised interest rates. This means the projected investment returns the Insurance Companies were banking on to help subsidize the pool of funds to pay claims from was decreased by a lot. To make good on their commitments, insurers have had to increase the flow of funds moving into the hat from policy holders which results in rapid increases in premiums.

Future anticipated returns are higher due to new money buying fixed income investments that have higher yields. I’ll talk about this in the resolution.

2. Increased Claims Costs

Insurers are also seeing increases in the costs of the claims themselves (as well as overall expenses). Salaries have increased for underwriters and claims adjusters. Cars have gone up in price rapidly and thus repair costs have increased. I tried to look at dropping my comprehensive coverage on my 2009 minivan and it didn’t save much at the same time that the car was actually appreciating in value!!! Property has become more valuable which means it costs more to replace. Think back to 2021 when lumber was skyrocketing in price due to the supply disruptions of 2020. That meant homes damaged by storms were much more costly to repair. All of these factors mean even if claims on policies remain flat, the overall costs rise and pull additional funds out of the hat.

3. Decreased Competition

The above factors as well as more difficult financial conditions impact insurers in the form of shutting down certain coverage types/industries or closing up their doors all together. As overall insurance carrier participation drops, the remaining carriers don’t have to be as competitive with costs in those areas. Even during hard markets there are some coverage types or industries that don’t get impacted as much. It’s because competition remains robust in those areas. For all the rest, the reduction in competition means insurance companies can be more picky about the risks they choose to insure and at what price. Also think about the size of the hat (pooled premiums). If their expenses remain high but they get more picky about who they’re insuring, the “lucky” recipients of a policy get to pay a larger share of those expenses in the form of higher premiums.

How Do Hard Markets Resolve?

Insurance routinely moves back and forth between Hard and Soft market conditions. Hard markets in a way lay the groundwork for the next soft market. Just like supply and demand, higher premiums in a particular area attract new market participants, especially if that sector’s profitability is robust. This increases competition and drives down prices. In addition, the current market is being impacted by interest rates. However, the future of those returns is higher as new premiums right now are being invested in higher yielding fixed income investments. This points to more subsidizing of the pooled premiums in the future. It just doesn’t impact things in the here and now like the legacy obligations the insurers have already committed to. And finally, the economy will need to improve. It is soft right now which means insurers aren’t growing. Growth allows an insurer to forego some profitability in the near future for a larger share of the market. Ultimately, the government and Federal Reserve need to get out of the way and let the financial pain be realized within the economy. Until they do, these ‘paper cuts’ like higher insurance premiums will continue to contribute to the slow death of the US consumer.

What Should You Do?

It’s fairly simple, buy less things that require insurance if they aren’t necessary to your daily life or operations as a business. The items that you absolutely need and require insurance may need lower coverage on them or you will need to reduce expenses in other areas to pay for the higher cost to maintain the level of insurance you currently have. Finally, use a broker that can market your coverage to many insurers. Sometimes hard markets are the best time for a company to pick up market share if they’re still trying to be price competitive. Your broker might be able to find that company for you.

Affiliate Links

Get $10 in free Bitcoin and start stacking today with Swan Bitcoin: https://www.swanbitcoin.com/anarchistinvestor

Automate your Gold & Silver Purchases with Vaulted:https://vaulted.blbvux.net/g1EGKX

Save/Make Money on your Cell Phone Plan with Helium MOBILE:https://my.hellohelium.com/ref/2FN2CHL

Anarchist Investor Links

Anarchist Investor on Substack: anarchistinvestor.substack.com

Anarchist Investor on Spotify:

~~~ embed:embed-podcast/show/5bPTSl9UcLuDOlki25iBjU?go=1&sp_cid=195eae3f83bf1083418e06af7cb8af8f&utm_source=embed_player_p&utm_medium=desktop spotify ~~~

Anarchist Investor on Rumble: https://rumble.com/c/c-6154833

Matt_Archy on X: https://twitter.com/Matt_Archy

Matt’s Personal FB: https://www.facebook.com/matthew.struck.37

Matt’s Personal LinkedIn: https://www.linkedin.com/in/matthewstruck/

Matt-Archy on HIVE: https://peakd.com/@matt-archy

Matt-Archy on Vimm.tv: https://www.vimm.tv/c/matt-archy

Keep in mind that investment and investment results are very much based on you as an individual. I am not an investment advisor. I’m a dude with an opinion. Do not rely solely on the discussion here to inform your investment decisions. Always make the investment decisions that are right for you and your situation

Congratulations @matt-archy! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 250 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: