Anarchist Investor Weekly

Your weekly review of the Anarchist Investor Newsletter

Gold's Warning

A Lookback at Gold's All-time High's

THE ANARCHIST INVESTOR

APR 01, 2024

Gold is rallying as I type this. It is at a new all-time high of $2,276.20 per ounce. Most folks think of gold as an inflation hedge. Some also see it as a lifeboat when times get tough. Let’s look back at the times Gold surged to new all-time highs and the economies that followed.

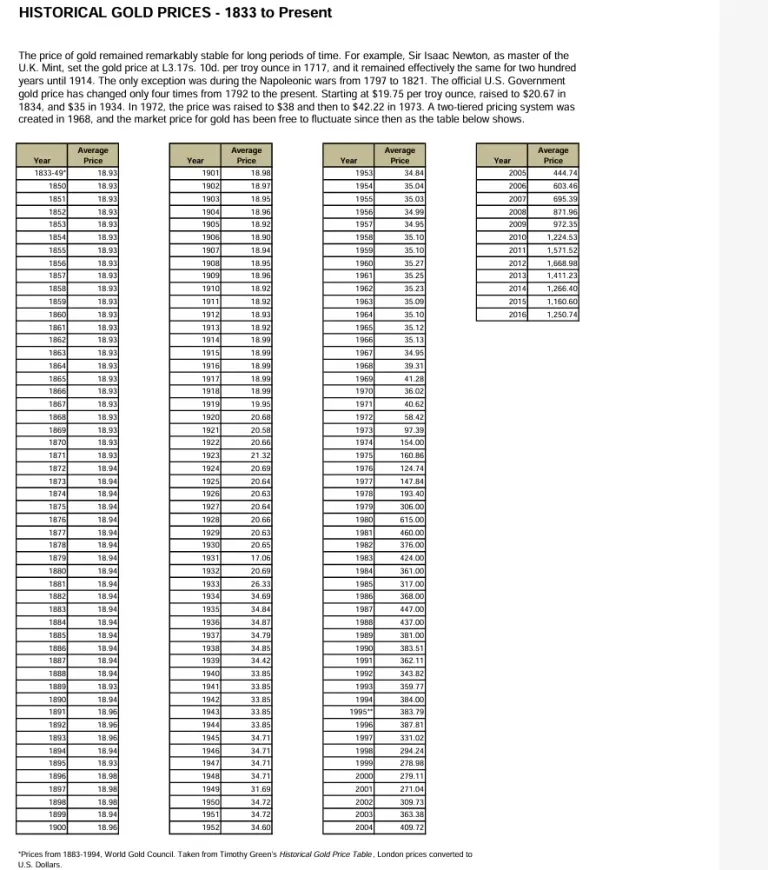

Source: NMA.org

1932-1934

Gold prices were fairly calm and consistent at around $18-$20 per ounce from 1833 up until the early 1900’s. From 1932 to 1934, that price spiked up to $34 per ounce. That represents about a 79% rise in those 2 years.

The Great Depression was in full swing in 1932. In fact, it had been raging for approximately 3 years at that point. The price of gold didn’t do much in those first three years. In fact, it drops to $17 per ounce in 1931. The fledgling central bank (created in 1913) had erratic policy decisions. It caused a cash crunch throughout 1929-1931 in response to a huge drop in stock markets. As a result, gold was sold to purchase dollars. Several other policy decisions by the Congress such as banning gold exports affected the global price of gold. Starting in 1932 gold rises in anticipation of FDR’s New Deal. The Government’s debt grew by over 50% in the 3 years following the New Deal. The Money supply falls initially in 1932 and then rises dramatically from 1934 onward. Many hard money advocates argue that it was at this point that the US dollar was destined for hyperinflation.

1968-1980

Following the 1930’s gold hung around $33-35 per ounce until rising precipitously to $625 in 1980. That’s a 1,700% rise over those 12 years. 1971 marked the death of the gold standard in the United States that was begun in 1933 by FDR. The original gold standard meant that any US currency had a fixed amount of gold backing it and any creditors could demand payment in either US currency or gold. This meant the two could be readily converted into each other. During the Great Depression, FDR removed that obligation to fulfill creditors’ wishes to be paid in gold following a lack of faith in US Banks causing Americans to hold more gold than US dollars deposited in banks. In 1934, the US still kept the “peg” meaning each ounce of gold was valued at $35. In 1971, President Nixon removed that peg entirely and thus died any remnant of the Gold Standard.

Don’t Miss Your Chance At BITCOIN!!! 💰💰💰

I’m giving away $25 in Bitcoin to up to 4 free subscribers on May 1, 2024

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Subscribe to enter: anarchistinvestor.substack.com

Or better yet…Become a paid subscriber to get a chance at $100 IN BITCOIN and:

📚 Access to the full Anarchist Investor Archive

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

2007-2011

The 1980 high of $625 was more than cut in half by 2001 ($271). From that point, gold rose quickly to a new all-time high in 2007 and reaching a peak of nearly $1,700 in 2012. That’s over a 500% rise in 4 years. The onset of the Great Financial Crisis coincided with gold’s rise. The depths of that crisis were fully realized in 2008 and 2009.

From the third quarter of 2007 until the third quarter of 2009, the Federal Debt increased by almost 33%. In fact, that debt hasn’t decreased any year since. From that same starting point, the Total Federal Debt is up 278% to a total of over $34,000,000,000,000.

2015-2024

In December of 2015 gold bottomed out at $1,045 per ounce. Since that point it has rallied to a new all-time high of $2270 at present. That represents a 117% increase. The United States has suffered a near recession in 2019 and a ‘flash recession’ during the COVID pandemic in 2020-2022.

Since the first quarter of 2020, the Federal Debt has increased by almost 48% from $23 Trillion to now over $34 Trillion. Unemployment remains historically low but the current economic conditions are miserable for anyone in the lower quartile of annual income.

Gold continues to anticipate increases in Federal Spending and Money Printing following economic crises which also begets debasement of the US Dollar. The current rally doesn’t seem to be done, nor should it be. The trajectory of the Federal Debt that pushed gold up during the Great Financial Crisis has been accelerated starting in 2020 (ie - the slope of the line is now even higher). My short-term price target for Gold is $2,600. However, this would only mark a 150% increase in the price since 2015. Based on the amount of spending and printing, it’s entirely possible that Gold ends up at $3,000-4000 per ounce. This is especially true if the US economy enters a recession and even more debt and money printing is on the horizon.

Bitcoin Is Not Digital Gold

It Is a Digital Inflation Hedge

THE ANARCHIST INVESTOR

APR 03, 2024

It has been a colloquialism that Gold is a hedge against inflation. Recently, there have also been a lot of folks touting Bitcoin as digital gold. All those people are wrong, on both accounts. I’m going to dispel both of those old adages and let you know what Bitcoin and Gold actually are in this article.

Gold Isn’t An Inflation Hedge

It’s an insurance policy against uncertainty. The same is true of silver. Gold and silver underperform dollar denominated assets like stocks over long time frames because they don’t create yield/profits and they technically aren’t denominated in dollars (they’re denominated in ounces or grams). Gold and Silver also aren’t linked to currencies any longer. This means their supply and demand materially changes over time based on whether or not the dominant empire in the world pegs their currency to them. At present, almost no currencies are pegged to gold or silver so their relative demand is low as a store of value. As you’ll see below, gold and silver are an inflation hedge but imperfect ones.

When you look at the dollar value of gold and silver versus a chart of the Consumer Price Index you see they aren’t directly correlated.

Gold Futures (bars) vs CPI (orange line)

While both Gold and the CPI rise in this chart, notice there are periods where gold falls and the CPI continues to rise. There are also periods where gold rises dramatically compared to the CPI’s consistent movement higher. This denotes a loose association but not a strong one. Also of note is the rising geopolitical risk over the past 40-50 years that has fueled gold’s rise. The best hedges against inflation are dollar denominated assets that produce some kind of yield. I’m not a huge advocate for stocks but they are strongly correlated to inflation because of the aforementioned characteristics.

S&P 500 Index (bar chart) vs CPI (orange line)

You can also notice that periods of uncertainty are when Gold shines. From 2007 to 2011 there were huge concerns about global financial markets. Investors were hedging their exposure to financial collapse. This was true even after everyone thinks the smoke cleared in 2009 as the Federal Reserve had to engage in multiple rounds of Quantitative Easing throughout the 2010’s to keep the train on the tracks. Gold also rises dramatically starting in 2019 after the Federal Reserve’s first attempt at Quantitative Tightening and Rate Increases following the Great Financial Crisis. The US nearly escaped a recession as The Fed reversed course immediately when it was apparent the banking system couldn’t withstand stricter credit controls. The subsequent COVID crisis continued the trend.

Both Gold and Silver are imperfect hedges against inflation. What they do serve as is insurance against large-scale financial collapse and credit tightening. This story may change in the future as more skepticism surrounding the US dollar and financial system pushes folks to stack precious metals and even use them for purchases via new digital providers as well as a source of yield via gold and silver leasing providers. For now, Gold and Silver are monetary insurance against catastrophe and only slightly useful as a hedge against dollar devaluation.

Don’t Miss Your Chance At BITCOIN!!! 💰💰💰

I’m giving away $25 in Bitcoin to up to 4 free subscribers on May 1, 2024

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Subscribe to enter: anarchistinvestor.substack.com

Or better yet…Become a paid subscriber to get a chance at $100 IN BITCOIN and:

📚 Access to the full Anarchist Investor Archive

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

Bitcoin Is Not Digital Gold

In short, Bitcoin is a NASDAQ stock. In fact, most crypto’s are as well. This stems from the fact that crypto’s are dollar denominated, digital assets that presumably have some kind of productive use. Many of them have developed ways to generate a yield and be used to result in productive activity such as digital contracts, data collection, data analysis, and marketing activity.

I know this isn’t going to win me very many fans in the Bitcoin space but let me make the case and then you can let me know in the comments how you think I’m wrong. Bitcoin doesn’t correlate very well to the price of something like Gold. This means it is not necessarily a safe haven asset (i.e. insurance).

BTCUSD (bar chart) vs Gold in USD (line chart) 2019-2024

In recent history, there have been times that Bitcoin and gold have moved together. There have also been very noticeable divergences (such as mid 2019 to mid 2020). Bitcoin is beginning to diverge in the present as there are extremely big economic and geopolitical risks at work. Precious metals are rallying as insurance against those potential calamities.

BTCUSD (bar chart) vs Gold in USD (line chart) 2016-2021)

Notice the sideways motion of Gold from 2016 to 2019 while Bitcoin moves dramatically higher and then falls off. Lower risk of catastrophe meant that Gold was in a holding pattern while Bitcoin was going through dramatic price movements due to adoption, development, and then the near miss that was supposed to be the 2019 recession.

Bitcoin does have a future (along with other crypto’s that develop strong use cases) as an inflation hedge because it tracks like a dollar denominated stock. This becomes clear when looking at the price of Bitcoin compared to the movement of the NASDAQ index. Of note is the highly concentrated technology and financial sectors in the NASDAQ.

NASDAQ Index (bar chart) vs BTCUSD price (orange line) 2015-2024

The synchronicity here is quite noticeable. Anecdotally, there also seems to be a lot of demographic overlap between young Bitcoiners, Tesla/NVDA investors, and Meme stock day traders.

The result is that Bitcoin is probably going to be a good inflation hedge into the future as long as it builds a strong use case and can generate yield. Just like a publicly traded company would. The same can be said about every crypto currency and independent, base layer blockchain. Its’ use as a payment medium is a wild card. However, it would require widespread adoption as such. Competitors such as Bitcoin Cash and Monero might limit Bitcoin’s growth in this area.

Conclusion

Gold, silver, and bitcoin all have a place within your portfolio. Several other crypto’s as well. You need to be wary of just what their role is and is not. These distinctions will also help you understand when one of them is under or overvalued and how to treat them in those moments. Risk management is crucial when managing your personal investments. Step one of risk management is identifying what risks you’re facing. Hopefully, one of those risks isn’t misunderstanding what assets you own and why you own them!

Value Averaging is Over Powered

Here's Why

THE ANARCHIST INVESTOR

APR 04, 2024

This may seem like a rudimentary topic to write about. Dollar Cost Averaging is a long standing investment strategy. However, most folks still don’t know why it’s valuable as an investment strategy. I also have some tweaks to share with you that can amplify your investment returns without straying too far from it.

What is Dollar Cost Averaging?

Dollar Cost Averaging comes from the set-it and forget it investment school that I am so adamantly against. However, it’s not a bad technique. It just lends itself to complacency. So what is it exactly?

Dollar-cost averaging involves investing the same amount of money in a target security at regular intervals over a certain period of time, regardless of price. By using dollar-cost averaging, investors may lower their average cost per share and reduce the impact of volatility on the their portfolios.1 In effect, this strategy eliminates the effort required to attempt to time the market to buy at the best prices.

-Investopedia

In essence, you buy small amounts at regular intervals as opposed to buying all you want to at a single moment in time. For instance, in stead of investing $100 in an asset on day 1, you space out those purchases to $25 the first of every month for 4 months. This gives you an opportunity to potentially take advantage of dips in the price so you can achieve a lower price per unit of that investment and possibly a higher number of total units purchased as well.

Here are the advantages:

Removes emotion and impulse buying/selling

MIGHT result in lower entry costs and more purchased units

Helps to limit losses

Here are the disadvantages:

More fees if you pay per transaction

MIGHT result in higher entry cost and less purchased units

Loss of potential returns if your money sits in cash for longer

Promotes complacency in investing

There is a much more powerful technique that I advocate using as it makes you think about what you’re investing in, how much it’s worth relative to the current price, and how you’re buying it.

Don’t Miss Your Chance At BITCOIN!!! 💰💰💰

I’m giving away $25 in Bitcoin to up to 4 free subscribers on May 1, 2024

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Subscribe to enter: anarchistinvestor.substack.com

OR BETTER YET…Become a paid subscriber for a chance at $100 IN BITCOIN and:

📚 Access to the full Anarchist Investor Archive

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

Value Averaging

Think of Dollar Cost Averaging and add in the concept that the fluctuation in a price of an asset can result in under or over valuation. You develop an idea of what a fair price is for that asset and you purchase more when it’s lower and less when it’s higher. You are still putting money to work consistently but you’re actively managing that investment process and potentially profiting more from long-term gains.

Let’s take the earlier example of $100 to invest. Perhaps the asset you’re looking to purchase dips below what you consider a fair price in the second month and rebounds to be over that price in month four. Instead of four equal monthly purchases of $25, you purchase $25, $40, $25, and $10. This means you are amplifying the benefits of Dollar Cost Averaging. You have also added an element of active investment that eliminates complacency from the equation.

The main drawback? It is possible that your assessment of a fair price for the asset is wrong and you’ve over stated it. This means you may commit more money earlier in the decline of that asset than you would’ve otherwise with a standard Dollar Cost Averaging approach. That being said, you are still retaining some amount of the protection of dollar cost averaging when comparing it to a straight up lump sum purchase.

Why Value Averaging?

Dollar Cost Averaging is living on easy mode. However, it is a common practice of the masses while active investment is a common practice of the wealthy and powerful. You’ll hear that results from asymmetric knowledge and that the wealthy and powerful know more than you do. I assure you that on a short-term basis, that is correct.

However, on a medium to long-term timeline, it is possible to accrue and capitalize on the knowledge necessary to match their performance. Value Averaging is a tool that helps to level the playing field. It also adds an element of being present in your mind with your investment portfolio as opposed to forgetting about it for months on end until you receive a quarterly/annual statement and find out what has happened.

Finally, it helps you to realize the point of investment. To identify the long-term value in an asset and participate in the realization of that value over time. It’s what creates true stakeholders and not masses blindly purchasing shares in a multitude of companies that they have no idea what they do and whether that means they are over or under valued.

I Am Giving Away Bitcoin!

Get a chance at $25 or even $100 worth.

THE ANARCHIST INVESTOR

APR 05, 2024

Last month’s giveaway was a huge success and it made me feel so awesome to give back to the folks that support me. Four lucky winners each got an ounce of pure Silver and a copy of Henry Hazlitt’s ‘Economics in One Lesson’. One of the recipients was in South America. It was going to cost $20 to ship those two small items collectively worth about $35. So instead, I was able to send him $25 worth of Solana crypto in seconds for a fee of less than $0.25. Crypto and blockchain will change the world. This got me thinking, ‘I should give away some crypto!’

So here’s how you get a shot at the May 1st Bitcoin Giveaway!

How to Enter

It’s super simple, subscribe for free! Use the button below or paste anarchistinvestor.substack.com into your browser and enter your email address. That will enter you for a chance at 4 separate $25 amounts of Bitcoin that I’ll be giving away on the The Anarchist Investor LIVE! at 12 pm EST on May 1, 2024.

Already Subscribed? There’s More!

I’m also giving away $100 to a single paid subscriber on May 1st. This means you can upgrade your subscription to paid for the month at a cost of $10 or for the year at a discounted price of $99 and get a shot at having your whole annual paid subscription taken care of….in Bitcoin!

You can also earn months of paid subscription if you refer your friends to the free subscription! No purchases necessary! Use the links below to directly refer folks you think would be interested in The Anarchist Investor newsletter or to share it on social media.

Refer a Friend:

https://anarchistinvestor.substack.com/leaderboard?&referrer_token=2f653e&utm_source=post

Affiliate Links

Get $10 in free Bitcoin and start stacking today with Swan Bitcoin: https://www.swanbitcoin.com/anarchistinvestor

Automate your Gold & Silver Purchases with Vaulted:https://vaulted.blbvux.net/g1EGKX

Save/Make Money on your Cell Phone Plan with Helium MOBILE:https://my.hellohelium.com/ref/2FN2CHL

Channel Links

Matt-Archy on X: https://twitter.com/Matt_Archy

Ungovernable on X: https://twitter.com/UngovernPod

Ungovernable on YouTube: https://www.youtube.com/channel/UCL0qwtU4SZhCgpz6f4EMgzw

Ungovernable on Facebook: https://www.facebook.com/UngovernablePod

Ungovernable on Twitch:

Ungovernable on Rumble: https://rumble.com/c/c-5871264

Ungovernable on Odysee: https://odysee.com/@WhyLibertarian:f

Keep in mind that investment and investment results are very much based on you as an individual. I am not an investment advisor. I’m a dude with an opinion. Do not rely solely on the discussion here to inform your investment decisions. Always make the investment decisions that are right for you and your situation

Congratulations @matt-archy! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 200 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: