Ever heard of the phrase, "Money do not grow on trees." Well I may have just for that statement to be false and in fact banks are making boat load of dollars in the current economy and I will explain.

As everyone is focused on the current FED rate hikes and Quantitative Tightening it would leave many to believe the FED is doing harm to the economy. We see this as stock market prices are falling, real estate is falling, and many other durable goods prices are falling, but food and energy prices soaring. All in all its been a messy 2022 for the average consumer.

On top of that the government is curbing stimulus checks and assistance to the average American even though the real economy is struggling. So with all this going on you would think not the whole country is struggling from top to bottom. Well not the banks.

FED's Reverse Repo Facility

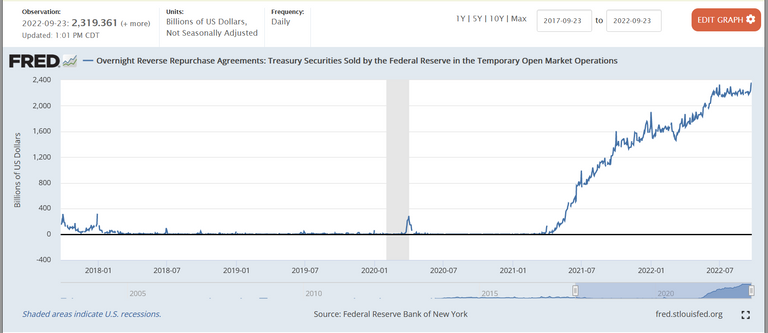

(Courtesy of FED St. Louis)

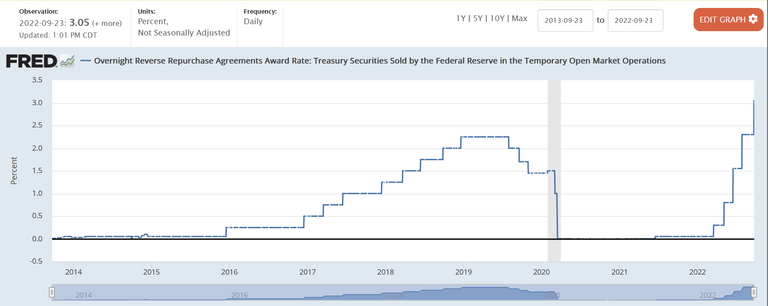

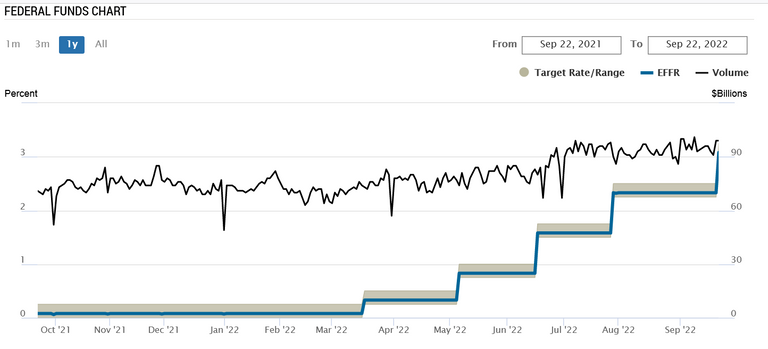

As we all know the FED just raised the base lending rate to around 3% - 3.25%. This means all type of US lending that starts right now would be at least 3% from the federal government. That means whether people borrow or lend to the government the going rate is 3%.

Lets just ponder than with the stock markets crashing and asset prices falling where could the banks park their cash and customer deposits to earn a good yield? Well with FED raising interest rates what better place to park the cash deposits than to the FED themselves? Indeed the banks are giving money to the FED and in return since base rate for borrowing is 3% the FED is giving interest on the banks' deposits at a annual rate of 3%.

Of course this is not done out of the generosity of the FED, but money is given to the banks and you maybe wondering why?

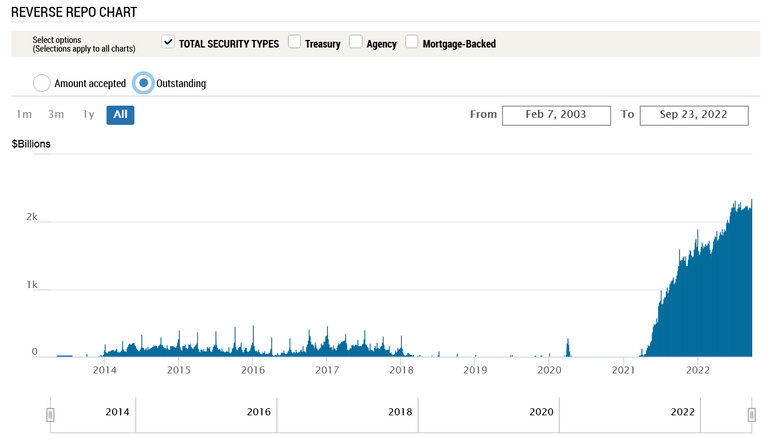

The chart above courtesy of the New York FED is illustrating the current amount of cash deposits provided to the FED in what is call the reverse repo market. Over the years the amount of cash in the reverse repo market has been mostly non-existent. To date there is nearly $2.3 trillion inside the reverse repo market and each day it is stored there the FED is required to pay what now going rate of 3% to the depositors, AKA banks.

Assume interest paid at 3% for a full year that equates to $69 billion. That is currently if the FED hold rates steady and keep the reverse repo facility operating and the banks do not remove the deposits in the facility the banks in total will collect $69 billion in a year or $18.9 million a day.

Why Even Have The Reverse Repo

I may have gotten ahead of myself but here is a short definition of what a repo market is from Wikipedia:

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of short-term borrowing, mainly in government securities.

Back in 2018 the short term liquidity in the markets were seizing. This main corporations and banks were unable to get dollars to spend on a short term basis. Day to day activities would not occur such as paying taxes, paying employees, and even day to day business expenses. The FED had to intervene as the economy was seizing with lack of short term borrowing.

The FED came out with the supporting the Repo market by supporting all the short term loans at zero to no interest. Banks then were able to sell their securities and in return FED provide the much need cash for the banks and corporate to run business at usual.

However over the years of low interest rate lending and plentiful pool of cash from Quantitative Easing meant that banks had amass a large holding of cash. In addition with the 2020 pandemic the government injected cash to the consumers and they themselves were putting their cash into banks which created even bigger cash surplus in the banks.

(Courtesy of wshu.org)

Fast forward to 2022 the banks needed a place to invest all the cash they were holding. The best outlet came from the FED in the form of their intervention of the Repo markets. With the intervention the FED was accepting reverse repo. This meant the FED was willing to sell security to lenders in exchange for overnight cash deposits. The banks knew that the FED could not fail therefore parked as much cash as they could into the reverse repo market to collect interest.

(Courtesy of FED)

The borrowing rate rose within the past six months from a low of 0% up to current 3%. As I mentioned before the rate is for both borrowing and lending. In the part where banks are the lenders it meant the FED had to pay out 3% interest to the banks for the cash deposits. This is happening as we speak and the cash deposit into the repo market continues to grow. Estimates are it will go up even higher from here where it could potentially reach $3 trillion by end of 2022.

Conclusions

News media and even social media to a certain extend has mostly covered the rising interest rates and how it is effecting the stock market and the average American. Yet behind the scenes the FED is supporting banks by providing liquidity and interest payments. The banks are basically earning profits with zero risk.

If FED continues to raise rates you bet the banks will put even more money into the reverse repo market and collect the interest. Add more salt to the wound the FED is not ending their intervention to the repo market because currently it appears the market will fall apart if FED pulls out.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

I saw a huge decrease this week in my stock portfolio. I don't care because I am purchasing for the long-term and focused to increase my position on dividends stocks.

Yes same here as I am losing a lot but like you I’m holding long term. !PIZZA !WINE

WINEX Tokens To Make Another Successful Call.Hi @mawit07, You Do Not Have Enough

Please Stake More WINEX Tokens.

(We Will Not Send This Error Message In Next 24 Hrs).

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.236

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

The problem is that the banks don't want to lend and I don't think they want to buy stocks/bonds right now. They are in the process of making money and I doubt they would do things that would do anything outside of that. The reverse repo facilities are more for providing liquidity to the market and I don't think it's bad.

Posted Using LeoFinance Beta

I politely disagree. As mentioned bank customers who deposit money into the banks. Those same banks take the money and put it in reverse repo to earn 3%. We as the customers don’t see the 3% in bank saving accounts, lucky even at 2%, so banks make dollars doing arbitrage and taking on zero risk. Dirty financial engineering if you ask me. !LOL !PIZZA

Yes they do earn money off the arbitrage but it's not always the case. In a way, the money is also a liability to them as they are only allowed to hold a certain amount of money but I do agree that it is scummy though.

Posted Using LeoFinance Beta

Eye opening.

Backdoor QE

Sure is. Great gif !LOL

Thanks for the vote 🗳

Next time vote Donald Trump

Extortion at it peak

Posted Using LeoFinance Beta

Dazu noch ein kleines !BEER & VOIN-TokenDu wurdest als Member von @investinthefutur gevotet!

PIZZA Holders sent $PIZZA tips in this post's comments:

(4/5)

mawit07 tipped cryptosnowball (x1) @mawit07 tipped @jfang003 (x1)

Learn more at https://hive.pizza.

Yay! 🤗

Your content has been boosted with Ecency Points

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more, by @mawit07.

Actually this isnt correct. The Fed Funds rate is a weighted average of the different rates that banks use to lend to each other. It has nothing to do with the Federal Government.

So you are saying the Fed is giving the banks a great deal by offering 3% through Repo?

Yet the commercial bank can get a 10 year yielding over 3.6% right now. Hell they can get 3.2% on a 3 month t-bill.

The volume in the reverse repo market has nothing to do with return. Over the last few months, the market has bid the securities up, especially the short term ones.

There is a lot more to the system then what you promote here.

Posted Using LeoFinance Beta

Fed paying out interest is fully guaranteed. Any other loan posses including commercial risk the lost of principal.

You have a point that the 3% is not a guarantee, but Fed is paying out at that rate.

In my humble opinion Fed should stop reverse repo. They say out right how hawkish they are in fighting inflation. If that is so force the banks to put the surplus cash into treasuries and bonds. This process will push rates lower, hence less inflation.

I stand corrected in some of the items due to my poor choice of words. Yet the numbers don’t lie. Banks are filled to the brim with cash while average American is trying to make ends meet.