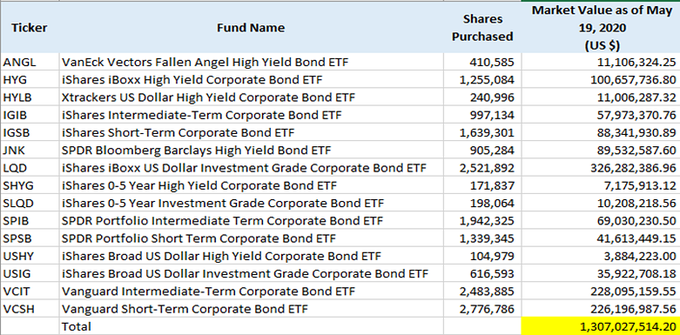

Above is public information of current holdings of the Central Bank Federal Reserve's holdings since early May 2020. For over a little of a month the FED has been purchasing specific ETFs in order to provide liquidity to the supposed impending trouble with corporate bonds. The thought that any investment by the FED into publicly trading assets lies a deep moral hazard. The FED has the ability to create currency by buying up bonds that are printed by the government. Government become fiscally irresponsible by borrowing more to sustain itself and weather hurdles such as the country wide shutdown. The FED essentially bails out the government. Then there is corporate bonds where companies are borrowing money to sustain its growth or basically keep doors open. The recent struggles in corporations has lead to deterioration in the corporate bond market. The FED basically steps in by promising to purchase as much need corporate bonds until the economy gets back on its feet and corporations can pay down their debt.

The moral hazard of all of the borrowing is the underlying issues are never resolved. The increase in borrowing loans while decrease in corporation profits is the resulting in a economy with high unemployment and stagnant wages. The separation of haves and have nots widens as more people are left behind. The FED is basically saving the stock market from free falling but in the same exact time has done less to help the US economy.

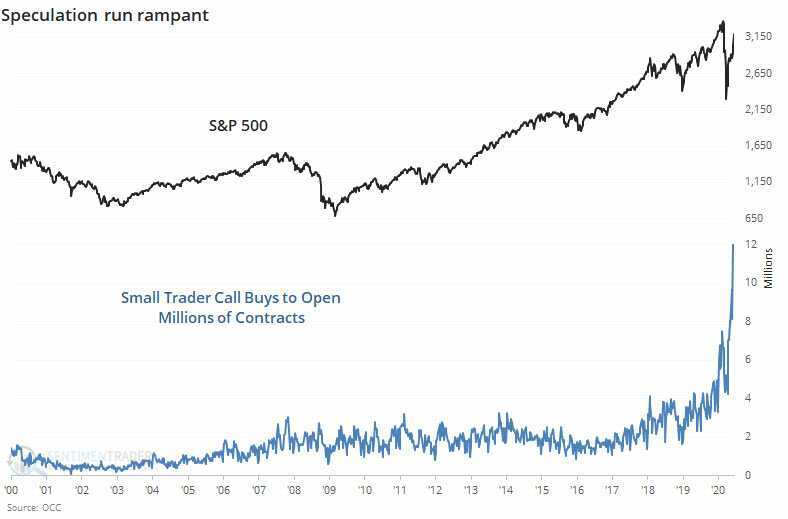

As retail investors pile into stock market due to recent europium of gains it leave one to wonder how much more of stock value increase is possible since the real economy is still struggling. Retail investors are heavily in on call options at record numbers as of Friday. This can not be sustained as there can only be so much being invested that a resistance will soon form.

Small investors have over 12 million call options in equities. This heavy skew to for the bulls leaves little wiggle room as to the time to sell. When too many are on one side it does not take much to have a cascading effect to the downside when some start to sell out. It is like trying to fit people thru an exit door in a theatre when the theatre is over capacity. Too many running for the exit will lead to very few escaping from financial carnage.

Posted Using LeoFinance

Congratulations @mawit07! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!