While not posting on LeoFinance, I have been researching technical analysis and investing in the ASX and US markets. I’ve also been slowly growing my stock portfolio with a mixture of growth and income stocks and ETFs.

My tentative entry into the US markets has mostly been via ETFs (exchange traded funds). And, in addition to learning technical analysis, have been learning about alternative investment vehicles such as options trading.

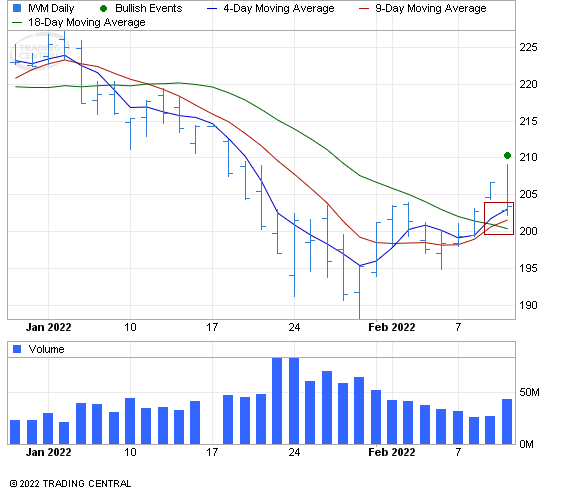

But, to be on the safe side while becoming familiar with the US market, I tend to invest heavily into ETFs while keeping some funds aside for more higher risk trading strategies (such as options). But it still pays to perform some technical analysis on these funds prior to putting your money into them. Today I took a look at the iShares Russell 2000 ETF (IWM on the NYSE). This ETF appears to be forming a bullish "Triple Moving Average Crossover" chart pattern. This bullish signal suggests that we may see the stock price rise beyond it’s current price of $203.

The price is generally in a bullish trend for the time horizon represented by the moving average periods. See the image below.

To date, I have only looked at IWM as an ETF to use for options trading purposes, however with this trend I am considering creating a position here that I will slowly grow to 100 shares in order to commence selling covered calls against my holdings. Doing so will allow me to generate a reasonable and regular cashflow from the ETF.

Hopefully this information is of use to someone out there in Hive/Leo Land.

Posted Using LeoFinance Beta

Welcome back mate :)

Posted Using LeoFinance Beta