As decentralized finance (DeFi) rapidly evolves, Cetus on the Sui blockchain is positioning itself as a leading platform for crypto enthusiasts seeking high returns on their investments. With some of the most competitive APYs in the DeFi ecosystem, Cetus pools allow liquidity providers to maximize earnings through well-structured and profitable opportunities. This guide explores how you can leverage the high returns on Cetus pools, diving into their features, benefits, and strategies to optimize your DeFi earnings.

Why Choose Cetus Pools on Sui for High-Yield Liquidity Mining?

High APY and Earnings Potential

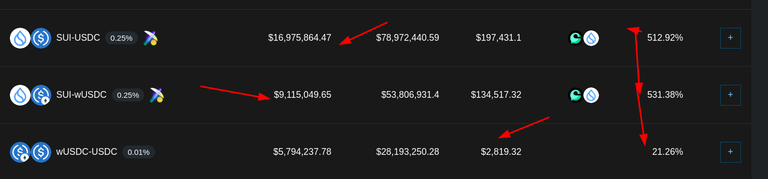

Cetus offers a range of pools with attractive APYs, such as the SUI-USDC pool with an APR of over 512% and the SUI-wUSDC pool, which boasts an even higher APR of 531%. These pools have large volumes and substantial daily fees, giving liquidity providers substantial earning potential.Reliable and Low-Cost Platform

Operating on the Sui blockchain, Cetus provides a decentralized, low-fee environment ideal for high-frequency trades and liquidity operations. The efficiency of Sui allows Cetus pools to maintain low slippage and optimal speed, enhancing profitability for users.

Top Cetus Pools to Explore on Sui for Maximum Returns

SUI-USDC Pool

Liquidity: $16.9 million

24-Hour Volume: $79 million

Fees (Daily): $197,431

APR: 512.92%

Advantages: Ideal for users seeking stability and high-volume trading.

SUI-wUSDC Pool

Liquidity: $9.1 million

24-Hour Volume: $53.8 million

Fees (Daily): $134,517

APR: 531.38%

Advantages: Offers the highest APR, making it highly appealing to high-reward investors.

wUSDC-USDC Pool

Liquidity: $5.8 million

24-Hour Volume: $28.1 million

Fees (Daily): $2,819

APR: 21.26%

Advantages: A low-risk option with stablecoin pairs that reduces volatility exposure.

For more information, visit the Cetus Pools on Sui and review current rates and opportunities.

Steps to Get Started with Cetus Liquidity Pools

Choose Your Preferred Pool: Each pool offers unique benefits; from high APY options with SUI-based pairs to stablecoin pairs for those seeking steady returns.

Connect Your Wallet and Deposit Liquidity: Visit the official Cetus pools, link your crypto wallet, and select your pool to add liquidity.

Monitor Your Returns and Compound Earnings: Regularly reinvest or reallocate your earnings to maximize compound returns and benefit from fluctuations in pool rates.

Tips to Maximize Your DeFi Returns on Cetus Pools

Stay Updated on APY Trends: Monitoring changes in APYs and adjusting investments based on trends can help capture the best opportunities.

Compound Regularly: Reinvesting rewards can significantly increase long-term returns, particularly in high-yield pools.

Diversify Across Pools: Consider spreading liquidity across several pools to balance high rewards with stability. https://app.cetus.zone/pool/list

Posted Using InLeo Alpha

Hello.

We would appreciate it if you could avoid copying and pasting or cross-posting content from external sources (full or partial texts, video links, art, etc.).

Thank you.

If you believe this comment is in error, please contact us in #appeals in Discord.

proof it it original content

Translate-copypasta from another language or copypasta of Chat GPT prompt is not original content.