BNB Dominates Crypto Market

The cryptocurrency market has slumped so far in 2025 but incase you missed it, BNB is quietly building its position as one of the most resilient top tier assets outperforming Solana in both market cap and user engagement.

Despite entering a corrective phase, BNB has held its ground and even strengthened its grip as the number 4 cryptocurrency overtaking Solana in both market sentiment and blockchain activity.

BNB Takes The Lead Over Solana

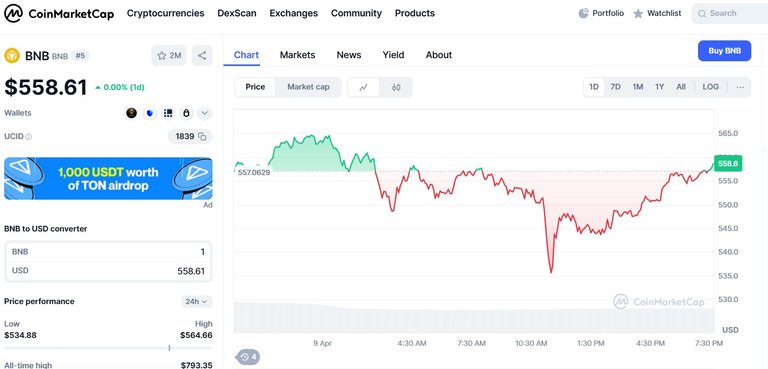

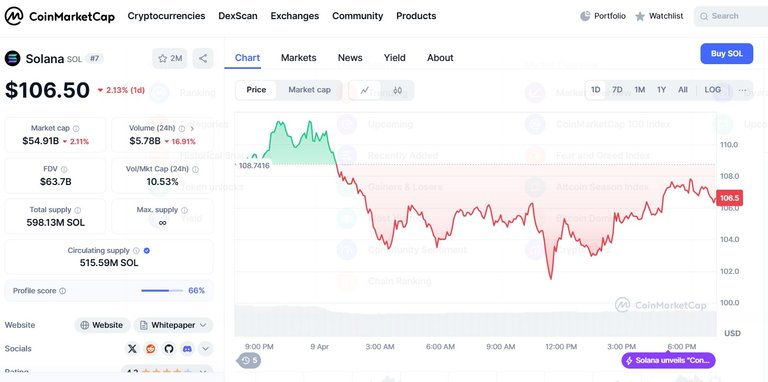

As of April 2025 BNB has surged to a market capitalization of over USD 104 billion and even after a correction is coming back this is clearly surpassing Solana. This shift began in late March when the two assets were neck and neck in terms of valuation. But while both have since faced downward pressure, Solana’s market cap has dipped more sharply, allowing BNB to not only retain but expand its lead.

Part of this strength is alleged to come from the to active promotion and continued influence from Binance founder and former CEO Changpeng Zhao (CZ). Even after stepping back from the exchange's leadership, CZ has remained a strong supporter of the BNB. He downplayed the rivalry with Solana, saying, “Not a competition. But just the beginning.”

Solana Takes a Hit

Despite outperforming its rivals, BNB isn’t without challenges. The token recently entered a significant corrective trend after forming a Swing Failure Pattern near its all time high of USD 798. It is now approaching a critical high-timeframe support zone above the USD 500.

This zone is huge news for BNB as it it aligns with the 200 week moving average, the 0.618 Fibonacci retracement and a major weekly swing low. Everyone is closely watching whether this level will hold, as it could form the basis for a long term bottom.

Although price action briefly dipped below the multi year Value Area High, there’s been no decisive bullish reversal yet. Lower timeframes remain bearish suggesting further downside risk unless a clear shift in momentum occurs. Still, the USD 500 zone remains a high value area, drawing the markets attention.

image source

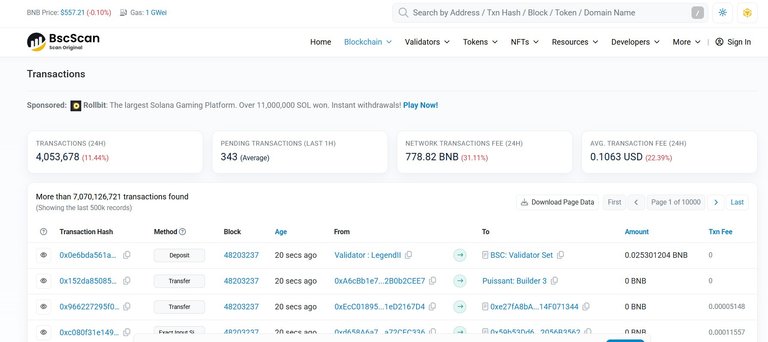

Binance Smart Chain Leads Transaction Volumes

Beyond price action, BNB Chain is flexing its operational muscle.

In the last 30 days it has processed over 70 million transactions second only to Solana and the most among Ethereum Virtual Machine (EVM) chains. This surge in network usage has positioned BNB as a serious player in the decentralized application (dApp) space especially with the growing traction of memecoins on its platform.

One of the standout contributors to this spike is Four.meme a meme coin launchpad that recently enabled the creation of over 12,000 meme tokens in a single day. The BNB Chain is riding a new wave of speculative hype even outpacing Solana’s Pump.fun and Tron’s SunPump platforms.

Despite the chaotic and sometimes scam ridden nature of meme coin launches, BNB's ability to sustain massive on-chain activity while navigating the usual Web 3.0 issues is being viewed as a sign of strength.

CZ Continues To Shill BNB

BNB’s rise has also been lifted by strategic coin listings and investor hype tied to CZ’s legacy. Newly listed tokens like TST and CHEEMS have injected fresh interest into Binance the world’s largest crypto Centralized Exchange (CEX) and have likely contributed to the spike in trading volume.

Crypto analyst Zeus noted the trend, stating, “I don’t think everyone is bullish enough on BNB… Every chart I look at makes me feel more bullish.” Zeus also suggested that investor capital may be rotating from Solana to BNB, driven by better perceived efficiency and infrastructure reliability.

That rotation appears to be happening already. With investors seeking shelter from volatile market conditions many are choosing assets with strong fundamentals, deep liquidity and institutional connections. BNB, backed by Binance’s massive reach and enduring ecosystem, fits that bill.

Let us know what you think is next for BNB in the comments below.

Image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using INLEO