DEX Boom To $479 Billion

The Decentralized Finance (DeFi) sector continues to grow with the latest news breaking that Decentralized Exchanges (DEX) hit record trading volumes in December 2024. With Uniswap leading trading volumes, this surge in trading indicates that Cryptocurrency investors prefer DeFi over Centralized Exchanges 9CEX0.

The Decentralised Finance Boom

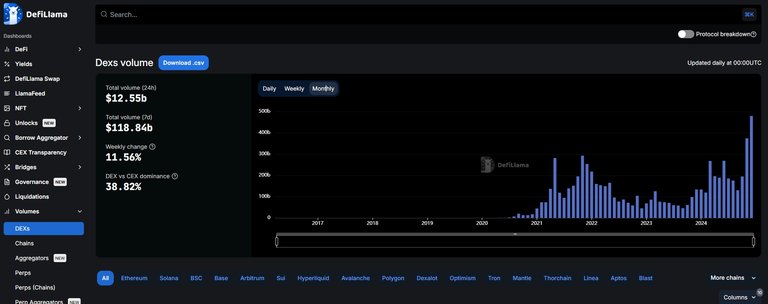

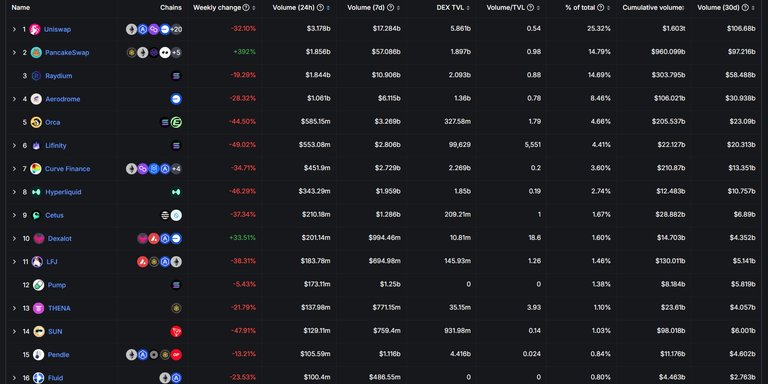

Data from DefiLlama and The Block reveals that December 2024 set a new all time high for DEX trading volumes, reaching USD 479 billion. This shattered the previous record of USD 374 billion in November. Uniswap led the pack, contributing over USD 106 billion, followed by PancakeSwap with USD 97 billion and Solana’s Raydium at USD 58 billion. Other decent DEX's included Aerodrome USD 30 Billion and Orca USD 23 Billion.

The rise in trading activity is consistant with a few thins, including improved DeFi infrastructure, heightened market volatility and increased adoption of decentralized platforms. December’s trading surge also aligned with Donald Trump’s reelection as U.S. President and support of Cryptocurrency which saw markets climb and caused rapid growth across the crypto sector.

UniSwap Remains Sector Leader

Uniswap continues to be the clear leader in December, accounting for nearly a quarter of all DEX activity. Since it's launch Uniswap has continued to maintain it's hold on the DeFi sector rolling out a number of upgrades. With its user friendly interface, deep liquidity pools and innovative features like concentrated liquidity, Uniswap has become the go to platform for both retail and institutional traders.

PancakeSwap, the second largest DEX which is based off Uniswap, also maintained its stronghold on the Binance Smart Chain, while Raydium is the new contender in this field and capitalized on the growth of Solana’s decentralized applications (DApps). Solana based platforms, grew mainly due to memecoins and other niche tokens and have reported a revenue of USD 365 million in November, reinforcing their position in the DeFi ecosystem.

DEX Vs CEX

While DEXs celebrated record breaking volumes, centralized exchanges (CEXs) also experienced a decent rise in trading volume. Monthly spot trading volume on CEXs reached USD 2.78 trillion in December, marking the highest level since May 2021. Binance led the centralized pack with USD 950 billion in trading volume, followed by Coinbase, Upbit, Crypto.com and Bybit. Each seeing hundreds of billions of dollars pass through their exchanges.

The narrative around DEXs and CEXs is shifting. Market analysts suggest that DEXs are increasingly viewed as the future of crypto trading due to their transparency, user control and resilience against hacks. Unlike CEXs, which require users to surrender custody of their assets, DEXs enable direct wallet-to-wallet trading appealing to those prioritizing security and decentralization. Remember, Not Your Key's, not your crypto!

James Toledano, COO at crypto wallet Unity, also believes that CEX's have a lot to do in order to keep up with the DEX's once they become easier to use.](https://www.dlnews.com/articles/defi/decentralised-exchanges-breaks-usd-463-billion-record/).

Despite their advantages, DEXs face challenges in competing with CEXs. Centralized platforms excel in ease of use and offer robust customer support, making them attractive to new and casual traders. listing a token on a major CEXs like Binance or Coinbase remains key for any crypto project that want to make it in the sector as these platforms provide visibility and liquidity, while holding trust of investors.

For DEXs to sustain their growth, they must address issues like user interface complexity and transaction speeds. Innovations in Layer 2 scaling solutions and blockchain interoperability could play a crucial role in enhancing the DEX experience.

Don't forget to upvote, subscribe and share to stay upto day with the latest Decentralised News!

image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services

Posted Using InLeo Alpha

The DEX capabilities have certainly gotten a lot better and gives life to all these new projects. Being able to launch and have the liquidity build as trades occur is huge. I launched $ZENA on Raydium.

they have and will continue to get better

I agree