It's been nearly 365 days since I first staked all my $POLYCUB into the PolyCUB DeFi platform, which was built by the LeoFinance team.

While the USD-denominated value of $POLYCUB has declined ~92% since then, my investment is time-locked for more than a year into the future.

More than anything, PolyCUB represented my first real foray into DeFi protocols and studying how they worked (after dipping my toes in Cubfinance for a very short time. The Polygon Network was extremely hyped back in 2021, and I think that this bear market has deflated a lot of the ego and FOMO that drove the last bull market to insane heights.

Although Polygon Network was designed to help alleviate some of the congestion on Ethereum's base layer blockchain, it hasn't really done much to lower the overall high cost of transacting on the chain. Transactions are still settled on the base layer, regardless of how much is temporarily offloaded.

Polygon Network also has very little utility, in general. While it is supposedly now the #1 blockchain for gaming, blockchain-based gaming is in its infancy right now, and a tiny sliver of the ~3 billion gamers in the global community are participants. Not only are there a lack of serious competitors all around (other than Splinterlands), but, it still remains to be seen if blockchain-based gaming has a real future.

PolyCUB is just an experiment, at this point. It's not known widely how many unique users there are currently staked in xPolyCUB, however, the supply of $POLYCUB is already so low, that any token burns are bound to cause further liquidity crunches in the future.

While I wouldn't recommend anyone get involved in DeFi with any money that they aren't comfortable losing, I do think that it's vital to build as many DApps as possible, not just for competition's sake, but to see what works and what doesn't. Not all business models from Traditional Finance will work in Decentralized Finance.

![]()

Now to just give a quick summary of my experience using PolyCUB.

As you can see in the above graphic, there are a few features of PolyCub that you can choose to engage with: Yield Farming, Kingdoms, xPOLYCUB, and Governance.

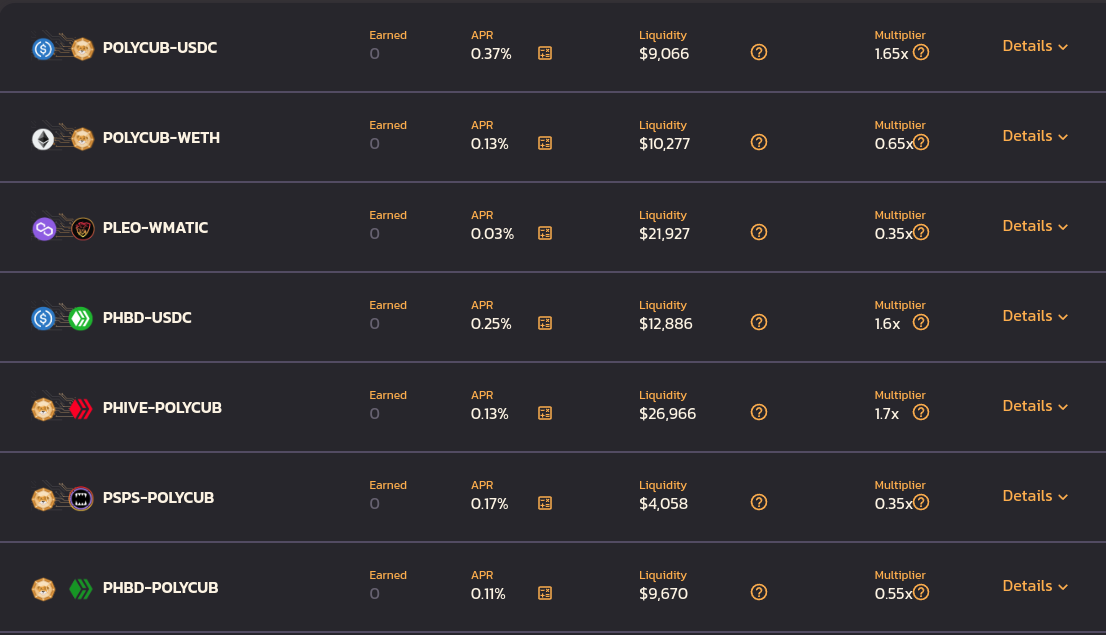

My personal experience was focused, originally, on Yield Farming, which was still relatively-new to me in early-2021. I had read up on Yearn.finance and Uniswap for a while, but had never been interested in paying Ethereum's gas price (gwei) to try anything out. PolyCUB's gas fees, since they are paid on Polygon, were very cheap, and not cost-prohibitive.

For anyone interested in obtaining these Liquidity Pool (LP) tokens, here are the contract addresses for each:

PolyCub: 0x7cc15fef543f205bf21018f038f591c6bada941c

MasterChef: 0xef79881df640b42bda6a84ac9435611ec6bb51a4

xStaker: 0x905e21f6c4cb1ad789ced61cd0734590a4542346

Sushiswap LP tokens:

PolyCub-USDC: 0x5aefd5c04ed6dbd856a5aeb691efcc80c0ab7472

PolyCub-WETH: 0xc9ba162d07d762ad4c2a759cf806f8650b6c9a93

$pLEO-WMATIC: 0xf8095ffd24f02bd8aedc96e5a3617310815cc4c7

pHBD-USDC: 0x4414B5a6356e9F1a5DaAde9eB5F3fe9e37Af1635

pHIVE-POLYCUB: 0x29f13baded9ade12acc4069a8ffeef95146b8bc9

pSPS-POLYCUB: 0xf89261d86c6e8bd4c719f1fd769220dfc746d67a

When PolyCub first launched, the Annual Percentage Rate (APR) were well above 20% for the POLYCUB-USDC, POLYCUB-WETH, and PLEO-WMATIC. Later on, the PHBD-USDC, PHBD-POLYCUB, PHIVE-POLYCUB, and PSPS-POLYCUB farms were added. I never touched anything with WETH or WMATIC, as I preferred to stay in PHBD-POLYCUB and POLYCUB-USDC, before I liquidated my LP tokens in favor of:

drumroll please

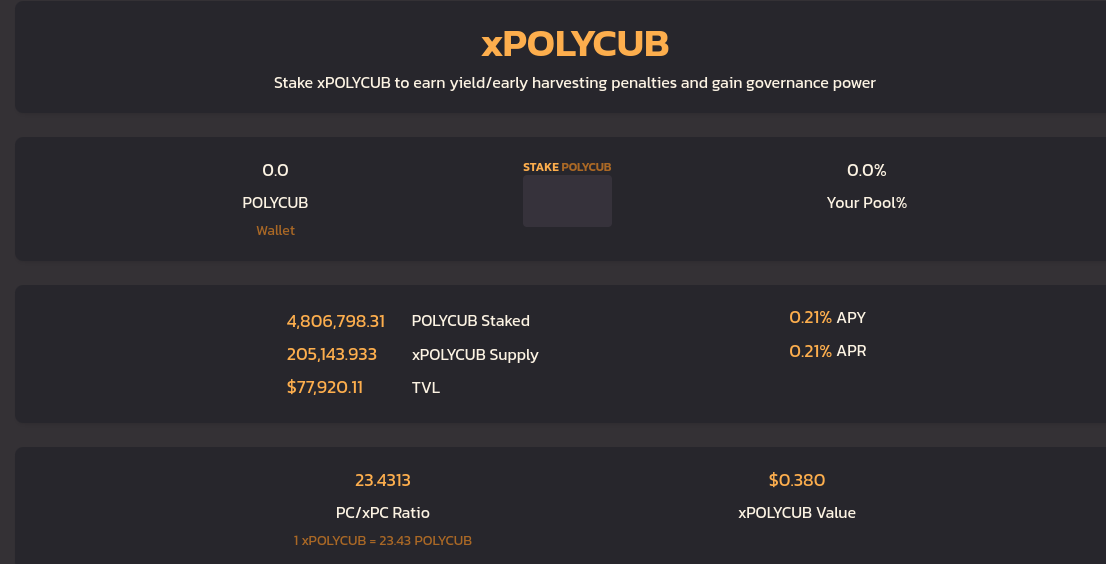

To me, xPOLYCUB was the most logical choice, as staking $POLYCUB within the product led to increased governance power and further earning of yield and early-harvesting penalties paid by other users.

As you can see, there are 4,806,798.31 POLYCUB staked in xPOLYCUB, which is out of a total of 7,272,819 POLYCUB in circulation, which are worth collectively $117,895. Some basic napkin math will tell you that 66% of all $POLYCUB are staked in xPOLYCUB - so I'm not the only one with the longterm time preference.

Also note: when I staked my $POLYCUB in xPOLYCUB, the APY and APR were much MUCH higher than the currently 0.21% where it sits. The current ratio of $POLYCUB tokens that it takes to equal 1 xPOLYCUB is 23.4313, hence the total xPOLYCUB supply of 205,143.933 tokens.

![]()

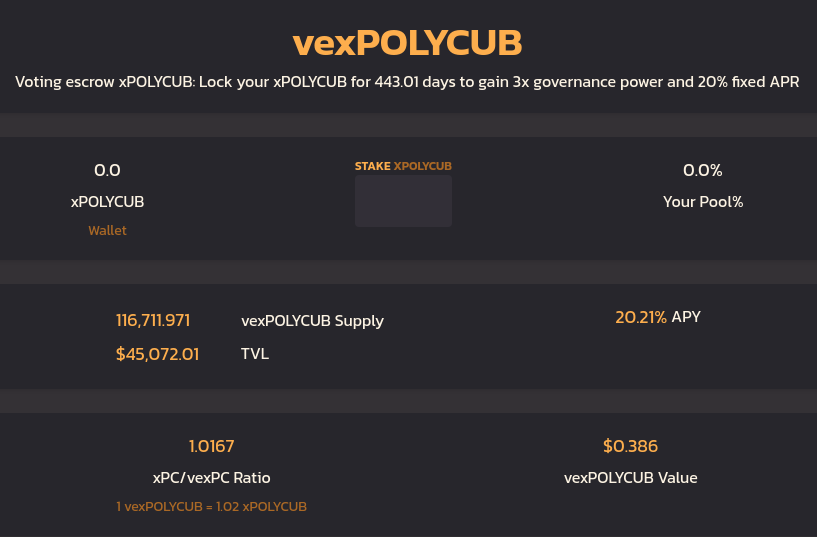

To finish up this article (which was originally intended to be short, I'll talk briefly about the latest added feature to POLYCUB: vexPolyCUB.

vexPOLYCUB stands for Voting Escrow xPOLYCUB, which requires time-locking your xPOLYCUB stake in order to gain 3x governance power (in decision-making for the POLYCUB DAO) and a 20% fixed rate APR, which mirrors the APR you can currently earn on $HBD when deposited in Hive Savings.

Links Courtesy of LeoGlossary

![]()

gifs by @doze

![]()

If you appreciate my work and would like to be a patron, feel free to send crypto to any of the following addresses:

XMR: 432LkrBjScjg6PuwstToSY6TRN7GrUgQ87sKPdbssT81fS5f1jqPZTaLxRKYWc2nqaKN77Etf4BXCbicVc3ELNkYK47xEwK

BTC: bc1qhcfcsslhdkhrat3mmxhusc8gflq9s3yhc0vt8t

ETH: 0x5eA1D3f8CF169481b5708F6114ff2fA9E6b8bDed

SCRT: secret1w5ttvq6gvpjvhvjcggn5yeqpvj84a4k9vpt9sj

ATOM: cosmos1gt4u8rnd2mc3glc0j544488glsrz7nnry0fgwm

ADA: addr1qy5elqqcuj7jdeanlff9snkcz7m2ahhjcn3da3j937nqe7a2zrq9hqvf4jeq6e7ggcqdqq28g890xahu6lglhe5vnveqhc0rd6

Posted Using LeoFinance Beta

thank you for this very useful post, I never really understood what this project was

Congratulations @mercadomaestro! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

Support the HiveBuzz project. Vote for our proposal!

Congratulations @mercadomaestro! You received a personal badge!

Participate in the next Power Up Day and try to power-up more HIVE to get a bigger Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

Support the HiveBuzz project. Vote for our proposal!