On January 2, 2024, BlackRock, the world’s largest asset manager, announced its intensified focus on Bitcoin (BTC) and Ethereum (ETH), identifying them as the only cryptocurrencies worth substantial investment. This declaration underscores the firm's evolving perspective on digital assets and highlights its $56.41 billion crypto portfolio, where Bitcoin and Ethereum constitute over 99% of the total value.

Dominance of Bitcoin and Ethereum in BlackRock's Portfolio

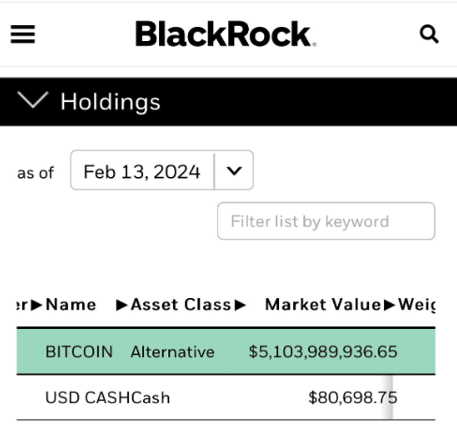

Bitcoin leads BlackRock’s holdings with 550,643 BTC, valued at $52.78 billion, based on a price of $95,855 per coin. Ethereum follows with 1.037 million ETH, worth $3.55 billion at $3,425 per token. Together, these assets form the core of BlackRock’s crypto strategy, reflecting its confidence in their long-term value and market leadership.

The remainder of BlackRock’s portfolio includes smaller, exploratory positions in stablecoins like USDC ($74.67 million) and alternative tokens such as COLLE ($303,080), SPX ($78,250), TUA ($29,100), UBXS ($24,180), and MOG ($16,490).

From Skepticism to Market Leadership: BlackRock's Crypto Transformation

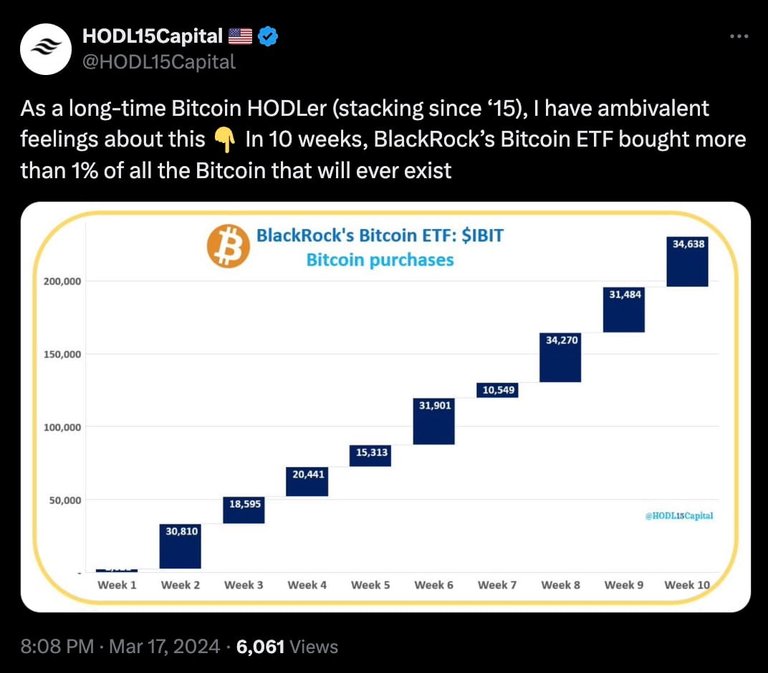

BlackRock’s journey from crypto skepticism to market leadership has been transformative. Initially hesitant, the firm shifted its stance after obtaining SEC approval for its Bitcoin ETF. This product, launched in the wake of Grayscale’s legal victory over the SEC, achieved historic success, amassing over $50 billion in assets under management (AUM) within just 11 months.

This rapid growth not only contributed to Bitcoin’s crossing the $100,000 price threshold in 2024 but also sparked discussions about the ETF’s potential to eclipse traditional gold ETFs in AUM.

According to Nate Geraci, CEO of ETF Store, BlackRock's Bitcoin ETF (IBIT) could surpass SPDR Gold Shares—the world’s largest gold ETF—by 2025, barring a significant Bitcoin price drop. Such a shift would mark a pivotal moment in institutional investment, signaling a transition from traditional assets to digital ones.

Limited Interest Beyond Bitcoin and Ethereum

BlackRock’s focus remains firmly on Bitcoin and Ethereum, with little appetite for other cryptocurrencies among its investors. Robert Mitchnick, a key figure at BlackRock, noted that interest in altcoins remains minimal, reflecting a cautious approach to diversifying beyond these two market leaders.

However, the broader crypto market is evolving. Competing asset managers like Franklin Templeton and VanEck are exploring blockchain projects such as Solana (SOL). Franklin Templeton, for instance, has identified Solana as one of the most promising blockchain projects, suggesting the potential for altcoin adoption in institutional portfolios.

Growing Momentum for Altcoin ETFs

While BlackRock remains focused on Bitcoin and Ethereum, other firms are pushing for diversification in the institutional crypto space. ETF applications for XRP by WisdomTree, Bitwise, and Canary Capital illustrate the growing interest in broadening crypto exposure.

Additionally, futures-based ETF proposals for Solana have gained traction, with analysts like Eric Balchunas of Bloomberg suggesting that futures ETFs could pave the way for spot ETFs, providing altcoins like Solana and XRP with enhanced institutional visibility.

The Road Ahead for Institutional Crypto Investments

BlackRock’s strategic emphasis on Bitcoin and Ethereum reinforces their status as the cornerstones of the crypto market. However, the gradual entry of other asset managers into altcoin projects hints at a potential broadening of institutional interest.

The success of BlackRock’s Bitcoin ETF and its significant portfolio allocation underscore a deep-seated confidence in Bitcoin and Ethereum as store-of-value and utility assets, respectively. Meanwhile, the rise of altcoin-focused ETFs could offer a new dimension to institutional crypto adoption, potentially diversifying the landscape further in the years to come.

😎👍🏾 @tipu curate

Thank you very much for your support and appreciation!

You are welcome 😎🤝🏾 Happy new year to you and your family 🎉🎉🎉🎉

Upvoted 👌 (Mana: 11/51) Liquid rewards.