Source: https://www.denaro.it/quotazione-oro-18k

There will be three articles, and in this, the first one, we are going to go deep into the Gold aspects!

1 - Inflation and safe-haven assets.

The world economy is undergoing a major crisis for two basic reasons: pandemic Covid 19 and the (presumed) war in Ukraina.

In the first case, the shutdown of all production has forced states to run for cover by putting more liquidity into circulation.

What is called Helicopter Money, or stimulus, has, at the financial level, a very specific purpose: by providing money to citizens, in the face of 0 production, it incentivizes more spending and thus faster economic recovery.

This is all at the theoretical level, but if we analyze the data, we realize the exact opposite.

The stimulus in the United States has been used as an investment in cryptocurrencies, while in Italy, fear of the future has reinforced a savings-oriented budget management.

Further complicating the situation was the war in Ukraina, which brought the rising cost of procuring certain raw materials such as heating fuels and electricity generation. Many of us have witnessed this with utility costs rising by almost 100 percent.-

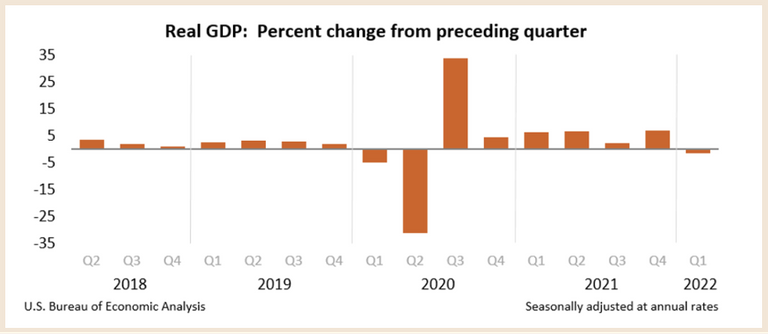

This scenario does not bode well: the GPD forecast was between 0 and +2.5, while in the second quarter of 2022, we had a decline of 2.1 percent, as we can see from the graphs.

Source:https://www.bea.gov/news/2022/gross-domestic-product-fourth-quarter-and-year-2021-advance-estimate

Data in hand, even the IMF (International Monetary Fund) had to revise its U.S. growth forecast to +2.9 from +3.7.

The FED (Federal Reserve) is running for cover trying to curb inflation, which is soaring: in April 22 it recorded +8.3 percent compared to the same period in 2021.

Source: https://www.rivaluta.it/inflazione/ultimo-dato-inflazione-usa.htm

The only way is by raising interest rates; and it has raised them by as much as 75 basis points (0.75 percent highest increase since 1994) with almost total certainty that the recessionary state will not be touched at all.

Meanwhile, the dollar, the world currency par excellence, inexorably loses purchasing power.

In Italy the situation is a tad more serious; in fact, inflation is rising almost steeply:

Source: https://www.rivaluta.it/inflazione.asp?t=NIC_T&yi=2021&yf=2022&mi=12&mf=12

This data does not give some peace of mind: inflation indicates the increase in prices of certain basic necessities that are listed in a particular group. Practically with inflation close to 12% we can safely assert that 100 € in December had a purchasing power of 96%, in December 2022, they had a purchasing power of 88%. 6% less!

So what can we do?

The answer is to find the best method to make sure that our capital is not eroded by inflation.

The only way is to manage it in such a way that it can produce income at a rate very similar to that of inflation; therefore, we could turn to safe-haven assets: these are those assets that, in the long run, have an increase in value.

See you at the Digital Gold chapter!

in the capitalist world we underestimate one of our enemies, inflation. Thanks for these posts !BEER

I totally agree!

Inflation and consumerism. Two scary enemies of our everyday life, of our families and our children.

Cryptocurrencies represent a good tool to fight inflation, through trading and accumulation

View or trade

BEER.BEERHey @mikezillo, here is a little bit of from @stefano.massari for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.