About a week ago I published a guide how to farming Quick and what to earn. But why do you want to have Quick? How to earn money with it?

Here is why...

Stake and get dividens

If you stake quick in Dragons Lair you will get a part of ALL fees collected in the QuickSwap platform. Not only thoose with quick - ALL...

Everytime someone use Quickswap they pay 0,3 % in fee. Same as in Uniswap, Sushiswap and a lot of other swapservices. Of this 0,04% goes to Dragons Lair and will be split to all that has staked Quick.

And because Quickswap is the biggest swap in Polygon and Polygon is the biggest 2-layer solution at Ethereum it can be a lot of money.

How much?

How much you will earn each day is depending of three parts.

Your numbers of staked Quick

If you are staking 1 quick you earn double then you stake 0,5 quick. So the first part is how much you stake.

The total pool of staking

The next part is the total pool of staked Quick. Lets say it is 1000 Quick staked and you stake 1 quick. Then you will get 1/1000 of all fees

Total tradingvolume

Third part is total trading volume at QuickSwap. Becuase 0,04% of all fees is collected to this Dragon Lair and distributed to thoose who staking Quick.

A calculation

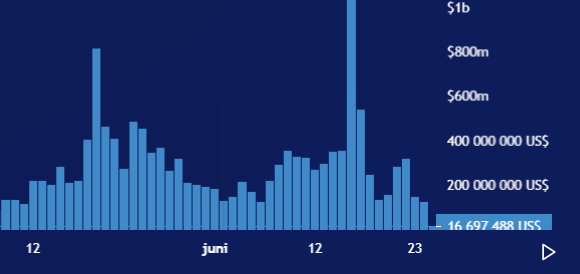

The Trading Volume is very different day to day.

24 june it was about 150 000 000 USD.

0,04 % of that is 600 000 USD in fees !

So what do I get?

The easiest way to see the APR for 1 Quick is to check this link

Just now it is 16,9 % but I have seen days at about 50-60 %.

https://matic.apy.vision/#/rewards/quickswap

Good or bad?

Well it depend what you compare too. Get about 15 % for staking is good. But I think you only should do it if you really think Quick is a very good service and the price will go up. And that depend of what you think about Polygon - because Quickswap is the biggest swap at Polygon.

If you think Polygon "is the future" becuase of the 2-layer solution - I think this is a very good investment.

IF you think Ether 2.0 will make transactions so cheap that you dont need second-layer - maybe you can find better investments.

I ususally dont go for staking. When I have an good amount of quick I swap half to USDC or ETH and go for the LP-mining insead. It is 50 - 100 % APR at thoose pairs and I have never seen staking in this levels. BUT to be a LP is more risky then just staking.

Keep on Staking !

Minimining

Posted Using LeoFinance Beta

Congratulations @minimining! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 79000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP