Crescent has more than most AMM Dexs as it’s a Hybrid Dex

New kind of Dexs are up in the Blockchain space and they have improved over general Dexs that were a rage a few years ago. Crescent is one kind of Dex that differs from basic Dexs with its enhanced capabilities.

Crescent is designed to be a Dex which provides deep liquidity for coin trading pairs, while LP providers get maximum rewards for their liquidity contribution to a coin pair in Crescent Dex. The main principle adhered to by the Dex is to function in a capital efficient manner.

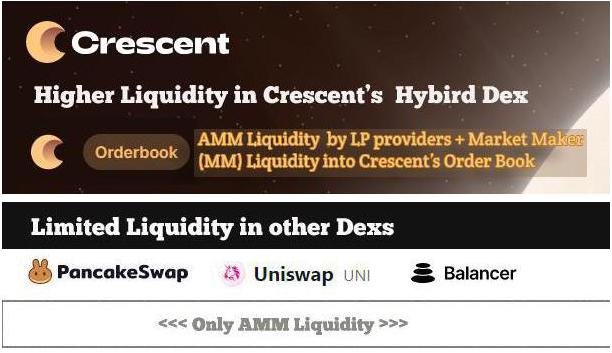

Additional liquidity in Crescent Dex with Market Makers providing liquidity

Crescent is a Hybrid Dex with an order book feature. Here, just like other AMM Dexs there are LP providers who provide liquidity to coin pair pools, but apart from this there are Market Makers(MM) as well, who provide liquidity to coins making coins available for traders to trade at specific price ranges.

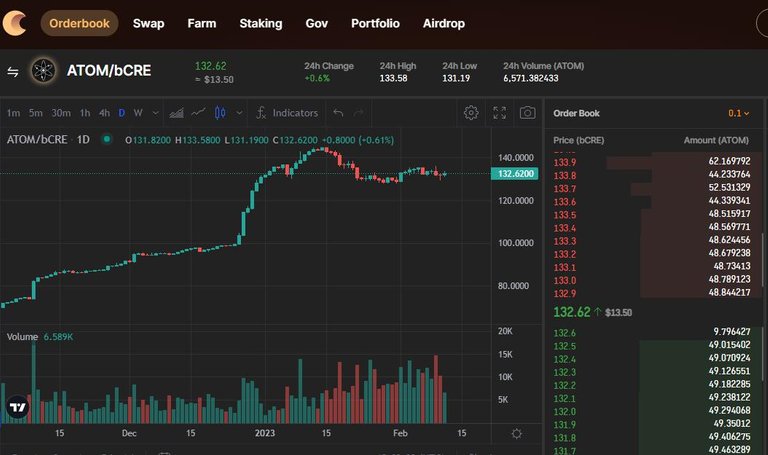

An extra feature in Crescent Dex that’s lacking in other Dexs - Order Book

With Order book, users can get visibility on the sell and buy order price and trading volume, just like in CEX. This is a very useful feature for traders.

Crescent’s Hybrid Dex advantage - Liquidity from both LP providers and Market Makers

Market Makers (MM) have to be whitelisted, they are selected by the community through Governance Proposal after they register to be a MM. MM’s quality of liquidity will be evaluated off chain, based on which they will be rewarded and incentivised.

LP providers get incentivised though LP rewards plus farming rewards, where LP providers get CRE tokens for staking their earned LP rewards.

MMs are also incentivised through CRE tokens.

Crescent is designed to be a hybrid Dex having deep liquidity combining liquidity provided by LP providers from Crescent’s AMM module and Market Makers who provide stable liquidity for both buy and ask trades.

Crescent’s Order Book aggregates liquidity provided by both AMM LP providers and Market Makers (MM). This way even small LP providers become market makers, earning LP rewards and CRE farming rewards.

This is the foundation of Crescent as a Hybrid Dex, but it offers much more.

This article ventures to explain how Crescent is different from other AMMs as it’s a Hybrid Dex with an Order Book. However, apart from this, Crescent has more features than other Dexs that’s all introduced to sort out common limitations of existing Dexs which I will cover in my next article.

Understanding basic aspects of Crescent Dex

Crescent is a Cosmos chain Hybrid Dex. Crescent Dex has its own validator set, and users can stake their CRE for staking rewards.

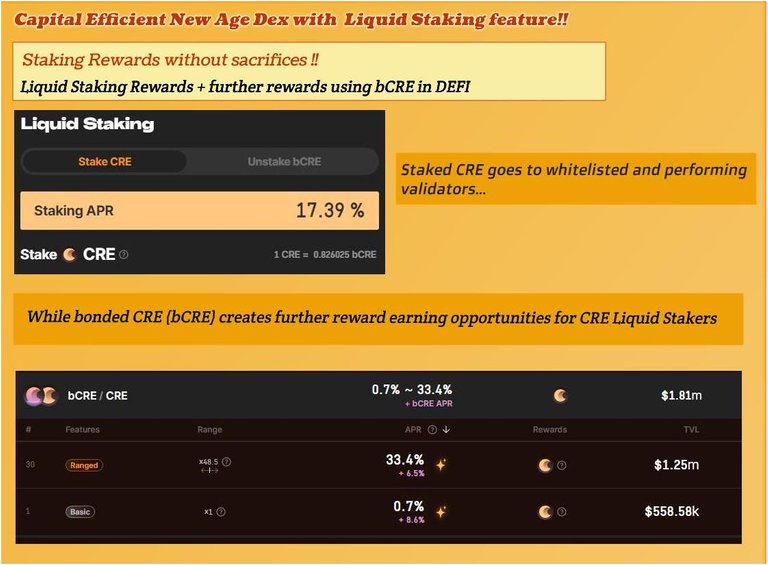

Liquid Stake CRE and use bCRE to earn more CRE based rewards

Crescent's Liquid Staking Module

In Crescent, staking is easy, because all we need to do is stake CRE in Crescent’s Liquid Staking module and get bCRE that’s bonded CRE which users can use in DEFI.

The staked CRE goes to whitelisted validators whose performance is tracked, and whose management is done by community through the Governance process.

This is a capital efficient feature in Crescent, as CRE holders can earn staking rewards while earning further rewards using their liquid staked CRE; bCRE in DEFI.

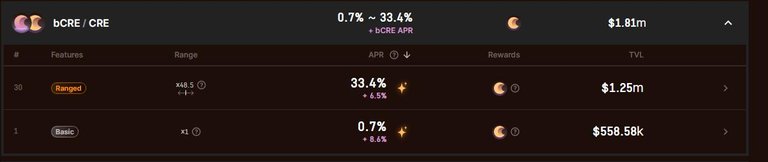

A goto pool for CRE holders to earn maximum CRE rewards - CRE -bCRE pool

There’s a CRE -bCRE pool which is a low risk pool to provide liquidity for CRE holders, while getting maximum earnings of CRE tokens. It’s low risk as they are the same tokens, so there is no possibility of impermanent loss.

That’s all folks…

You can check out Crescent Dex here -

App -: https://app.crescent.network/staking

Learn about Crescent Dex - :

https://docs.crescent.network/introduction/what-is-crescent

*Read updates about Crescent on Twitter -: *

https://twitter.com/CrescentHub

Join Crescent’s Discort Channel -:

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.