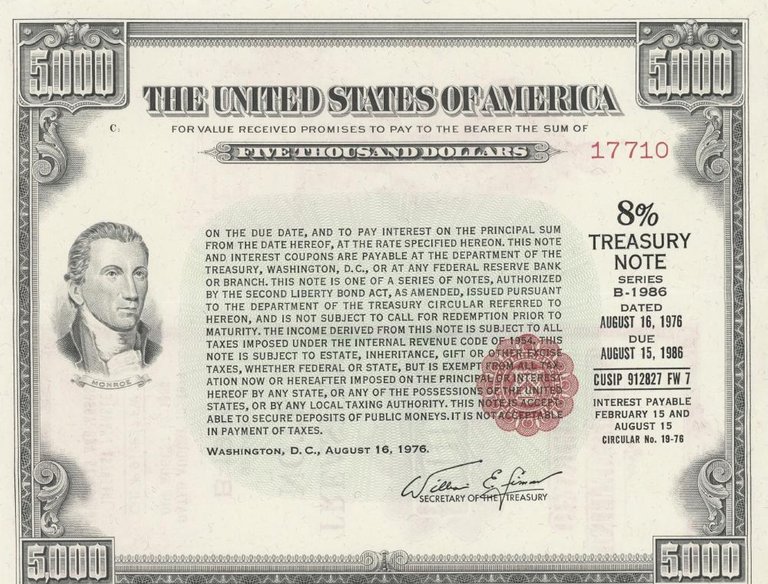

Looking at a common debt instrument for US government - Bonds

One of the most common straight forward ways any Government raises debt is through issuance of bonds. Traditionally, bonds are considered to be one of the safest investments because the Government promises to return the principal amount along with interest.

Let’s understand the basics of the Bond Market in the context of US Government Bonds which is a US Government debt instrument.

Understanding the price and yield mechanics of Bond Markets!!

This is how Bond Market works -

When there are a lot of buyers(demand) for Bonds, prices of bonds rise but their yields rates fall.

When there are few buyers for Bonds i.e, less demand and more selling of this IOU instrument, prices of bonds fall but their yield rates rise.

Yield rates are interest rates for holding bonds.

Yield rates rise during times when bond buyers are few, to encourage more buyers, and the bond price is at a discount.

Similarly when bonds are overbought, conditions adjust encouraging less buying with the price of bonds rising but their yields declining.

This concept is very important to understand when you want to analyze Bond Markets.

Gauging sentiments of the public by studying bond yield rates moves

When Bond yield rates are falling, it is interpreted as investors having confidence in the US Economy, as there is good demand for the instrument with the investing public feeling that the US government can pay back the bond amount along with interest.

However, when Bond yields are rising, it is interpreted as investing public having less confidence in the US Government’s ability to pay back their bond amounts along with interest.

Whenever you study a Bond yield chart, keep that in your mind.

Youtube channel CoinBureau has this podcast where Guy explains all this basics of Bond Market here, check it out -:

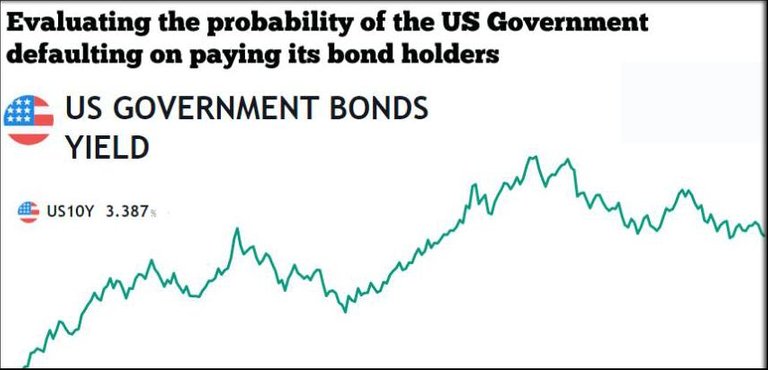

Yield rate movements of the US 10 year bond Market imply losing investor confidence

In that context let’s take a look at the US 10 year Bond yield chart -:

Did you notice that in recent years Bond yields are increasing, and now it has even risen above the declining trend line channel and for the past few years bond yields are clearly not touching the base low point because their yields have stopped falling so much as they used to historically.

This may signify that the larger investing public are not confident about the US Economy to invest in bonds. There may be doubts on whether the US Government Treasury is making enough revenues to pay bond holders back with interest!!

Just food for thought.

Is the US Government making enough revenues to pay back its bond holders?

Now, let’s see if our above assumed viewpoint of bond investors holds merit.

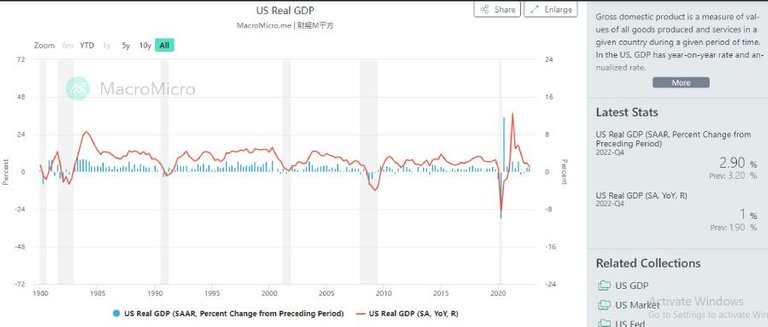

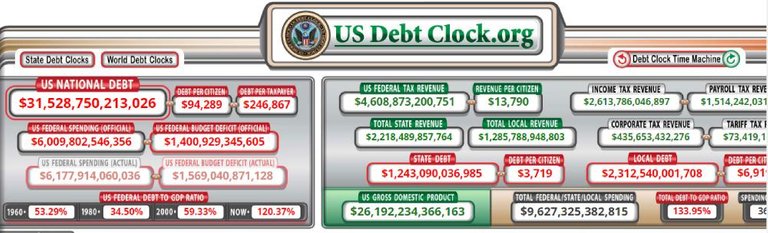

USA’s GDP is declining now. A decline in GDP growth rates implies that there is less growth of the economy, in terms of economic activity producing goods and services.

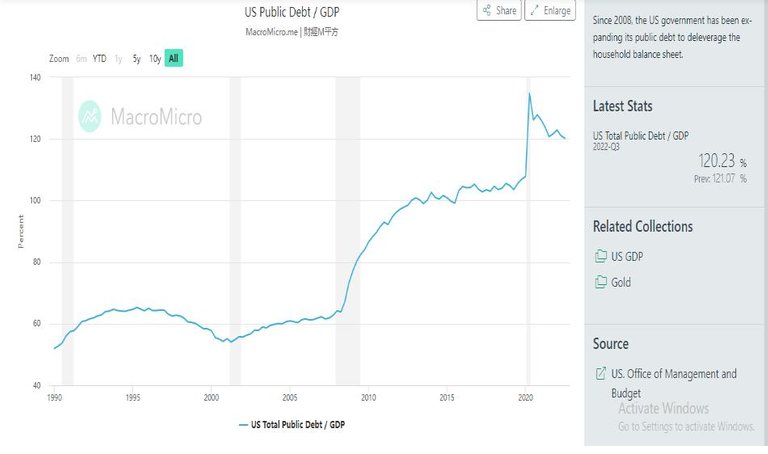

However, Government Debt to GDP ratio is huge - 120% . Obviously, this says that there is a large amount of Debt compared to GDP growth.

US Government’s Debt is more than the revenue it makes.

So, if you properly evaluate more such economic indicators, it appears that fundamentally the US Government lacks the ability to pay back its debt.

Now coming back to what this means for Bond holders.

US Government cannot afford to stop taking on debts as it would endanger its functioning

Image by Venita Oberholster from Pixabay

Right now, the US Government's debt amounts to $31.45 trillion and it’s coming close to touch the debt ceiling. Debt ceiling is the limit fixed by the Government beyond which the US Government and its Departments cannot take on further loans.

This severely limits the room for the government to spend.

Government needs funds to spend on paying interest to bond holders.

Besides this, it needs funds to spend on development of the country, building infrastructure and maintaining the welfare of its Citizens. Government needs money to pay to make roads, build and maintain public institutions, pay pensioners, Government Public servants etc.

If US Government cannot take on more Debt, it will have to curtail its expenditure which would mean

- cutting off paying interest to bond holders that would lead to a debt default, which is bad as the public will lose confidence on the US Economy and its US dollar currency.

- Stop spending on development of the country and supporting the welfare of its people. This would mean there will be no spending for the essential development of the country so economic activities would halt, public institutions relying on Government funds would shut down.

- People would also revolt as their pensions and basic benefits are stopped, it would lead to socio-economic instability.

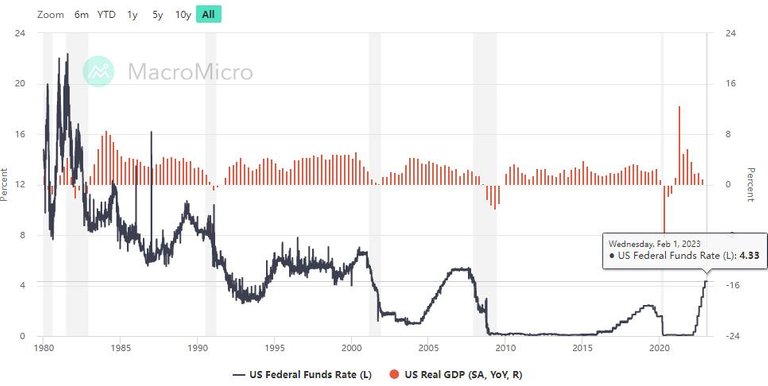

US Debt weighs more heavy for the Government since the rate hikes

US Government’s Debt problem is further compounded because interest payment rates are higher on Government Debt due to it’s own rate hike policies.

Plus, bond yield prices deviate, get high when there is a lot of selling, which is happening now because other country Governments like the Government of Japan indulge in selling of US bonds, so they get money to buy their own currency, to maintain parity with the US dollars.

US Government current challenge is to have the Debt ceiling extended

Well, fortunately, US Government can raise the Debt ceiling however it has to be approved in the Parliament. The Debt ceiling has been raised 78 times since 1960, where the Debt limit kept on getting extended under both Republican and Democrat presidents.

Now, both Democrats and Republican parties have to agree and vote to raise the Debt ceiling to give the US Government ability to spend to pay back its Bond holders and run the country.

However, if the Republican party chooses to block the move to extend the Debt ceiling it will be bad for the nation as the US economy will collapse without being permitted to take on further debt funding to function. Ouch!!

Thanks for reading !!

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Congratulations @mintymile! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 2250 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!