Hybrid Dex Advantage for Crescent - More liquidity than other basic Dexs

As a Hybrid Dex, Crescent gets more liquidity than other basic Dexs

Crescent Dex has integrated some smart methods to ensure that there is not only ample liquidity in its Dex, but also that there is effective and good quality liquidity.

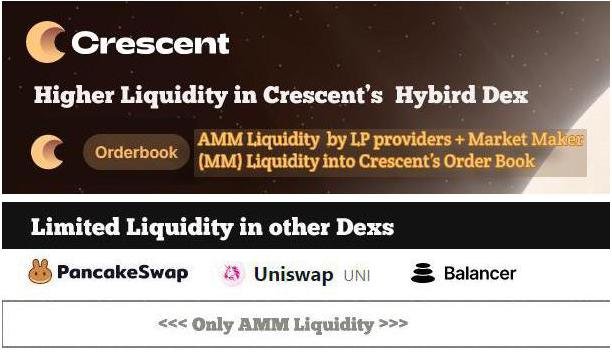

My readers who have read my previous article, would have understood that as a Hybrid Dex, Crescent Dex gets ample liquidity.

This is because Crescent Dex gets liquidity from both Liquidity providers(LPs) and Market Makers(MMs).

So, the Hybrid Dex advantage for Crescent Dex is that while other basic AMM Dexs get their liquidity only from Liquidity Providers(LPs), Crescent Dex gets it’s liquidity from not only LPs but also MMs.

Crescent Dex is Smart and Trader friendly as it has a Orderbook feature

Add to this, Crescent Dex is a convenient Dex for traders buying and selling crypto because it has an integrated Order book, providing visibility into trades - Buy Orders, Sell Orders, volume and such details.

Most other AMM Dexs can't provide this valuable data, because they don’t have an Order book. So, users can only swap crypto pairs without insights, at whatever price the swap takes place.

You can read my previous article here explaining this more fully -

Crescent Dex is unlike other Dexs being a enhanced Hybrid Dex with an Order book

Crescent Dex is designed to provide effective liquidity being a Capital Efficient Dex

So, till now we have explored how Crescent Dex being a Hybrid Dex with an Order book is able to procure more volume or amount of various cryptos to trade, now it’s time we see how Crescent Dex is also designed to provide effective liquidity or capital efficient liquidity besides merely containing more quantity/amount of liquidity.

Limitation with liquidity pools in Basic Dexs providing ineffective liquidity

Basic Dexs have pools that provide liquidity spread over all price ranges. It’s diluted liquidity. There are price ranges here where trades just don’t happen, so there is a lot of wasted liquidity that won’t be used up and LPs don’t get maximum possible rewards for the amount of liquidity they have provided.

Meanwhile, protocols provide farming incentives even to LPs whose liquidity was not

effectively utilised in executing trade orders and swaps.

There is scope for making pools more capital efficient, with LPs providing quality liquidity, and protocol farming incentives adjusted according to the effectiveness of the liquidity that is provided by LPs in the pool.

Effective and Capital Efficient Liquidity in Crescent Dex with Ranged Pools

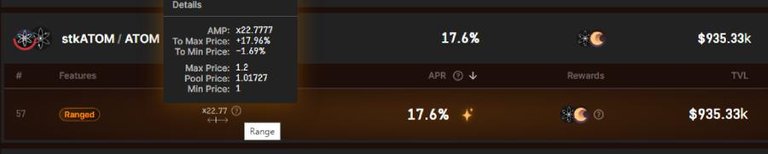

Crescent Dex, has Ranged Pools, to attract quality liquidity which is effective liquidity.

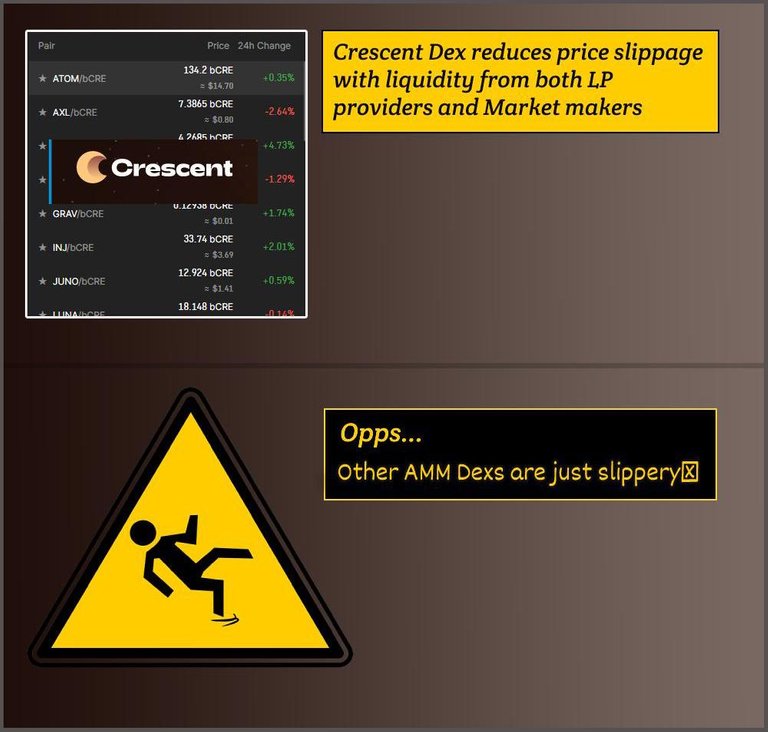

Ranged Pools provide liquidity only between two price ranges instead of all price ranges. This is concentrated liquidity.

Trades that happen between these price points benefit as there is a concentrated amount of liquidity/volume, so price slippage is mitigated.

Liquidity Providers get amplified LP rewards. Even small LPs can benefit with more rewards in form of both LP and farming rewards.

This is because LPs are providing quality liquidity, which is effective liquidity where plenty of orders in the Order Book between those price ranges get executed using the liquidity provided by these LPs.

Protocol farming rewards go proportionately according to the effective liquidity provided by the LPs.

By this way, Crescent Dex makes provision to make the most optimal use of Liquidity. Crescent Dex with concentrated liquidity in Ranged Pools, makes use of less amount of liquidity in a more capital efficient manner.

Understand the risks involved as a LP provider in Ranged Pool!!

Just understand that Ranged Pools carry the risks of amplified impermanent loss.

However, Ranged Pools with pairs trading with similar assets carry no risk of impermanent loss.

So, in ranged pools, it’s safe to provide liquidity to stablecoin pools like USDC/USDT and pools like CRE/bCRE, Atom/stAtom that are same asset pairs, with one being a liquid staking derivative of the other.

Ranged Pool that has concentrated liquidity between 1 to 1.2 price range...

Advantage here is that LPs get amplified, that is multiplied LP rewards as more of their liquidity is effectively used to execute trades in the Order book.

Check out various pools in Crescent Dex yourself here…

https://app.crescent.network/farm

Crescent Dex has both Ranged Pools and Basic Pools to deposit Liquidity

Ranged Pools with different crypto trading pairs do carry the risk of impermanent loss, but even so, a LP provider can monitor trading price ranges of the crypto pairs in the Orderbook, and provide liquidity in ranged pools that have safe price ranges, to avoid amplified impermanent loss.

Otherwise a lazy and novice LP provider, who is not often monitoring prices of crypto pairs in the Order book on a regular basis can always choose to provide liquidity to Basic Pool of the crypto trading pair, instead of Ranged Pool.

Meanwhile traders get good prices for their trades without slippage, and there is liquidity outside of the price ranges prevalent in the Ranged Pools with Basic Pool pairs also being there providing liquidity to all price range spreads.

Crescent Liquidity Providers get LP rewards plus CRE farming rewards…

The module that liquidity providers need to go to provide liquidity to liquidity pools in Crescent Dex is the Dex’s Farm module.

Crescent incentivises LPs through CRE farming rewards, according to the effectiveness of the liquidity that is provided by the LP.

For this, a Crescent Liquidity provider has to farm their staked portion of liquidity, which is nothing but the liquidity they provided to a liquidity pool pair.

After this, LP providers get CRE farming rewards every Block for locking their liquidity into a coin pair pool besides getting LP rewards.

As mentioned, farming rewards in Crescent are according to the effectiveness of liquidity provided, so when more of the liquidity provided by a LP is utilised, then there will be more CRE rewards going to that LP.

What’s different in Crescent Dex is that farming rewards are distributed every Block according to the effective liquidity provided by LPs. This incentivises LPs in providing liquidity to coin pair pools which are providing effective liquidity, like Ranged pools which was discussed before.

You can learn more about Crescent Dex yourself -

Crescent App - https://app.crescent.network/

Docs - https://docs.crescent.network/introduction/what-is-crescent

Discort - https://discord.gg/crescentnetwork

Twitter - https://twitter.com/CrescentHub

That’s all for now!!

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

This looks promising :) What are the trading fees like?

This post has been manually curated by the VYB curation project

Hey when did you get interested in checking DEFI posts from dog and cat related posts...

Yes... fees are in CRE... they should have a faucet for intial usage... all I discussed have just come up and its relatively new...

But I like many of their ideas...order book, ranged pools and there are some same and similar coin pools for maximum rewards without impermanent loss.

Also they have featuures like batch execution which I did not mention coz i am not clear.

Basically all transactions in a Block are validated in batch without reordering to prevent Maximum Extractional vale or MEV. They do that in ethereum, like reorder transactions so validators benifit out of fees...they front load transactions...

Very cool dex and the ambassador charactor for crescent is cat... very cool...

That being said you have to do your own research for your investment decisions(:

Thanks for curating, this blog was else having very low upvote points, not that it bothered so much, but sudden upvotes and points lifted my mood up a lot...

thankyou for visiting!!!

Posted Using LeoFinance Beta

I've been trading for some time now, but I've not used defi except for the Hive one. Mostly due to fees and not being able to place buy and sell orders...

You should join Dreemport :) ...

!PIZZA !ALIVE !LOL

Hey thanks for visiting and gifting some upvotes, really cheered me up!!

and it was a surprise you read one of my Defi blogs than the charming four legged charactor blogs(:

Fees are in CRE and its not much I reckon, there should be a faucet around in their discort to get some CRE to start with but I am not sure, I can check.

Yup this app is very cool but all these features just got activated months ago...

Let's see how it does...

I may write more on Crescent...but I am not sure, coz they don't give points for articles only tweeter threads, memes and graphics in Crew3...

But the app is pretty cool, and I love tnew features like ranged liquidity and order book...

there is a lot of maths in all this too... which I never understood but its explained for the LP rewards...some Constant Product Model...

I will definitely have a eye on Crescent and may post more content all though its doubthful(:

Thanks for visiting!!

I know how you feel, there's a centralized exchange that I've been using for years that I really like too, because of its unique features and community :)

!LUV

(2/10) sent you LUV. | tools | discord | community | HiveWiki |

HiveWiki |  NFT | <>< daily

NFT | <>< daily

PIZZA Holders sent $PIZZA tips in this post's comments:

(12/15) @wrestlingdesires tipped @mintymile (x1)

Learn more at https://hive.pizza.