Welcome to The Daily Leo! We pull the best articles in Finance, Crypto news, and Hive/Leo into one condensed information-packed space. Be sure to follow @thedailyleo so you never miss the Daily LEO. You can also subscribe to the newsletter here Subscribe to the Daily LEO

Bitcoin Succumbs to US Tariffs

U.S. tariffs under President Trump have triggered market turbulence, causing a 7.7% drop in Bitcoin and a broader crypto selloff. While the tariffs strengthened the U.S. dollar, uncertainty in global markets grew due to Trump's inconsistent messaging.

Bitcoin fell below $80,000 for the first time since November 2024, disappointing investors expecting favorable regulations. Some speculate Trump may be using tariff threats to curb inflation rather than implementing them fully. Markets remain cautious, awaiting further developments.

Will The Sell Off Continue?

Bitcoin briefly dipped below $80,000 before rebounding, but uncertainty remains over whether this is a real recovery. The upcoming 25% tariffs on Canada and Mexico could trigger another decline, though some believe it's already priced in. Despite apparent efforts to suppress crypto prices, institutions continue accumulating assets. The Fear and Greed Index signals extreme fear, suggesting a buying opportunity before a rebound.

Investors await key legislation that could bring institutional liquidity, benefiting Ethereum as banks adopt stablecoin-backed tokens and increase staking activity.

ArcadeColony NFT DRIVE: SPARK & SURGE Market Analysis.

The post discusses the Moon Karts game and the ArcadeColony NFT market, specifically focusing on the DRIVE platform and its key components, SPARK and SURGE. These NFTs, currently priced at $0.44, have nearly equal script values, making them an interesting trading opportunity. The post highlights the volatility of the NFT market, emphasizing how demand, transaction volume, and market trends influence price fluctuations.

It also stresses the importance of strategy, past investment analysis, and timely decisions for success. The future value of SPARK and SURGE remains uncertain, but they present potential opportunities for traders.

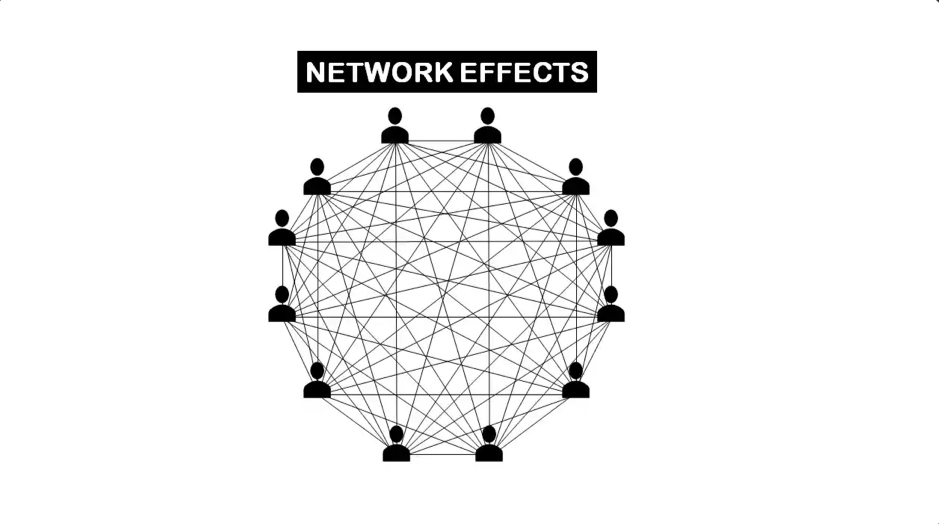

The Network Effects of the US Dollar

The post highlights the resilience of the US dollar, emphasizing its dominance through digital finance and network effects. While some predicted its decline, stablecoins are actually expanding its reach. Currency now functions primarily as digital data, with the US dollar having the most extensive global network.

Stablecoins like USDT and USDC, already handling trillions in transactions, will grow further as commercial banks enter the space. This will create a system where USD-denominated stablecoins operate outside traditional banking, strengthening the dollar’s network effects even more.

InLEO is a blockchain-based social media platform for Crypto & Finance content creators. Our tokenized app allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Posted Using INLEO

the conclusions are really interesting. I also believe that the dollar-linked stablecoins will make the dollar stronger. However, I note that the European Union is not convinced that USDT fully complies with the new European regulation called MICA. We'll see how this story ends, but I also believe that in the future, dollar-linked StableCoins will have a high flow of transactions every day. !PIMP

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below