The price of Bitcoin and DeFi

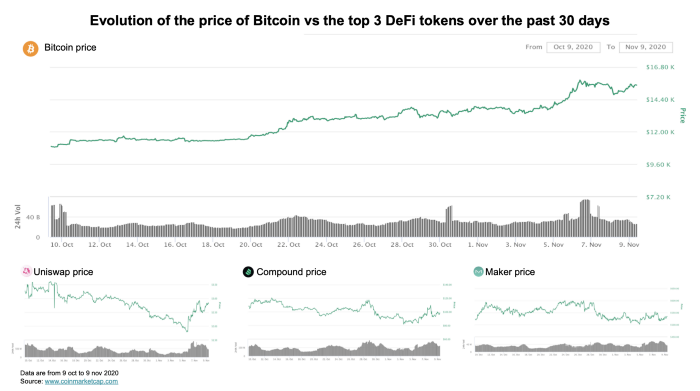

Bitcoin's price has risen by 43.28% in the last 30 days, while the value of most of the major DeFi stock exchange tokens has fallen. Just a few DeFi coins have been growing recently. However, they are slight, as they do not achieve results comparable to August this year, when the vast majority of the DeFi market was green with at least two-digit percentage. Despite this, DeFi is also experiencing a lot of volatility at the moment - for example, TVL has continued to grow 9.72% over the past 30 days. How should we interpret these changes? Does the recent dynamics in the Bitcoin price affect the DeFi market sector? If so, in what way?

DeFi - what is its role on the market?

DeFi can be seen as a fairly niche market for blockchain technology aimed at developing innovative financial products and services for cryptocurrency holders. The intention is to be very well adapted - so that each participant has full control over digital assets. Operating without centralized entities that can unfairly influence market prices, reduce transaction fees, speed up processes while providing a wide range of financial products such as loans, storage and insurance - in return for high interest rates and rewards. The concept itself is not new, however - it has its roots in 2016; in recent months, however, in times of global recession, it has become particularly attractive. Bitcoin, meant to demonstrate its strength as a safe haven, failed to stabilize during the crisis and fell to $ 4,474 on March 12. The result was the search for alternatives. This opened the door for new players; products and services that arouse interest even more than the effects of the centralized markets of Bitcoin and its alternative coins.

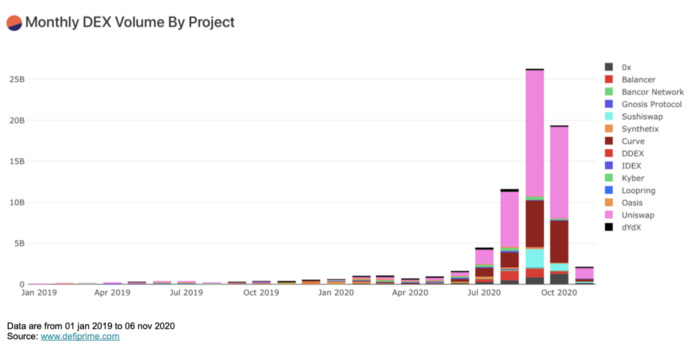

With many cryptocurrency holders seeing value in DeFi and shifting their funds to the market, Bitcoin's recent vertical spikes are a significant twist here. The volume of the DeFi market, experiencing a significant reduction, was the victim of the great return of the king of cryptocurrencies.

Is this the end of DeFi?

However, one should be careful with assumptions like “this is the end of DeFi”. This market is still a great complement to the entire cryptocurrency world and will definitely stay with us.

It is a known fact that fluctuations in the Bitcoin price affect practically all altcoins, including Ethereum. ETH is the "reference" cryptocurrency for most of the DeFi projects, and a large number of them share a blockchain with Ethereum, or even the cryptocurrency itself for online transactions. While the low price of Bitcoin has stimulated the community to look for alternatives, and investors have diversified their funds in favor of DeFi projects, when BTC gains momentum, investors also return their assets to it. Bitcoin, however, is not stable - there is a high probability that it will fall again, which will likely be a catalyst for mobilization and a possible bullish DeFi rally.

From a slightly different perspective, the recent decline is a good thing for a thriving market. A large number of projects launched this summer have either shown unsustainable business models or are experiencing a market correction or collapse. For this reason, we can predict that only the best projects with ambitious and solid foundations will survive. The risks involved in investing in DeFi, coupled with high potential returns, should attract seasoned investors and speculators who understand the ecosystem; believers in the possibilities and great potential of projects.

While the market has already verified the possibilities offered by yield farming, it is doubtful that traders will be satisfied with the return to the rules of centralized exchanges with dominant long / short or hold strategies. The crypto market has matured, with hedge funds and financial institutions creating new trading strategies backed by advanced technologies that can give you an edge in an inefficient market. Many active investors may see a better future in DeFi than in Bitcoin.

I believe DeFi is at the beginning of its journey and has much more to offer in the future. The recently introduced instant loan feature available on some platforms is just one example of opening up new opportunities for the financial world. We are witnessing an exciting time not only for traders, but also developers who have access to the open source of the DeFi protocol - which gives opportunities for further and further network improvements, reaching new blockchain boundaries.

The increase in the price of the king of cryptocurrencies can be perceived as a negative phenomenon for the DeFi market, but only in the short term - Bitcoin attracts an increasing number of investors, and with it people who can go towards DeFi products and services. Especially when the market shows weaknesses of centralized exchanges and the classic cryptocurrency market again. This time will surely contribute to the mass adoption of decentralized finance and the revolution of this service.

Posted Using LeoFinance Beta

Source of plagiarism

Plagiarism is the copying & pasting of others' work without giving credit to the original author or artist. Plagiarized posts are considered fraud and violate the intellectual property rights of the original creator.

Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #appeals in Discord.