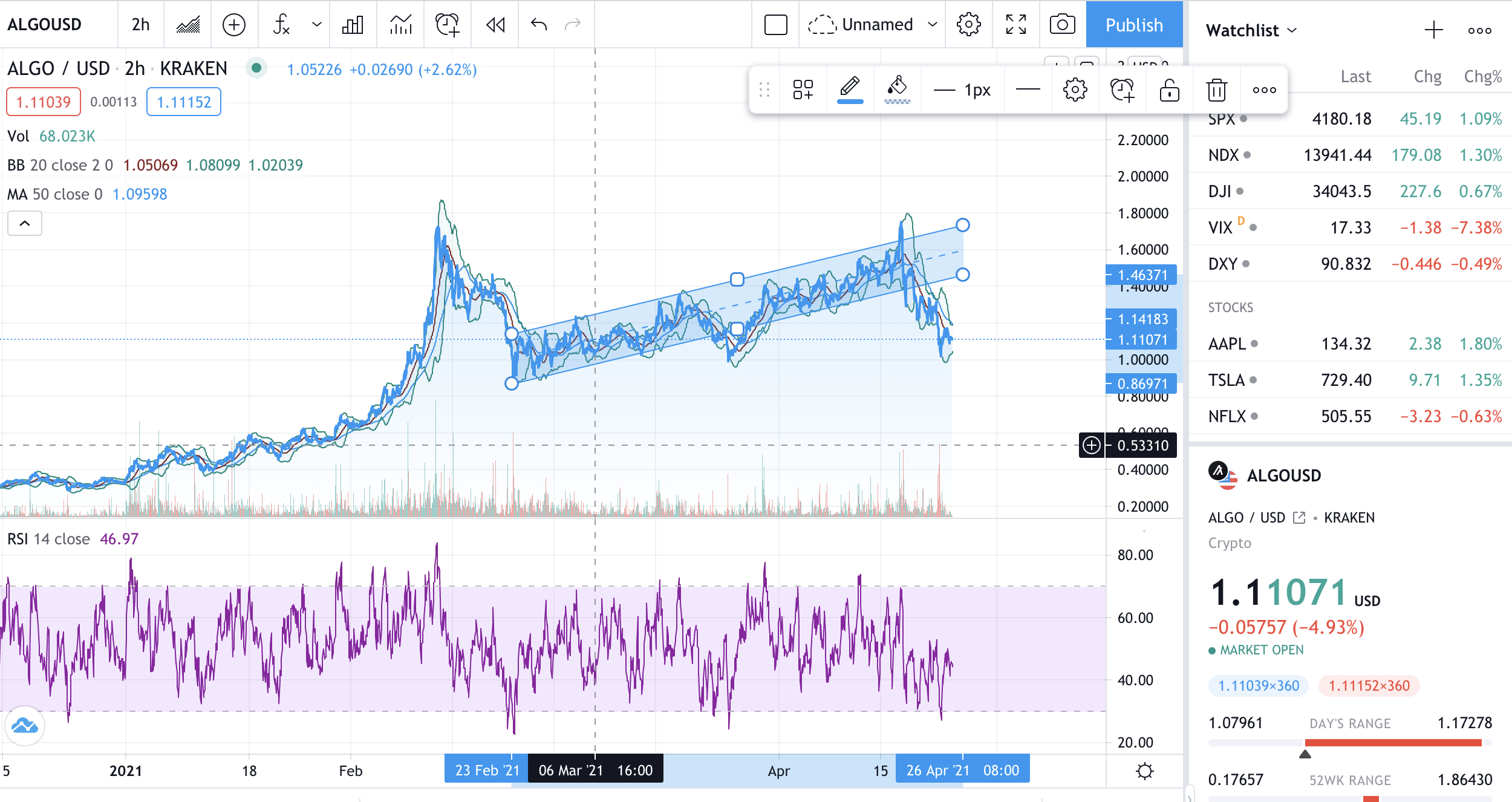

Algorand (ALGO) price closed last week with a mean bull trap that was triggered by Bitcoin's weakness. ALGO fell just below the all-time high, and quickly declined to the channel’s lower trend line before attracting some buying interest around the $1 level.

I have a long term positive outlook on ALGO as it's an environment-friendly consensus protocol that offers income with its annual APR. The Pure Proof of Stake (PPoS) solves the Blockchain Trilemma (scalability, security, and decentralization) and does it carbon neutral.

However, based on the technicals the bearish reversal from above the channel was a signal to the market that ALGO was facing substantial overhead near the high of $1.86.

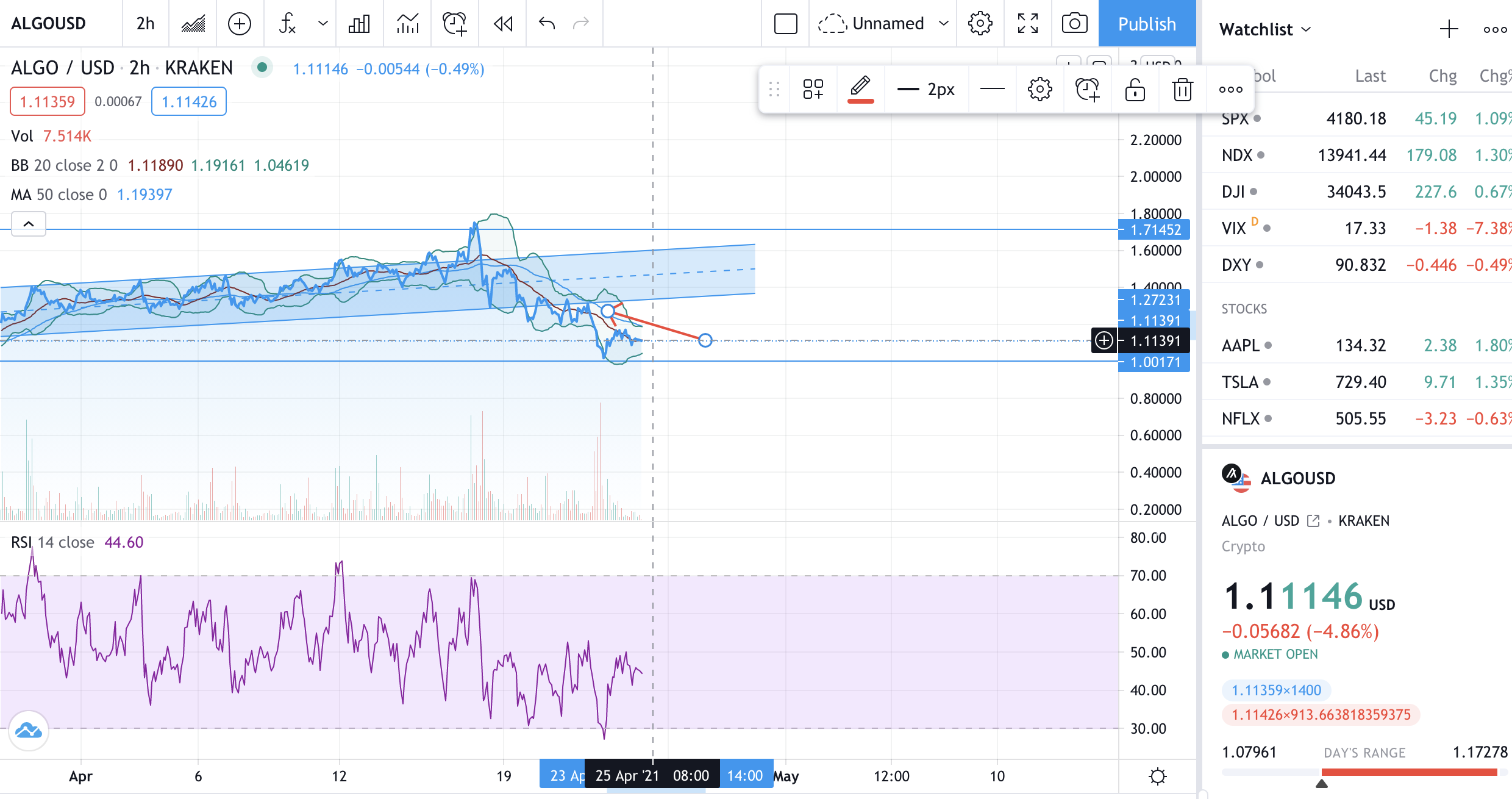

ALGO price needs to get back to that lower channel’s trend line, but having a hard time at the moment.

If it continues to fall the we could be looking at the $0.75-0.80 again. For now I'd look at the support around $0.98 and 0.84 before getting to worst-case situation.

If we get above the $1.20 level expect chop up to $1.55 above that I think we would test the high once again. All this depends on BTC at the moment.

Posted Using LeoFinance Beta