Welcome to the MPATH Weekly Report.

This has been another decent week, with token distribution up a fraction. This week's rise has been mainly on the income front, with vote-yield down, as is the Hive chain yield estimate.

Next week will see Hive's HF25 implemented. It remains unclear what the effect will be on MPATH. I suspect that initially vote yields will rise but curation income will fall. As the reward pool adjusts, and then humans adjust to the new economy, the effect after a month is less clear.

MPATH has aimed to distribute value as both votes and distributed income. The ultimate aim was that this split would be about even, at 50% each; the Hive economy has made this difficult to achieve (although on Steem the relative values are the other way round!) so that income has always been slightly below the vote-yield. My suspicion is that HF25 will make this even harder to achieve - we shall see.

We have started to see a glimmer of hope within some of our invested tokens. We shall be extracting value whenever their price is right. This is why we hold them, just so we don't need to delve further into our Hive Power unless necessary. They also allow a diversified source of income to complement that from posting and curation. This week has seen a stark contrast between those tokens adding to our income - and those that don't!

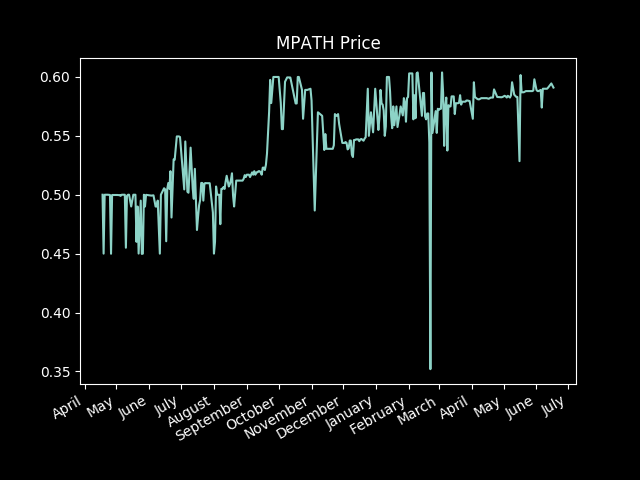

Here is a graph of the MPATH token price. (Thanks to @gerber for the discord-bot.)

As you can see, it is a rather jagged affair, mainly because the spread remains wide so those spikes are merely the difference between someone buying tokens and someone selling them.

A reminder that this is a market, and not a shop, so although official prices are designed to guide the market, you can sometimes find cheap MPATH tokens. I reiterate that our promise is that we will guarantee official buybaks equal to that week's income. Anything above that will require some waiting for an increase in power-downs.

MPATH still needs to break through that 60-cents ceiling! We have had sales at that price, but the graph illustrates how it remains a "resistance" level of sorts, even though the official sale price is well above that level. Need even more members, really.

And on to my usual closing remarks...

As ever, I give the caveat that individual member returns depend on many things, but these are our baseline figures to see how income changes from week to week. This is also a good time to remind members that such high returns may require adjustments at times so that our Voting Power does not get too low. We have plenty of capacity left, so this is not an issue, as yet, but members with 2000 MPATH tokens are getting votes from about 35k HP, so even if the VP is down to 60% that's still an effective vote from a 21k HP account.

A final reminder that the maximum holding to receive votes is 2000 MPATH, and the maximum to receive reward distributions is 5000 MPATH. You may, of course, own more than this as an investment. We shall increase these if we see the demand to do so, but they are there to attenuate the effects of large accounts and thereby help the smaller accounts. Also worth a reminder that any accounts below 10 MPATH will receive no benefits.

For full details, please read How the MPATH Program Works [May 2020].

Have a good week!

The MPATH headline figures are:

MPATH tokens active = 42,480

Earning HP = 42,950

Voting HP = 35,900

HP in MPATH = 22,120

Other HIVE = 3,500

Total HIVE = 25,620

MPATH ABV = 0.593 HIVE (+0.001, +9.3% APY)

Sale Price = 0.627 HIVE (spread 0.034 HIVE)

Estimated Gross Earnings = 7.35 HIVE per 1000 MPATH = 38.2% APR

(7.35 = 2.14 income + 5.21 votes)

Estimated Net Earnings = 4.75 HIVE per 1000 MPATH = 24.7% APR

(4.75 = 2.14 income + 2.61 votes)

Total MPATH Distribution = 91.0 HIVE = 145 MPATH tokens at 0.627 HIVE sale price

Hive est. APR = 15.1% (-0.1)

Note that "Other HIVE" is the sum of all holdings not powered up as HP: liquid HIVE and HBD plus holdings within Hive-Engine. Also note that such values are volatile, especially any holdings priced in US$, so the above numbers are a snapshot and may have changed when you look at the @MPATH account.

The Asset Backed Value (ABV) is our total holdings calculated in HIVE divided by the number of active MPATH tokens.

Any questions, please ask in the comments below or in our public chatroom.

[BUY MPATH] - [READ MPATH]

[BUY new M token] - [READ M posts]

MPATH Token price getting high

Hi, sorry, didn't see this sooner.

Yes, it is designed to have a modest price rise in line with our investments, hence holding MPATH will compound both the vote and the weekly rewards.