The pHBD-USDC pool on PolyCub is currently yielding 46.6%. When I evaluate it in terms of risk-reward ratio, it is an opportunity that should not be missed. On the other hand, I don't want to sell my assets like Bitcoin or Ethereum. Although the market sentiment is currently pessimistic, a bull run can start at any time. I wouldn't want my funds to be in stable coins during such a rally.

I thought it would be a viable solution to get a loan with my Bitcoin or Ethereum coins as collateral. Lending applications such as AAVE and Compound are among the largest in the DEFI ecosystem. I wanted to use Aave last year, but could not use it due to high Ethereum gas fees. AAVE has been operating on the Polygon network for a while now, we can use it at a low cost.

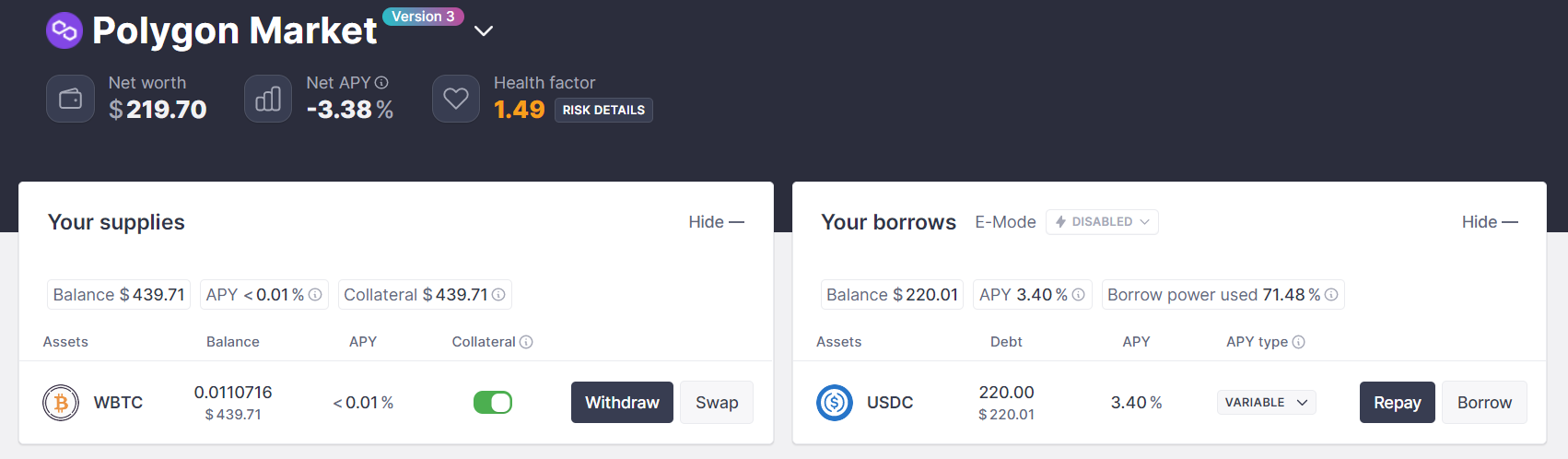

I deposited a small amount of Bitcoin that I kept on the Polygon network in AAVE. They provide close to zero percent interest on Bitcoin, but my intention was to use my Bitcoin as collateral rather than earn interest. The Bitcoins I deposited in AAVE gave me the right to use 70% of their value as a credit line. However, I found it more appropriate to borrow USDC worth %50 the Bitcoins I deposited. Even taking a loan of up to 40% of our collateral can keep us in a safer position against liquidation risk.

The 220 USDC I borrowed at 3.40% interest was the first loan I used directly in the crypto market.

I then converted half of 220 USDC to pHBD and added those coins to the USDC-pHBD liquidity pool in Sushiswap. Then I added this liquidity to the relevant pool in Polycub. So while I continue to own our Bitcoin, I start to get an annual return of 46.6% from an amount that is half the Bitcoins' value. Even if this rate declines over time, it will not fall anywhere near the 3.40% annual interest I pay to AAVE.

Conclusion

One of the important features of blue-chip cryptocurrencies is that they can be used as collateral. In the example above, I deposited a small amount of Bitcoin in the AAVE app and borrowed half its value in USDC. I invested this amount in the pHBD-USDC liquidity pool. Thus, after deducting the interest to be paid to AAVE, I had the opportunity to earn a yearly return of over 40%. If we consider the total value of Bitcoin, which I use as collateral, there is an annual return of 20%. Thus, we are taking advantage of an opportunity provided by the @leofinance community without giving up our Bitcoins or Ethereums.

Now that the proof of concept has been successful, it's time for me to do the same transactions with larger amounts.

I am not an investment adviser. Please do your own research on the possible consequences of the investment I mentioned above.

Thank you for reading.

Posted Using LeoFinance Beta

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

That is true. Detailed information can be found below.

https://hive.blog/hive-167922/@leofinance/phbd-usdc-is-now-live-or-hbd-is-about-to-get-a-usd5-000-000-liquidity-pool

I been saying this since day one, Polycub HBD farm is basically money on the table. It baffles me that only few are taking advantage of this opportunity. Thanks for sharing this ultimate process

Posted Using LeoFinance Beta

Very cool :)

We need to make it clear to more people that this a viable path that they can take with their blue chip crypto.

Posted Using LeoFinance Beta

I am there with you mate! Getting this nice yield. Peacefully.

This is an interesting way to be part of the pool and earn nice Apr.

Congratulations @muratkbesiroglu! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 65000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!