The world of decentralized finance (DeFi) is ever-evolving, and the Solana blockchain has been at the forefront of this innovation. Among the myriad of projects making waves is SharkyFi, a platform that’s redefining liquidity in the NFT space.

What is SharkyFi?

SharkyFi is a pioneering NFTfi platform on Solana that offers instant loans against NFTs. Launched in March 2022, it has quickly become a go-to solution for NFT holders looking to leverage their digital assets without selling them.

The Mechanics of SharkyFi

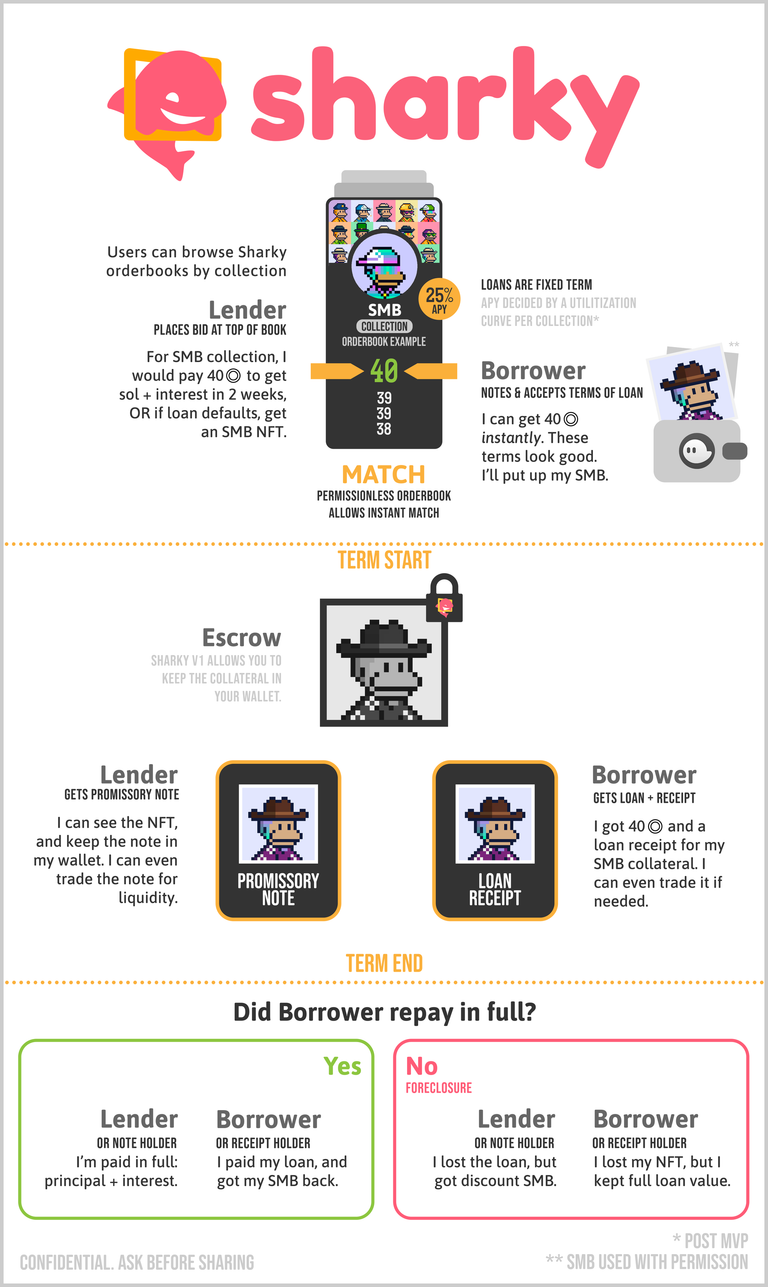

At its core, SharkyFi connects borrowers and lenders in a seamless manner. Borrowers can lock up their NFTs to secure a loan, while lenders provide the crypto funds for a healthy return. It’s a win-win situation where liquidity is instantly accessible, and lenders enjoy the security of holding an NFT that’s worth more than the loan provided.

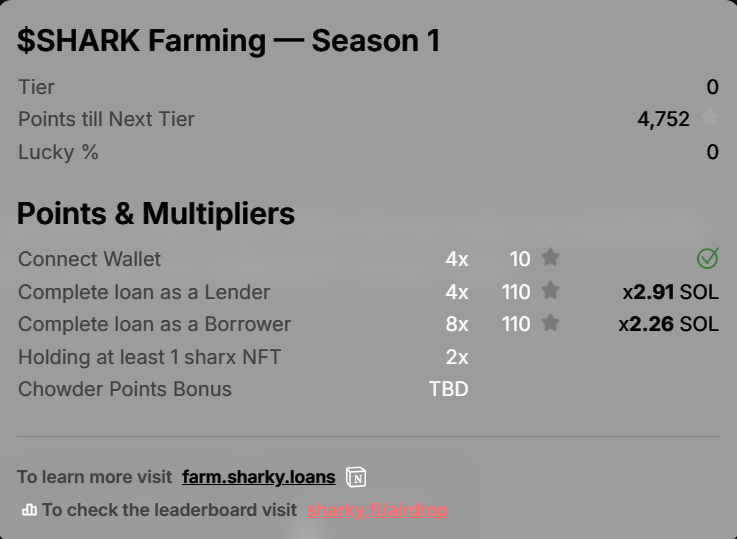

$SHARK Token

The $SHARK token is SharkyFi’s governance token, integral to the platform’s ecosystem. It’s a token that not only represents a stake in the platform’s future but also offers holders the opportunity to participate in key decision-making processes.

I have given the ways you can earn $SHARK token on my previous post "$SHARK Airdrop for Zealy tasks on Jupiter LFG Launchpad". If you haven't did the Zealy tasks, I recommend you to do it to receive $SHARK airdrop.

https://zealy.io/cw/sharky/invite/4LefTzcCiW1xHSN1zntrr

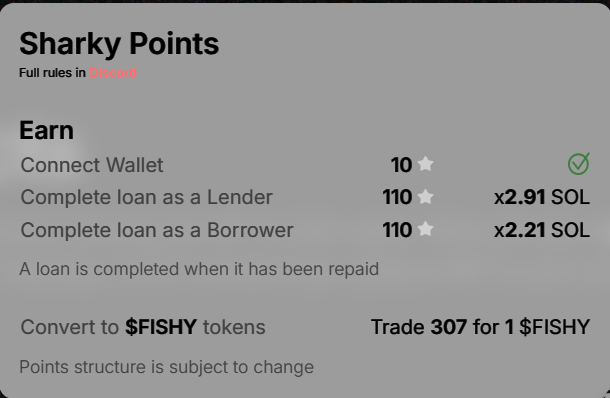

One of the ways to get $SHARK token for this airdrop is to lend or borrow on SharkyFi platform. By participating in the platform and utilizing its services, users can accumulate Sharky points. These points can then be converted into $FISHY tokens, which are used to upgrade Sharky’s official NFT collection, Sharx. The more Sharx you hold and upgrade, the more points you earn, leading to a larger allocation in the $SHARK airdrop.

https://sharky.fi/airdrop

$SHARK Farming Season 1 ends tomorrow, April 10th, 11pm UTC. Lend or borrow before it to be eligible for the airdrop.

Lending and Borrowing

Lending and borrowing on the SharkyFi platform operate under a unique model tailored for NFT assets. Here’s how it works:

Lending on SharkyFi

- Making Loan Offers: Lenders can make loan offers for NFTs listed in a collection on the SharkyFi platform.

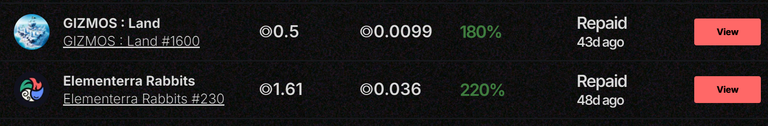

- Earning Returns: When a borrower accepts a loan offer, lenders earn a high Annual Percentage Yield (APY) on the provided $SOL.

Borrowing on SharkyFi

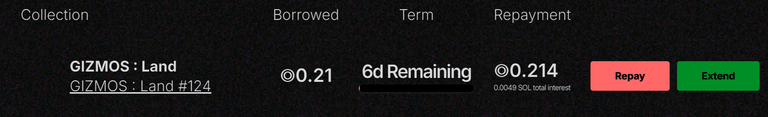

- Instant Loans Against NFTs: Borrowers can instantly take out a loan against their NFTs.

- Escrow-Free Loans: Unlike traditional loans, SharkyFi allows borrowers to keep the collateral NFT in their wallet. A secure contract is created, freezing the NFT in-wallet.

- Repayment and Repossession: Borrowers must repay the loan in full by the expiration date to automatically unfreeze the NFT. If they fail to repay, the lender can repossess the NFT.

This system provides immediate access to liquidity for NFT holders and a profitable opportunity for lenders, all facilitated by smart contracts for security and efficiency.

The Future of $SHARK

With a total supply of 100 million tokens and about 15% circulating at launch, $SHARK is set to become a significant player in the Solana ecosystem. The platform’s unique model has already garnered a remarkable 88% market share on Solana, with a monthly volume of $262 million.

SharkyFi stands as a testament to the innovative spirit of the DeFi community on Solana. By providing a platform for instant liquidity and a robust token economy with $SHARK, it’s paving the way for a more fluid and interconnected digital asset landscape.

For more info

https://sharkyfi.notion.site/Sharky-716aa8e1eb134d6ead9c81b6cbcfe361

Thank you for reading and feel free to post any questions in the comments.

Posted Using InLeo Alpha

Congratulations @mydba! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: