Hi! I hope everyone is doing well. My name is @nazarali. I have completed Batchelor in Computer Science. I also have knowledge about technical analyses of crypto trading. So, I decided to share this knowledge on the hive. blog platform. This is my first post on this platform.

The peoples who are attached to crypto and other types of trading know that the market makes different patterns due to the fluctuation in price. Traders use these revised patterns for making decisions. Because few traders’ psychologies say that the market repeats the same behavior as it made before.

There are different patterns that are made by the market. The patterns that include are Wedge, triangle, rectangle, flag, cup and handle double bottom and head and shoulder. There are many other patterns but few of them are mentioned here.

Today I going to discuss the Wedge pattern and also discuss how we can easily identify the wedge pattern. We also learn how we can take profit after identification and trading with the Wedge patterns.

What is the Wedge pattern in technical analyses of Crypto Assets?

Wedge pattern is having great importance in trading. We can make a profit by doing trading with a wedge pattern. In the wedge pattern, the price of the coin makes higher highs and higher in the uptrend scenario and makes lower lows and lower highs in the downtrend scenario. Two trend lines are drawn on the chart. One is the upper trendline and the second one is the bottom trend line.

There are two types of Wedge patterns. One is the Rising Wedge second one is the Falling Wedge. We use this two-wedge pattern for making decisions after determining the wedge pattern. Now we will discuss the types of the Wedge pattern.

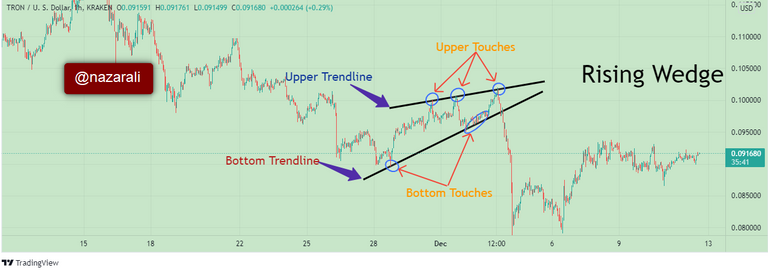

1. Rising Wedge Pattern

In the Rising wedge pattern, the price asset moving in an upward direction. The upper trendline is drawn in the way in which it touches all the higher highs and the bottom trend line is drawn in the way in which, it touches all the higher lows in the uptrend scenario.

In the above, figure, you can see that the Rising Wedge is formed. The price moves upward direction and makes higher highs and higher lows. Two trendlines are drawn on the both upper and bottom sides. You can see that it touches all the higher highs and lower lows.

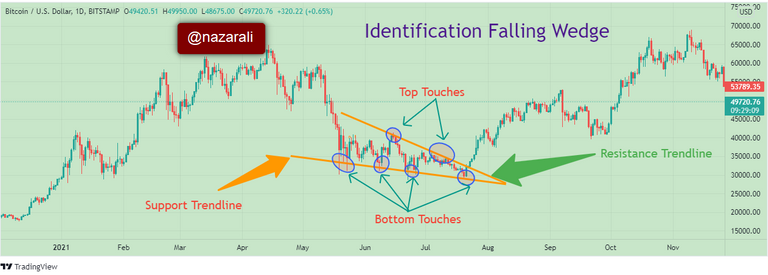

2. Falling Wedge Pattern

In the Falling wedge pattern, the price asset moves in a downward direction. The upper trendline is drawn in the way in which it touches all the lower highs and the bottom trend line is drawn in the way in which, it touches all the lower lows in the downtrend scenario.

In the above, figure, you can see that the Falling Wedge is formed. The price moves downward direction and makes lower lows and lower highs. Two trendlines are drawn on the both upper and bottom sides. You can see that it touches all the higher highs and lower lows.

Identification of Pattern

As we discussed above, there are two types of wedge patterns. Now we will discuss how to identify the both rising and falling wedge pattern.

Identification of Rising Wedge pattern

- The first thing is that the price of assets is moving upward direction.

- The price of asset makes higher highs and higher lows.

- Upper trendline must be touched with all the higher highs

- Bottom trendline must be touched with all the higher lows.

- Collectively there should be more than 5 touches of price to both trendlines.

In the above figure, you can see that the all the rules that are mentioned above are satisfied. You can see that the price is moving upward direction and making higher highs and higher lows. The price also makes 5 touches to the trendlines. In this way, we can identify the Rising wedge pattern.

Identification of Falling Wedge pattern

- The first thing is that the price of assets is moving downward direction.

- The price of asset makes lower lows and lower highs.

- Bottom trendline must be touched with all the lower lows.

- The Upper trendline must be touched with all the lower highs.

- Collectively there should be more than 5 touches of price to both trendlines.

In the above figure, you can see that the all the rules that are mentioned above are satisfied. You can see that the price is moving downward direction and making lower lows and lower highs. The price also makes 5 touches to the trendlines. In this way, we can identify the Falling wedge pattern.

Buying and Selling using Wedge pattern

We can use wedge pattern to take an entry and exit to the market. We can take profit by determining the appropriate buy entry and avoid loss by determining the appropriate exit position. Now we will discuss the buy and sell positions.

Buy Signal and Setup with Wedge Pattern

We can place buy entry by using the falling wedge pattern. Price is fluctuating in between the upper and bottom trendline of falling wedge pattern. The buy opportunity is made when the price breakout the upper trendline and moving upward direction. We should wait for one more bullish candle after breakout.

In the above figure, you can see that the price breakout the upper trendline and moving is upward direction. This is a buy signal when price breaks the upper trendline. We should place buy order after breakout the upper trendline. We should be very careful to take an entry. We should use any other additional indicator for confirmation of buy signal. The Moving Average Indicator is used for confirmation of the buy signal.

Sell Signal and Setup with Wedge Pattern

We can place sell entry by using the rising wedge pattern. Price is fluctuating in between the upper and bottom trendline of the falling wedge pattern. The sell opportunity is made when the price breakout the bottom trendline and moving upward direction. We should wait for one more bearish candle after a breakout to take an entry.

In the above figure, you can see that the price breakout the bottom trendline and moving is downward direction. This is a buy signal when price breaks the bottom trendline. We should place a buy order after breakout the upper trendline. We should be very careful for take an entry. We should use any other additional indicator for confirmation of buy signal. The Moving Average Indicator is used for confirmation of the buy signal.

I hope this post will help you to trade with wedge pattern.

Thank you for visiting and supporting my post.

Author: @nazarali

Posted Using LeoFinance Beta

YES! More chart patterns please. Thank you.