I realized after I finished recording that this is how fractional reserve banking works. With DeFi you can become your own fractional reserve banker!

Transcript:

All right. So this is a special post at the request of some people in the Leo finance discord, talking about how with that you can, you can actually have positive funding rates on both the borrower and the. Lending or on the deposit and the borrow side. And you compare me that up if you want to and to a whole stable coin thing.

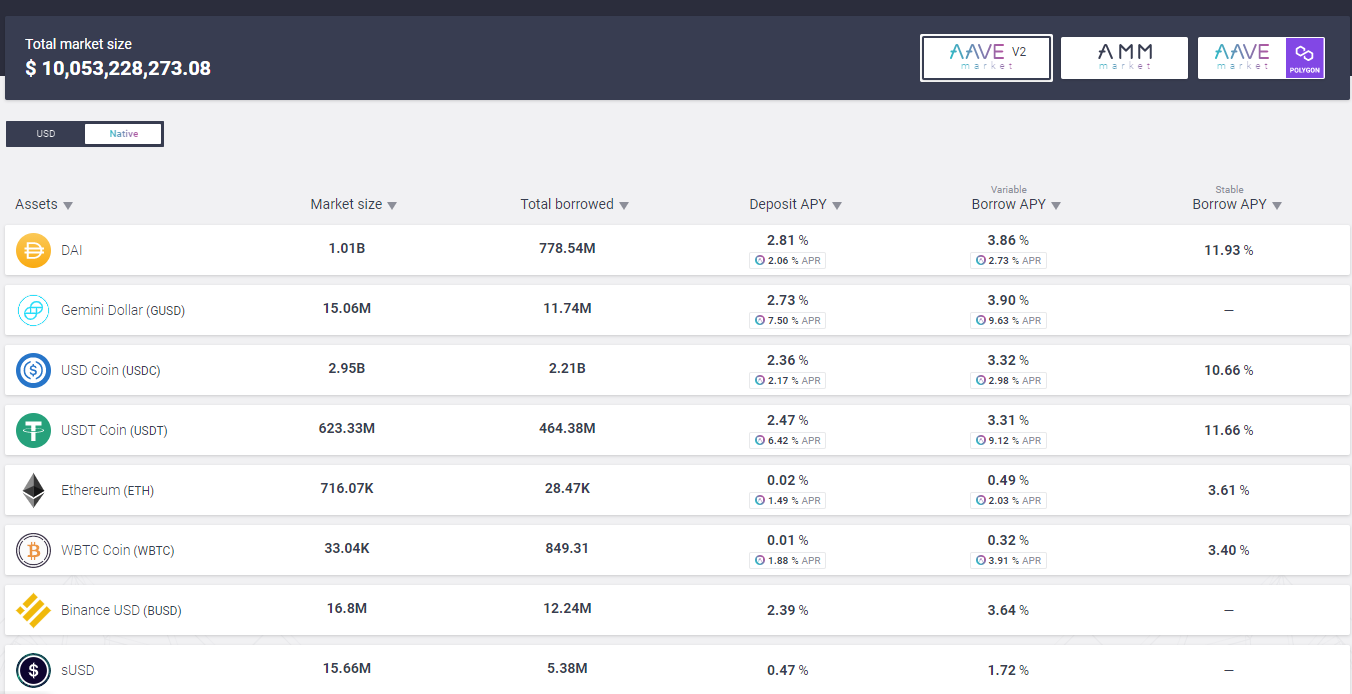

[00:00:20] So this is auto.com or app dot dot com. This is the deposit dashboard. So you can see here you can deposit stable coins and the APY that you get is it has two parts. So this is this ABA has different markets. This one's the Ethereum main net. And on di you get at the moment, 2.9, 3% of, of In kind interest and you also get 2.03% APR in terms of, you know, the state audit token.

[00:00:49] So G USD a little bit jucier lot. Jucier actually a 2.7, two and 7.27 and USD at 2.48 and 6.2, three USBC, a little bit lower 2.35, 2.1. So USBC and di running about four to four and a half, 5%. And G USD and USD are run at about 10%. So so yeah, you can just deposit earn 10% and you're good. Right.

[00:01:17] But if you want to take it to the next level then you can start to borrow at positive rates and pyramid the whole thing. So first let's make a spreadsheet cause you know, they called me and the spreadsheet for a reason. So let's say we are depositing. Let's do. Let's do G U S D. Cause that looks, that looks the best at the moment.

[00:01:36] Okay. So deposit. So let's say we take 10,000 and then we are making let's see, what was it? APY? Yeah. Two seven two and seven, two seven, two points two and 7.27 C interest APY and rewards APY. So rewards are claimable interests just builds into the position automatically. So you know, daily or hourly, or however often you can go in and claim your rewards and then do what you want with them.

[00:02:11] So The so those are, those are annual numbers. So daily it's going to be let's see that plus that divided by 365. So 0.02, 7% a day. And then. Daily yield is that by a hundred times? That, so not a whole lot, right? Two bucks $2 73 cents on 10,000. Okay. So that's part one. Then we go over to the borrow.

[00:02:43] So borrow, we're also looking stable coins and you can see that the AP wise, I mean, you can pay, you can, you can get a fixed. Interest rate, which you're paying, you know, much higher rates, or you can get a variable rate, you can pay lower rates, and you're also getting rewards as you can see here. So let's keep it in G USD, because one that has attractive rates and two, it just makes things simpler.

[00:03:06] Cause it's it's cuts out a step. So let's see borrow G USD. Right. And let's see. Interest paid APUI rewards APY. So interest paid is 3.8. Eights and rewards are 9.42. Okay. So remember interest paid is, is, you know, increasing the amount you owe. So that's a negative carry costs, but the rewards are positive.

[00:03:36] So the rewards outweigh the interest owed. And so you end up with positive funds of, you know, 6% or so. So there is you can't, if you deposit 10,000, you can't borrow 10,000 because there are loan devalue limits. So if you go back to, to deposit the GTV, Oh, can't use this as collateral damage.

[00:03:58] Alright. So we're going to go back and we're going to fi use, can we use USDT? No this is an important point USCC. Okay. So here, so we can't use a G U S D as a deposit because we need to be able to use it as collateral for this whole thing to work. So we're not going to get quite as much juice out of this, as I thought two, three, five, and.

[00:04:20]2.1. Okay. So now our daily yield is much lower because of rewards is, are much lower. So now we can go over to bar so we can use we can use collateral. We can use the, we have deposited as collateral to borrow the G U S D. So do USD is Gemini, right? So this is depositing a stable coin, barring a stable coin.

[00:04:42] There's not going to be a whole lot of fluctuation there. Unless we have a deep pegging of, of one of the coins in that case, the whole thing blows up. So that's a risk factor, but as long as the U S dollar coins, USD, USD, USD, T Dai, all those maintain their peg, you know, within, you know you know, a center.

[00:05:00] So then. You know, you can, you can do this because with, with Adda, you have to keep a loan devalue below a certain ratio. So on USBC here, it tells you that. Your maximum LTV is 80% and your liquidation threshold is 85%. So if you deposit 10,000, you can borrow it 8,000 of it. That's 80%. And it, and if the, if the, if the borrowed value raises to 8,500, which is 85% of the 10,000.

[00:05:29] Then you get liquidated and the, the position on wine, if you get charged a penalty, you lose a bunch of money. So that's a risk when you have volatile assets, but when you have stable coin and stable coin, it's not such a risk. So but let's say we take 75%, right? So we're going to take 0.7, five That amount.

[00:05:47] Okay. So now we're borrowing 7,500 G USD. We're paying 3.88% on that 7,500. And we're receiving 9.42% in terms of the Ave state rewards on that 7,500. So let's look at the daily here. So we're going to have the negative. Oh of this, plus that to go to buy a 365. So we're earning a 0.015 on the borrow and we're paying.

[00:06:17]Or, sorry, we're earning 0.012 on the deposit or we're earning 0.015 on the borrow. So daily yield is this times that by by a hundred. Okay. So not a huge amount. But you know, we're doing okay. So remember this, this whole, thing's going to be on $10,000. Original investment. Okay. So now what's happened.

[00:06:40] We have, we had 10,000 USD seat. Put it on deposit with Audrey. Now we borrowed out 7,500 of the G U S D. And so now what? Right. And it's just sitting there. Well, we can take that G U S T and we can swap it for USB-C and then we can put that USCC back on deposit with other. So, and this is how the pyramid begins.

[00:07:03] So let's see, let's see new borrowings and this case. It's just that. So now what we're going to do is we're going to deposit that new borrowing. Back into eBay and yes, you're going to pay a little bit of commission, you know, trading fees and stuff when you do the swap, but we're going to ignore that for purposes here.

[00:07:24] A rewards are all the same, so that's the same daily yield. We went from 1.2 up to 2.1 now, and now we can borrow up to 75% of the 17 500. So now we've already borrowed 7,500. So let's see, we can say that we can go up to 13, one 25. Right. And now we're earning a dollar 99 on the 13 one 25. So the new borrowing though is the difference between the previous round and this round.

[00:07:55] So now we're taking. We, we, our first borrower in of 7,500, we increase that size by 56, 25. So now we take that 56, 25 go back and deposited into. And will you just repeat, so now we're up to 23,000 on deposit, 17,000 on the borrow, and we're going to, you know, so we increased our borrowing by a 4,200 bucks and we're earning.

[00:08:25] Two 63 there, and we go again and we go again. And obviously there's a diminishing return here because you're only getting a a 75%, a fraction of the new deposits. It's not perfect recycling. So this won't go on forever, but you can go on for awhile. Let's see how many rounds we can get out of this.

[00:08:46] And I'll call it 500 right there. Okay. So let's, let's do that. That is 10 rounds of this cycle. And now we are earning we're earning four 29 on yield on the barring and we're earning four 60 on the deposits. So what does that total, right? So that total is the sum of those two things. So it's eight 88, 89 a day in, in you know, both.

[00:09:16] USBC position increasing and in state auto rewards. And then you can unstick those rewards and sell them or whatever. You know, you can just continue to compound whatever you want to do. So now what is that? What does that, you know, how much are you earning? Cause remember this whole thing started with just 10,000 USD.

[00:09:33] So that's the capital base that we are using in order to achieve this $8 and 89 cents. That's all it's around it. All of the, say 90 cents a day. So if we annualize that for an APR times 365 and then divided by the original capital. So we're at 32%. That's not terrible for very low capital risk. What, what is at risk though?

[00:10:00] Is that the value of the OD rewards? So this rewards APY will vary with the price of the token. So that's going to go up and down. And the interest that we're paying here is variable. And you know, in some coins, you'll see it move a lot more. So you SDT sometimes like within a day it can be like 2% borrowing interest costs and that could spike up to 15%.

[00:10:24]I've seen that you know, quite a bit over the last few days, especially with all this market volatility. So you have to watch that. And that will change the math on everything. But in terms of capital risk, you know, where you know, the whole thing. You know, you're it, you know, is your $10,000 at risk.

[00:10:40] It's relatively low. And you know, you can play with the percentages. You can say, well, instead of 75%, we're going to go more conservative. Let's go 60%. And now we're earning 19% on our original capital base. And you know, whether it's 10,000 or a hundred thousand, I mean, the percentages will remain the same, which is you know, which is okay.

[00:10:59] So. This is how the ABI pyramid works. And there are tweaks you can do. You know, Gerber was mentioning that you can, you can put things into curve. Curve has a stake of a pool and you can earn stake. Are they You know, on top of your curve rewards and then compound the thing over that way. There's, there's a million different flavors to this whole thing, but this is the basic idea of, of using leverage capital in stable coins in order to achieve, you know, a pretty attractive returns.

[00:11:28]You know, if you're doing straight up defy yield farming, then you're. Your percentage returns can be higher or probably will be higher. But you have a lot more volatility in terms of the tokens that you are dealing with. So, you know, everything's a bouncing game. How much, how much volatility do you want to accept for for the rewards and how much management do you want to do?

[00:11:51] So these, these are all questions that only you can answer and you have to consider when. Constructing your own portfolio. So you know, this is a strategy that personally I don't use very much. I, I might do like around or two with some extra funds. But I will, it's, it's not a whole, a whole pyramid that I, that I build up to this, you know, diminishing returns point.

[00:12:11] So, you know, just just FYI, you know, for your information. The other thing I want to point out is eBay has multiple markets. I've been using the polygon markets and the rates are different. So, if you want to look at a stable coins here, you can see that you know, USB-C is lower on the APY deposits, but higher on the rewards.

[00:12:32] And here you're getting rewarded at, in, in medic, which is the gas token of the Polyon network on the borrow side. Again. Rates are different. So here G U S D found an option. You, you can get positive rates on all of these right now. USD T is the juiciest and it's the most volatile. So just to tell you that from experience, so, you know, if you want something let's, I'll tell you.

[00:12:56] Deposit USBC bar USD, and then just run it back through. But if you want to go a little bit more aggressive, you would deposit USD, borrow USD T swap for USB-C redeposit. But you know, the, the general structure it works the same. So, you know, interesting stuff that's possible in the world of .

Posted Using LeoFinance Beta

Amazing. We are all now involved in the world of high finance. There are so many opportunities out there for those who are paying attention.

It is incredible the returns that can be amassed as compared to what the traditional system is presently offering.

By the way you did grab me with the title. Great attention grabber.

Thanks for the lesson. Now get this on CubFinance and we all can use it.

Posted Using LeoFinance Beta

Pretty sure LeoFi will be a thing.... soon

Posted Using LeoFinance Beta

I would believe you are right. A lot more layers to be added.

Posted Using LeoFinance Beta

I hope we become sooner or later more things on hive in defi space. because it's so hard to follow all these chains. Even if you want to follow everything on hive :D

Once defi started to click, I told my little group of crypto enthusiasts "We are all financial instruments now" it was a wild revelation for me.

Posted Using LeoFinance Beta

Damn, that was impressive! I'd take a long time to figure it out by myself so thanks for sharing it

Posted Using LeoFinance Beta

I was wanting to learn more about aave, your video came in perfect timing! Thanks!

Well this made Aave way easier to understand! Gracias senor!

Posted Using LeoFinance Beta

I'd love to see you edit that transcript to make it a little easier to read.

Maybe a subheading or two?

Posted Using LeoFinance Beta

I am just wondering if the reward coin has depreciated much, because if everyone adopted this strategy there will be lots of sell pressure on the reward coin.

I tried this on compound once when gas fees were much lower and it had a good spread one day, and a negative spread the next. That's because I was borrowing usdc and investing dai. But the spread was more volatile than I expected. Perhaps it's less volatile now.

Posted Using LeoFinance Beta

Doing this on Polygon!

Posted Using LeoFinance Beta

This personal and decentralized bank works much better than the traditional ones, since you know where your money is and how it grows, unlike the traditional bank where you don't know anything.

Posted Using LeoFinance Beta

this is brilliant ! thanks for the share

Posted Using LeoFinance Beta

Excellent definition and description - many thanks for that and also for the transcript for those who do not want to watch the video immediately. That's an impressive transcript, is it done with a software tool of some sort automatically?

Aave is an excellent platform and project and now I know so much more about it.

Posted Using LeoFinance Beta

It's wonderful

Posted Using LeoFinance Beta