Welcome to the first episode of Tax Sherpa Stories, where I share with you stories from the front lines of the tax world, current events that affect tax, finance, and markets, and a whole lot more.

On this episode I share my personal story with taxes and how I owed the IRS over $1,000,000 and then went on to pay none of it. Despite the stress that all caused, it led me to where I am today.

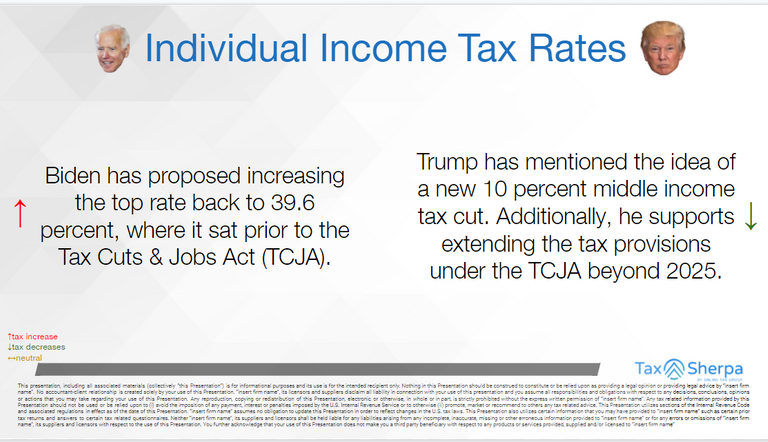

In the live Q&A portion, we went over some of Biden's proposed tax policy changes and how that might affect things. Nothing is set in stone and he's not even in office until tomorrow, but these are things we all need to stay aware of.

I still need to get some artwork for the show and maybe a theme song, but overall I think it went well. We had some technical issues, but those should all be sorted out for next week.

Links and images from chat

Transcript

Hey everybody. This is the first episode of the, the texture, the stories I was about to say the monster Maverick show, which is, which is my other show on discord. That's a weekly streaming live Q and A kind of thing, but this is Tax Sherpa Stories. So on this first show, I want to go over a couple, a couple of things basically what the show is about, the whole structure of it, and then we'll get into the actual meat of the episode. So basically this is going to be stories from the front lines of the tax world. Things I've learned from doing, oh, 50,000 tax returns or so over the past decade and current events, things going on in the financial and tax world , you know, ways to run your business better, you know, I'm a profit first professional.

That's a big part of what I do to help clients and , other topical things in the world of tax, finance markets and all those kinds of things. So that's kind of what the show is going to be about. And if that's your bag, if you're an entrepreneur, if you are into , keeping your money, not paying it to the government or, you know, operating your business in a more profitable way and just lowering your overall financial stress, then this is your place.

So , that's kind of what it's about now.

Who am I? why should you listen to anything I have to say? Obviously an important question. And basically I, well, my name's Neal. I am the principal over at Tax Sherpa at taxsherpa.co And I've been in the tax world for, like I said, about a decade.

And I got into it, the old fashioned way I married into it. And that'll, that's actually a big part of my story about how I came into the tax world. So I was trained as an engineer, went to Georgia Tech. I Was a bachelor of electrical engineering with an emphasis in bioengineering. This was before BME, biomedical engineering was its own separate major.

And you know, I did do my undergrad there. I did some graduate work, ended up not finishing there. And then I went out into the world and , I found out fairly quickly that the corporate world was not for me. I, I actually have a whole separate story about the instant. I realized that I did not wear to work in the corporate world, especially as an engineer.

So then I was doing other things you know, I've been in the investment markets, , for for about 20 years, really. Since I was an intern in college and that's going to play a part in in my story today about how I owed the IRS over a million dollars at one point and how I paid none of it and, and legally, so, so so there, but I don't want to, I don't want to spoil the surprise there.

But you know, I ended up going through a very old school kind of apprenticeship under a tax attorney. And you know, spent many years there and kind of learn the ins and outs of all the tax code and you know, how it applies to, your average kind of small business owner. If there is such a thing as an average, But the thing that turned out to be really interesting is that, so my background, as you know, training as an engineer allowed me to come to the tax world from a, a very different perspective, compared to most accountants. Most accounts, they major in accounting and they have this kind of very basic fluency in numbers and a little bit of understanding of the law and what I came when I came in as an engineer though, you know, engineering is all about like systems level analysis.

So by looking at things in that way, it has allowed me to, to, I think, see very readily what kinds of things are, are applicable and how one, one piece affects another very quickly. And it's kind of a unique perspective. I think I bring to the whole thing. On top of that, you know, at one point I had my series 65 investment advisor.

So I ended up not doing that, which is again, a whole other story unto itself. But yeah, so I do at least formerly had had those credentials, which I may not place any weight on, , you know, my take on the markets and things on top of that, you know, I, I am what's called profit first professionals which means that I help businesses structure their cash flows.

And the goal is to end entrepreneurial poverty. Thanks honey, for turning off those with hooks. I appreciate it. So, you know, entrepreneurial poverty is kind of a weird term because you know, the typical, I guess, pop culture idea of an entrepreneur is somebody who's rich and who wants to grow a business.

But the dirty little secret is that the the average entrepreneur is flat broke because the way that businesses are run for the most part. Is that, you know, money comes in, you know, in revenue and hopefully there's some revenue kind of there. A lot of businesses fail that step, but then right after revenue comes expenses and you know, whatever's leftover is profit.

That's the typical accounting formula, you know, profit minus our revenue minus expenses equals profit. So the way probably first looks at that is that that is not a sufficient way to run your business because what ends up happening and I've experienced this myself, is that money comes in, money, goes out, and then there's nothing left.

So there are so many entrepreneurs out there who have their own small businesses, whether it's just them or whether it's whether they have a team or, you know, any, any situation. It doesn't really matter because they put themselves last. Then they get nothing. And either they barely get by, or they end up going into debt in order to support the business.

And what profit first does is it turns that all around. So I'm sure that you've heard the old expression that, you know, you pay yourself first. You know, richest man in Babylon was written, I don't know, a hundred years ago, 120 years ago. Something like that. And it says, pay yourself first. And they say, let it not be less than a 10th of all you make.

So profit first just pays yourself first and there's, there's a whole structure to how you do it, but that's the basic idea. So, you know, when it comes in, you pay yourself and you run your business on whatever's left. And so that allows you to actually, you know, live and it allows the business to continue.

And, you know, there are certain decisions that need to be made along that, along that journey, but that will get you at least a step one, which is kind of the most important part. So that's, that's a little bit about who I am. So I've been in, in the world of money and finance and markets for roughly 20 years, a tax world specifically for 10 years done, as it turned out, the mentorship I went through was actually very high volume kind of place.

So, you know, the, the 50,000 tax returns I've done is, is way far above the norm. I'd go to these conferences, you know, with the IRS. And, you know, we talked to other taxpayers who were there to continue education kind of series that the IRS puts on every year and say, Oh, you know, what's, what's your business like?

And they would say, it's like, Oh, you know, you have 200 clients and your clients are 65 clients or whatever. It's like, Oh, we do 8,000, you know? So it's kind of a different scale of things. So that has really just through, just through the sheer volume has really built up my experience. In that way. So the way that this show is going to work is that there's going to be two basic segments.

So segment number one is going to be the Storytime. So we actually have two stories on tap for today. So story number one is going to be the time I owed the IRS a million dollars. And then how I didn't pay any of it. And story segment, number two is the Q and a. So this is a live show we're on discord here.

People could be watching on, on MSP waves.com or they can be watching on VIN. I think we're still on SEDA. I'm not sure about that. But the Q and a portion is here in discord. So you know, people can type in the chat and say whatever they want. And in the, in the in the view on the, on the live stream, which you can't see right now you, you will see in the bottom right-hand corner, there is a a window of the stream of the, of the discord channel assets as it's happening.

So so you can ask any questions you want. I do recommend not. Well, I can't give you any any Particular answers to, to you your situation simply because, you know, we don't have an existing relationship. I'm not with very few exceptions. I'm not a, your tax repair. And also this is a public forum. So, you know, I don't want to put your details out into the into the YouTube and podcast world like that.

So we will stick to generalities and how certain kinds of things would be done, that sort of thing. And that part may or may not be recorded depending on the topics that we dive into and, and how much people ignore my suggestion. I'm not getting too in detail about their personal situation. So if you have a question and you want me to definitely not record, just let me know, and then I can stop the recording and then we can talk about it live, but, you know, they won't make it into the the YouTube and the podcast stuff.

So. That's kind of the structure. And if that sounds exciting to you, then let's dive in. So part number one story time. So the time I owed the IRS a million dollars. So what happened was you know, I was, I was younger, this was around 2003. It was kind of a saga stretching from 2003 to 2008. And what had happened was, so I had mentioned that I didn't want a corporate job.

And I found this out fairly early in my career, really, as I was a senior in, in my degree program, I interned with AMD at, you know, advanced micro devices. They're out there, Texas campus. And through that experience, I realized that this is not what I want to do. Of course, it's kind of late, you know, this is my fourth year of college here.

And so that was kind of a shot to the gut. But after graduation, I started looking at, I had other things. I started doing other things. I started getting more involved in investing and the markets, you know, investing as a loose term trading, let's say that. So through no, no credit to myself. I ended up with a stockpile of about a hundred grand and I put it all into investment or trading accounts.

You know, this was in the very early days of electronic trading. So E-Trade was the thing, Ameritrade was a thing I don't think they had merged with TD yet. And there were a couple other other platforms that were. Being in use for, for people who are day trading, which is what I ended up doing. So it was interesting experience.

I lasted about two years and I, if you've ever thought about day trading, whether it be stocks or, or crypto or, or anything, I'd say don't, it's terrible, terrible job. So I got into this whole thing because I didn't want a job. And then I ended up giving myself like the worst job ever. Cause the thing about day trading, especially at that time, you know, there's no cell phones.

No, I mean, cell phones existed, but no smartphones. So, you know, I'd be sitting at my computer and, you know, the, the pre markets would open at eight 30 and I'd be sitting in my, in my seat from eight 30 until four. And then if the, if the post-market was, was active, then maybe a little bit longer, you know, afraid to go to the bathroom because you might miss something.

It was just a total grind and it was miserable. So, so if you're thinking about doing that thinking, Oh, I can day trade Bitcoin. Nope. That's a bad idea. So that is, that's not official financial advice, but it's just a recommendation of someone who's gone through it. So you know, my, my, my trading career went through many stages of evolution basically through long and painful experience.

So what I started off doing was, you know, looking at the various asset groups in the stock market, and I said, Oh, penny stocks from the thing. So. Is, it's just hilarious to me to, when I look back on it because of how wrong I was, but back in those days so like I said, it was about 2003. There was what was called the OTC BB, which is the over-the-counter bulletin board trading system.

Which was four companies that were not big enough to be listed on an exchange like the New York or the NASDAQ or the, of the American or the Philadelphia or whatever. They were on the OTC market which means that they were traded to peer to peer. It was sorta like defy before defy was a thing. There were market-makers who maintained a market in these different you know, these different issues.

And then they would ex you know, traits would come in. They w they would match up, you know, buys and sells just like the just like the market makers on the NASDAQ too, or the specialists on the NYC used to do. And then, you know, if the stock price changed, then you know, you could make money. The thing that's so attractive about, about these penny stocks and whether it be, you know, say the same mechanics apply, whether it's penny stocks back then, or it's, you know, microcap, cryptos today that the percentage gains can be enormous.

And so that's really attractive to the newbie trader. Oh, you know, I can make 50% and, you know, I do that over and over and over again. And I'll, I'll turn my $1,000 into, you know, a million. So, so I tried my hand at that. And what was interesting though, there was, I got a very, very school of hard knocks kind of education there.

So if you go to the NASDAQ or the NYC and you put in an order, and it's a valid order and the price hits that, that That's a price, you know, whatever your, whatever your order is, then they, the brokerage has to try to execute your your order. And it turns out in the OTC BB world that was not true.

So a market maker could literally just sit on your order and not trade it just because. And I learned this through this painful experience. And so, you know, it was this weird cycle. I would, I would make money Monday and make money Tuesday and make money Wednesday. You know, all these little, these little profit kind of days, you know, it might be 50 trades, but I did not make any 400 bucks that day.

Great. You know, if I could make 400 Monday, 400 Tuesday, 400 Wednesday, that's, that's a decent income. But then Friday rolls around. And this didn't happen every Friday, but let's like, you know, once every once in awhile I would just get stuck in this trade and then lose everything. And then some, you know, everything that I built up then more so, you know, This having small, small wins and then large losses was not a system that ended up working for me.

So after, I dunno, a few months of that realizing that I was fighting the system and that the system would, when I graduated in my trading career and I moved on to two listed stocks, you know, it was trading well, Google wasn't a thing yet. I have another story about that. But you know, I trade at T and T or T TJ max, or, you know, whatever was, was, was active that day.

You know, typically at that point in time, the biggest movers of the day were things that revolve around earnings reports. So, you know, I to stay up late or get in early and I say, get in, you know, go from one bedroom to another bedroom in my house. And Then, you know, I'll check, check the earnings reports and you know, if there's a positive surprise, you know, I would you know, go along and play that whole game.

Over the course of year, I ended up with a net loss because you know, I would have these small gains and then, you know, these blow up losses, which is kind of a typical pattern for a day trader, you know, you make those small wins and you think, you know what you're doing, and then, you know, life comes around and, and it shows you otherwise.

So. I ended up with a net loss at the end of the year. And you know, my broker statements showed that, you know, I lost whatever it was. You know, 10,000, $20,000 not including, you know, the money I had just taken out to live on during this time. So this a hundred grand was going pretty fast. So I thought at the time that, Oh, I lost money.

I don't have to file taxes. That's a two, my 22, 23 year old brain. That makes sense. And I thought I had heard that somewhere and it turns out that's not true. So this goes on, like I said, for two years, so two years I don't file taxes. The following year I don't remember what had happened, but at this point, you know, 2005, you know, I had to file for a couple of years.

I, I got a job. I ended up I ended up working as a tutor for kids in high school teaching them, SATs math you know, basically everything except for foreign languages is what I ended up tutoring. And about 50% that was sat kind of prep. And of course, you know, I'm a W2 employee now. So I get my W2.

I was making. Barely barely enough to survive on. And so I think the first year I didn't file either. And because at this point I was afraid, you know, so, you know, I got this, I got my W2 at the end of the year. I was like, well, I haven't filed taxes for, you know, three, four years, whatever it was. And now what happens if I file now?

Does that trigger something? You know, I just didn't know. And I didn't know who to ask. So, you know, it was just kind of an inaction by, you know, paralysis kind of thing. So I start getting letters from the IRS. So letter number one says, Oh, you know you need to file letter number two says you need to file letter number three, you know, this goes on for a little while.

Then they start there starts being a number on these letters that I owe. A million dollars. It was like 1.2 million, something like that. And at that point I was just like laughing to myself because there was no way, there's no way I would owe any kind of, any kind of anything remotely related to that.

And I saw that it was related to that trading that I did, you know, those years ago. And you know, I just continued to ignore it just through, through that that fear of that paralysis. So, you know, after awhile in the IRS process, what happens is they start sending you certified letters, still, you have to sign for them with the mail and everything.

So they know you got it. And so I got a couple of those. I still ignored it. And then they if you ignore those and they have determined that you do owe this money, then what happens is, and you have a paycheck, then they start garnishing your wages. So, this is what really got my attention. So I remember I was, I went into work.

I got a call from HR. The way this was go to tutoring place was the you know, they had different branches all over the place. And, you know, there was a corporate central location. So I got a call from the, from the central location. And they tell me, Oh, you know, the IRS is calling us about you and you know, we have to garnish your paycheck.

I'll send you this thing, you have to sign. And and so, so sign it basically. So I remember I got, I got the thing, they printed it out and you know, I signed my acknowledgement, but on the, you know, I thought you and I said, this is not a valid you know, a valid debt or valid tax or something like that.

So but you know, sure enough, they started garnishing my paycheck and I wasn't making much to begin with at that point. So I was, I forget what, how much they were taking, but basically I was left with like $300 per pay period. So every two weeks, and that was not enough to pay my rent. It was not enough to buy food and all those kinds of costs of living sort of things.

So that's when I really woke up and said, Oh, I gotta do something about this. And so that I had met this person who happened to have a father who was a Texas. So I, I ended up talking to him and you know, we went through the whole thing. And what happened was that back in those days, it's changed since then.

So back in those days, the, when, when you sold a stock in a, in a brokerage account, the brokerage would report the sale to the IRS and owning the sale. So the IRS gets all these, all these 10 99 B's, which is the statement of. Of sale. And they would say, Oh, you know, you sold this, you sold that. You sold that.

And you know, the computers add them up. And total sale is, you know, ended up being like 4 million during that year that I was day trading. And then the so, you know, because the tax on $4 million, it is a million dollars. It's one point, whatever it was. So that's where the IRS got their information.

And so we go through the whole thing and I dig up my old brokerage accounts and, and find out that, Oh, you know, sure enough, there is a net loss on the account. So I have to go back and I have to, you know, go years in the past and, and file returns because what happens in the IRS process is that if you don't file for a few years, they do, what's called an SFR and that's a substitute for return.

And so what they do is they take the information that they have from third parties, whether it's, you know, W2's from your employers, 10 99 signs and all the different versions of 10 90 nines, you know, there's 10 and nine miscellaneous there's new one this year called 10 99, NEC IMTS divs 10 and nine BS, 10 and nine S so these are all statements of, of information provided by third parties saying this particular kind of transaction happened regarding this taxpayer tonight.

K is another one. There's also the 10 90 eights, which is your, like your mortgage interest. It'd be a 10 98. And then the various collects all the data that they can and they create a substitute return. And of course it's the worst possible way you could, you could file a tax return and you know, no deductions, no anything.

And then the they assess, you know, whatever the tax would be on their version. So they went ahead and did this and and then the you know, they came up with it number and it spits out. And if it's a, if it's a positive number in that you owe tax, they start getting these letters and you start going into the process.

So what ended up happening was, you know, I went through this whole chain of events and because they were return was never filed. I was actually able to address the issue by filing and, and just filing the right way to begin with. So we went ahead and did that and sure enough, you know, the Iris agreed that yes, I had $4 million in sales, but I had like $4.1 million of purchases.

So it ended up being a net loss of about, you know, whatever it was. I think it was like 30 K that first year and maybe maybe another 20 the next year, something like that. So when that percolates through their computer systems the whole issue just disappears. And that's what ended up happening.

So, you know, I had, I had this million dollar debt with the IRS and they were taking my money, the money, money they took from my paycheck and never got back because the there's a statute of limitations on, on refunds, which is that I think they kind of did me dirty here, but that you have three years to claim a refund.

And the IRS has, has 10 years to go after you. So, you know, I guess who writes the rules, you know? So you can file further than three years back. But but if it's beyond that and you're owed a refund, then it's just, sorry, Charlie, you'll get a little letter in the mail saying, Oh, you know, you have.

We have processed your, your claim for refund, but because it's past actually limitations, you don't go pound sand. So I got, I got one of those for, for the amounts that I had already paid towards this. So that is something to keep in mind if you haven't filed. So we're in 2021, which means three years ago was 2017 or no, 2018 rather.

And in 2018 we were filing 2017 taxes. So the, so the window in 2017, it's coming to a close here in just a month or two or three months, I guess at this point. So I ended up clearing clearing the whole issue, a million dollars, just poof disappears. And I was able to continue my life. And obviously since then, I've gotten into what they call compliance and I have kept my filings up-to-date so you know, burying your head in the sand, like I did is the exact wrong thing to do because really.

What the IRS is trying to do, and you can debate the merits of whether the tax laws are fair or whatever, but what they are trying to do, the people who work in the offices there, they are trying to get people to file, get people to file accurately. So as long as you're doing that, you know, they're okay.

If you are not filing or if you're doing fraudulent filings and other things like that, then, then there's problems. But you know, if you owe tax, if you get tax refunds, they don't really care. It's just file and file accurately. I have a lot of clients who asked me, it's like, Oh, you know, I'm getting a $20,000 refund.

Is that a red flag? It's like, no, it's not a red flag. It's just, you know, it's just a, it's just a number as far as that, as far as they're concerned and it's backed up by, by everything that, that has gone on throughout the year tax year and against with Neil. So, yeah, so that was my own shenanigan. And, and I fortunately ended up meeting the right person.

Like I said, this tax attorney that I studied under for years and years. And he ended up bringing me in to the business and I learned the tax business, basically I'd at his side. He was an old wall street guy which was interesting. So if you've ever had a 60, 40 longterm versus short term capital game on, on index options, he was part of that whole creation because they used to handle the, the specialists on the New York stock exchange and their firm.

So that's a story for another day. But that's my story. And since then I've been, I've been in the tax world and like excited, you know, gone through. 50,000 tax returns at this point. And I've seen, I've seen a lot of stuff. A lot of, you know, things people bring in with that are just craziness. A story on another show that we'll do is the time that this couple comes in and their brother, it actually caused them to file a fraudulent tax return and the whole, the whole back and forth with that.

That was a crazy one. But but that's my story. And so, you know, hopefully that gives you some insights. You know, when people come in to me while they don't come in anymore, you know, we close the office. My office was in Boca Raton, but now I'm at, in my basement here in Atlanta doing everything virtual because of the COVID.

So people would come in and say, yo, you know you know, the IRS says I owe $15,000. What am I going to do? And I understand that kind of stress because I was there, you know, I am, and my number was way bigger. So I tell these people, it's like, if he makes you feel any better, I owed the IRS a billion dollars and we got it all sorted out.

So, and usually that does make them feel better because, you know, having, having that frame of reference makes, puts their stuff in perspective. Now don't get me wrong. 50 grand, 15 grand is a lot of money. And you know, you certainly don't want to pay that if you don't have to, but But the point is, is that the process works.

You know, the, the filing system that the IRS has, it can be very slow. It can be very tedious and it can be kind of painful, but it does. I ended up working and you know, in the, in the rare, rare situations where it doesn't, then you have. Organizations like the taxpayer advocate service, which is, which is your supposed to be your voice with the IRS.

So we'll get into that another time I suppose, but at this point I wanted to change gears just a little, well entirely. And and then I had a special request. Rollin sent me a message for for the. The first show to get into some of the Biden tax stuff. And I wanted to do that as, as the first part of our Q and a.

So what I'm going to do here is just pivot a bit and talk about the things that Biden is TA is suggesting as far as his his plans for tax changes, because right now it's January 18, 20, 21. Biden's going to be sworn in in two days, and he's promised, you know, this, that, and the other, when it comes to taxes, No, obviously the way the tax code works is that the the Congress creates a tax law.

The IRS implements the tax law. So Congress has to create a bill and it has to be passed by both houses. And then it has to be signed by the president or, you know, you have the whole veto override kind of thing. And then it goes to the IRS. The IRS is responsible for implementing whatever changes that they come up with.

That's not a short process. So. So for 2021 and 2022, the Democrats control the house and the Senate and the presidency. So it is likely that whatever large changes that are going to occur are going to occur in that window probably sooner rather than later. And then the grandpa, you missed half the show hole.

That's okay. You can catch the replay. So so the, the Congress has to be convened for 2021. They have to pass a bill and then it has to go to the Senate, all that kind of stuff. So historically what has happened is that most bills, most tax bills like this, they go through and they get passed and then they start to apply to the following year.

There had been a few circumstances. This is where I'll have to tell my life story intro again. It's only recording. So there have been a few circumstances where the, the current Congress has, has passed a new tax bill and has applied it to the current year. So that is something to be aware of. It's unlikely, but it could happen.

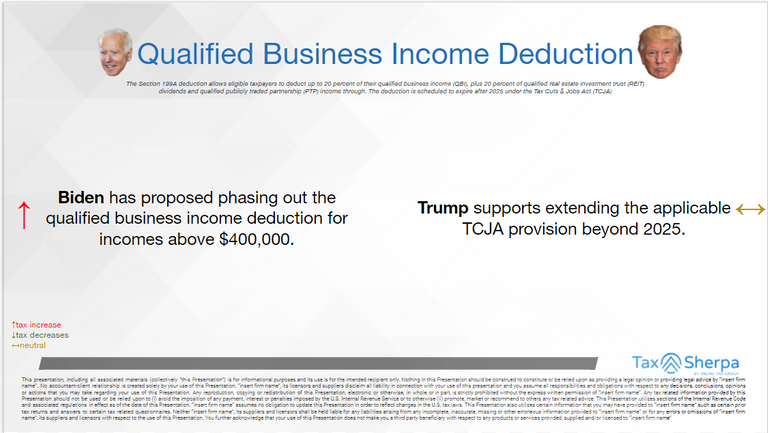

So with all these changes that we're going to be talking about here in a second, just keep that in the back of your mind. So I have an old one old it's like four months old patient deck on, on how Trump versus Biden plans different. So I'm going to be grabbing some of these screenshots and I'll drop them into the into the chat here.

So if the Shreem were working perfectly, then you'd be able to watch follow along, but I'll just do a cut and paste kind of thing here. So individual income tax rates. And so here's Biden versus Trump and how Trump's side doesn't really matter anymore. So we'll just focus on the Biden stuff. So Biden's proposing increasing the top rate back to third, 9.6% where it's at prior to the tax cut and jobs act.

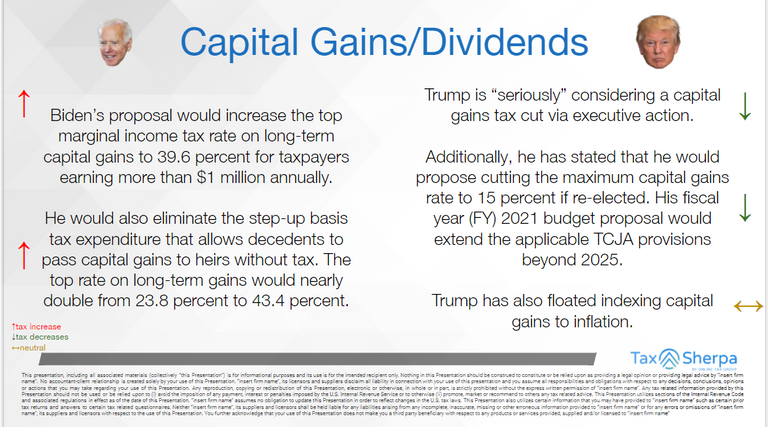

So tax cuts and jobs act, or tick is the Trump tax reform that was passed at the end of 2017. So there was a case where the vast majority of provisions in the tax cut and jobs act applied to the following year 2018. There were a couple of, couple of little nuances that did apply to 2017. So, you know, that was partially retroactive capital gains and dividends.

So capital gains and dividends is this is a big one Biden's proposal. So would increase the top marginal income tax rate on long-term capital gains to 39.6% for taxpayers earning more than $1 million annually. So what does that mean? What that means when you sell some kind of property or security.

Like crypto or a stock or a piece of real estate or whatever, it's a capital gains event meaning that it has its own separate taxation. So a long-term capital gain means that you held that piece of property for at least a year. So again, you could have been, could have been a stock, could have been some, some Bitcoin could have been a piece of real estate.

And if it's over a year, it gets, it gets lower taxes. So the amount of tax would depend on how much total income you have that year. But under, under the current system, it's either gonna be 0%, 15% or 20%. Now on top of that, there may be an additional 3.8% tax, which is the, what is one of the Obamacare taxes.

So if it's a, if it's a large sale and your total income, that year is a couple hundred thousand dollars, you're look, you're looking at a combined everything of basically 24%. So you sell, let's say you sell a piece of real estate for a million dollars and, you know, it's, it's a gain of a million dollars and you'd be paying 24% of that to the federal government.

And then your state's, you know, whatever the state rate would be, which varies from zero all the way up to like 13. So what he saying that is that if, if your total income that year is a million dollars or more, you lose the lower tax rate entirely, and that whole gain gets taxed at your top rate, which in this case is going to be 39.6 because of the previous provision.

And and that's it basically. So so if you're selling a business or you're, you're selling something that is appreciated a lot, then, you know, And you go over that million dollar threshold, then all of a sudden you go from 24% to basically 40%. And when you add on the States on top of that, if you're in California or in New York or any of these high tax States, you're talking about 50% plus because of the, the total amount of tax there.

So, you know, that is a huge disincentive to, to sell things. And, you know, if you're selling stock, Or if you're selling crypto or something like that, then you can actually, you can have a good deal of control because you can decide how much to sell. You know, you can sell, you know, just under the threshold and, and you'll be okay, assuming that this ends up this bill, that there will, I'm sure it will pass something, ends up being what Biden's proposing here.

But on the other hand, if. You're selling, let's say a business that you have then you can't well, I mean you can, but it's, it's really difficult to sell just a small part or a fractional part. It's usually an all or nothing kind of deal. So I have a lot of clients in the online business world where, you know, they own websites, it could be an e-commerce site.

It could be a content site. It could be an Amazon FBA business. And you know, typically those sell for three times three to four times their annual income. So if a business is making $500,000 a year, it could sell for 1.5 to 2 million, something like that, depending on the particulars. So. All of a sudden now, you know, because the multiple was, you know, three, maybe four it's like, am I going to sell for, let's say, let's say it's making 500.

I sell for 1.5. Now I've got to pay half of it to the government in tax because there's no preferential treatment for capital gains. I'm left with seven 50 versus the $500 making. Is that really worth it? That's you know, it's, it's hard to make that argument and there are tax planning things you can do to do that, but basically they all revolve around you not getting the money for her lifestyle.

You can set it aside and keep it in a, in a tax favorite place. But you know, that means, you know, you're, you're just not enjoying the fruits of your labor at least for a long time. So that is a, that is a huge disincentive to any kind of any kind of business MNA kind of activity. And I think that's, that's going to be felt by the small entrepreneurs, which is basically my people, you know, the, the vast majority of my clients are, are small business people.

And whether it's, you know, they have their own insurance practice or, you know, they real estate agents or their online business owners, you know, they're, they are the ones who will be hit the most by this kind of thing. Now the other capital gains provision that they're talking about, or the binders propose is eliminating the step-up in basis.

And so this, this is, this is a huge one, and this is, this is a middle-class tax increase. And let don't let anybody tell you otherwise, because well, the step-up in basis is, is when you inherit property from someone who passes away. Your tax basis for eventual capital gains calculations is whatever the market value is on the date.

You receive it. So that, and that's called the step-up. So let's say, you know, grandma has a house, she bought it for $5,000 back in 1962. And you know, she's, she passes away and leaves it to, you know, an error, you know, usually a child or, you know, a group of children or grandchildren or whatever it is.

And so she paid $5,000 for it. Now it's worth, let's say $400,000 just because the market has, has evolved, you know, in those 50 years. And so. A lot of times what happens is that, you know, the, the inheritor will, will turn around and sell that piece of property. Cause you know, they're not living there anymore and it's, it's a, it's a valuable asset.

So now they sell it for $400,000 and you know, they, they effectively bought it for tax purposes. For $400,000 through zero gain. And, you know, you just go on your Merry way. This is a, this is a generational transfer of wealth, and this is a big part of how that transfer of wealth happens between generations in the middle-class a lot of people on the lower end of the economic spectrum don't own a property like this.

And on the higher end, you know, it may happen, but it's not as significant because it's just a smaller percentage of the state. So this is, this is a very relevant issue for that, for that middle group where the house value is a significant chunk of the net worth. So he's, so what they're saying here is they're going to get rid of that.

So if grandma and butter for $5,000 and you inherit it, you bought it for $5,000. So now you're selling it for 400, let's say maybe you're in that maybe that kicks you up into that higher bracket, you know, where you pay 50% or 44% plus state, you know, into of that, of that sale. Maybe you're below that threshold.

And you're only, you're only quote, unquote only paying you know, 24% plus state tax. But this is, this is a big deal and I don't see anybody talking about this. The IRS invented time machines. Well, this is, this is Biden's proposal. So, you know, it's people like to, people like to blame the IRS and the IRS has a lot of stuff.

That's blame worthy, but but the law is set by Congress. So, you know, when, when people come to me we had a great situation for, for, I think it was two years. We had we had the Congressman actually had his, his local office. Just down the hall from our office. And so people say, you know, why is this this way?

I was like, well, talk to your Congressman. And then, you know, he's down the hall now. He was different there. I think I saw him once, but you know, his staff was there and so we just sent them over. He ended up moving his office across the street. I didn't know if it was because of being saying this kind of stuff, but, but it was, I liked to pretend that it was.

But but yeah, so, you know, it's, it's Congress, you need to complain to. And then, like I said, the implementation is the IRS. So you got to place the blame where it is where it is. So, but those are the two major capital gains you know, applies to dividends as well. But that's less of a thing.

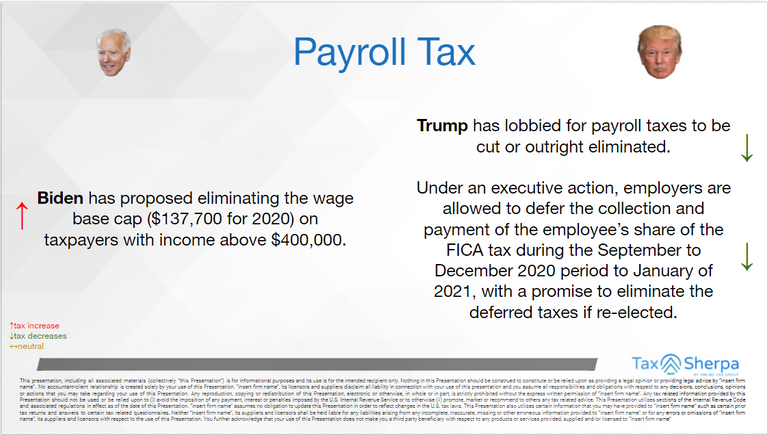

The next they are things to implement tax time machines. That's right. The next issue is the payroll tax. So if you have your own small business and you're paying payroll, you may have noticed that the you could have taken a discount on your social security taxes. So this is we'll get into this just a little bit in that in when somebody gets paid a payroll from an employer.

The you know, there's, there's the actual wage portion and the employee pays seven point a, what is it? 7.6, 5% in social security and Medicare tax on that, the employer also pays the same amount in social security and Medicare tax. And together that adds up to 15.3%. And then also there's, you know, whenever withholdings that the that the employee has on their income tax, but we're touched on my social security Medicare tax here.

So under the current system if you make above $137,000 in pay in wage in W2 income, then your social security tax stops. And similarly on the employer side, it stopped. So that's, that's actually a big discount. It's the majority of that 15.3% is is social security tax. So on top of that, because of the COVID crisis Trump passed this this little deal here where employers have the option to defer paying the social security portion of that tax.

And they would have to pay it, you know, and half by the end of 21, 20, 21 and half by the end of 2022. But it was a nice little float. It's basically a loan, a stealth loan from the government to employers. And a lot of, a lot of employers took advantage of that. So during the election, Trump was, was, was saying that, well, if he gets reelected instead of a loan, we're just gonna, you know, forgive it and you won't have to ever pay it back.

I knew this is saying no, no, no. So that is, that is an issue then is going to potentially affect current employers. On top of that employer and employee buying is talking about getting rid of the, the cap on social security. Once you have income above $400,000, So, this is a very weird proposal, because let's say you make, you know your wage is $300,000 and you have investment income and whatever else.

And you end up with $399,000. So now you only pay social security tax on 137,000. Same with your employer. And what this is saying is that once you go above the 400,000, now, all of a sudden you owe social security tax on that difference and your employer does too. So it's, it's, it creates a very weird dynamic in that there's this gatekeeping threshold between one 37 and 400.

You know, you would think that if there are going to get rid of it, they're just going to get rid of it. And I think that's what they will end up doing. In fact, I wrote an article on this a couple, like a year or two ago, and I'll see if I can dig up the link. And basically if they get rid of the cap entirely, then they can extend the lifetime of social security by basically two years.

Just based on the statistics at that time. So I think that is much more likely of, of what's going to happen. They'll just, they'll just remove the cap entirely and forget this one 37, 400 stuff. Just go to just go to, you know, pay as you go over the whole thing and corporate tax rates.

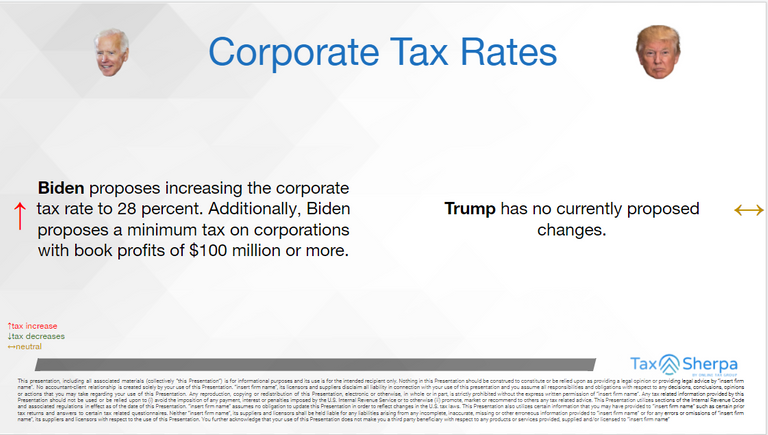

So part of the tax cut and jobs act was that the corporate rates were lowered down to 21% for C corporations. So C corporation is a company that pays its own taxes. So any kind of publicly traded company has revenue. It has expenses. It has a profit at the bottom. It pays a percentage of that profit in tax under the tax cut jobs act, which is current policy.

It's 21%. And then if it pays a dividend, then the, that dividend money gets taxed at the individual level as, as part of your dividend taxes. So that's that's, if you've ever heard the phrase double taxation, that's what they're talking about. That money was paid tax at the corporate level, and then it's paid tax again at the, at the individual level, as, as a dividend tax.

What he's talking about here is that 21% is going to raise 28%. And additionally Biden proposes a minimum tax on corporations with book profits of a hundred million dollars or more book profits versus a versus tax profits. You know, that gets into some depreciation and credits and that kind of thing.

Not terribly relevant for, for our discussion right here, but, you know, it's just one of those things. So 21% to 28%, you might say a 7% increase. You might also say it's a 33% increase because it's, whether you're looking at the absolute scale or the relative scale. But either way, it's, it's a big increase.

And so the 21% rate, plus the dividend rate came out to 36 ish percent, which was pretty close to the 35% of, of, you know, high-income people. Anyways. So the 21% was picked as a pretty neutral level four C corporation. Profits and, you know, by raising that, now you are going back to the system that we used to have, where having secret relations was really disadvantaged by, you know, 7% and then a qualified business income.

Deduction. So this was a new thing that was created in T in the tax cut and jobs act where if you have a pass through like an LLC or a, or an escort or something like that, then you got a break on the taxable income, which was called the qualified business income deduction or QBI. So that that whole thing is a nice little bonus for people who own their own businesses or, or who get K ones from things.

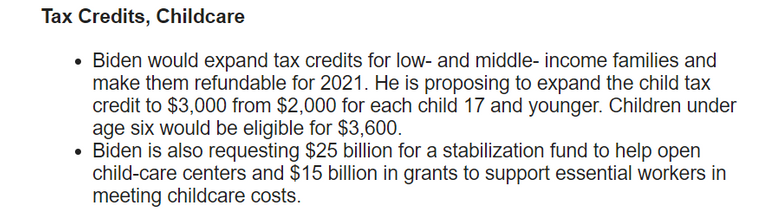

And Biden's talking about getting rid of that for again, above this 400,000. So a bunch of other differences. One thing that I just want to hit on real quick, before we run at a time here is the child tax credits by my copy and paste is not working.

There we go. So child tax credits for patient repatriation of profits, energy tax incentives, all this kind of stuff. So I'll, I'll have differences and, you know, we'll see what ends up passing, but the child tax credit was specifically, we hit on a, in Biden's speech. The other night. I was $1.9 trillion proposal here that he plans to submit to Congress, you know, right away.

Where so under the current law if you have a child under 17, you get scaredy cat says, okay, just to make sure I don't have a business that makes 400 K less than digested. It depends on what's actually passed. These are proposals at the moment. So, but these are the things to be aware of. So under the under tax cut and jobs act, a kid under 17 is worth up to 2000 in tax credits and probably to that's refundable.

Part of that's not refundable, but 2000 bucks. Biden is saying, we're going to raise that to $3,000 and children under six will be up to 3,600. So that is a big increase and the texts and drop Jack was already a big increase on the tax credits. So, you know, it's it's, it's interesting. So, you know, if you're on the.

If you are in the range of income where you get these tax credits for children, which is a pretty wide range then each kid is, is going, gonna be, you know, nice, nice chunk of money. So, you know, I've got two kids. One is four, one is six right now. So under this plan I would get well for, for the following year, there would be five and seven.

So I would get $6,600 in tax credits for them. And, you know, we'll see how much ends up being cashed back versus just a reduction of taxes, but still nice, nice chunk of change. And you know, they're also talking about you know, grants to childcare centers and those kinds of things to help with the, with the COVID stuff.

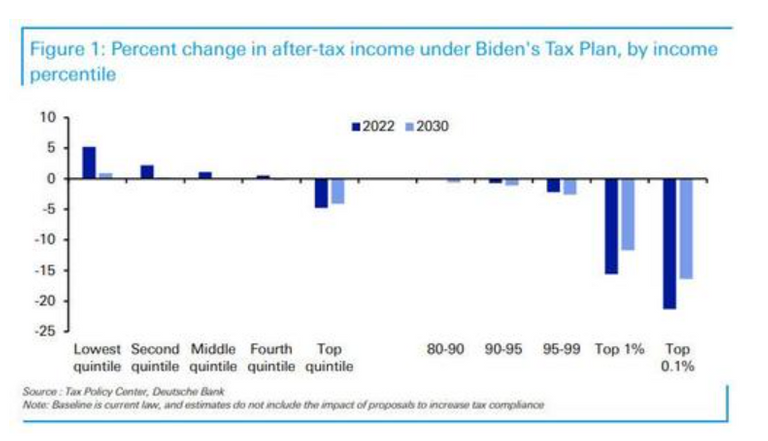

So lots of, lots of money being thrown around here and Just a quick little summary graph that was prepared by Deutsche bank actually. Who's been in the news for other reasons lately. And they're saying that under Biden's plan, then your after tax income change will be this graph. Basically you'll get more money in the lowest half of the, of the taxpayer brackets.

And then the, in the upper 20%, especially the upper 10%, then you will end up being you'll end up losing money. And you top 0.1%, they said, we'll lose like 22% or something like that of, of actual after-tax income. So that is a big chunk to those to those top 0.1 percenters. But to get to that level, you're talking about huge numbers.

So the vast, vast majority of people will, according to Georgia bank will come out. Okay. Or possibly slightly hurt. But you know, we'll see what like I said, what, what ends up actually passing as, as a bill and how the IRS ends up implementing that stuff? We will all be there by 2022. I appreciate the optimism Rolland.

We will all be in that 0.1% group because the crypto is going to the moon. You know, after Bitcoin hits 400 in December, You know, could be, could be, I don't know. But that is I know we went a little bit long there, but that is an expanded section or first segment of the show, which is the stories and news kind of stuff.

We're going to keep coming up with Biden's plan as it evolves, you know, as he gets sworn in and as they, as things start to go through the house but you know, that's, that's the, that's the proposal that they have right now. So we have it looks like seven minutes left and now is the time for the Q and a.

So if anybody has anything that they want to talk about you know, feel free to drop it in the chat. Again, I don't want anything that's like too personal because obviously this is a public thing and the Ron says, sounds like you enjoy what you do. And I do. I love doing taxes. So a large part of my, of my background that I didn't get into yet.

Is the is, you know, my, my philosophy of, of life really. So I get a huge rush out of keeping money away from the government and that's, that's in two parts. So part number one is just that much less money going to the, so like me personally, by, you know, with proper tax planning and implementing structures and all this kind of stuff, I probably keep.

I don't know, $20 million, something like that away from the government each year. And then the, and then the other side is, you know, I like helping people, you know, my whole life has been, you know, one version of that or another, you know, like when I was tutoring, I love that because I was helping these kids, you know, get into the colleges that they wanted.

I liked them helping to learn new things and I, I love helping business owners especially. Everybody, but particularly the business owner, you know, keep more of their money and make it work for them and make their lives better. And all that kind of stuff around, let's say only five minutes for Q and a yes.

Only five minutes this time. Cause we went a little bit long on their terms and says it's nerdy by 11. We appreciate everybody. Who's who's in the chat and everybody who's gonna watch this later. I hope you join in the chat. On our future shows, it's going to be Mondays 3:00 PM Eastern. So that's the time to to get it, get in there.

It says your slogan should be helping create generational wealth. I like that. That's pretty good. And so yeah, crim is a Canadian. She loves listening to us tax code show. So yeah, I am, I'm a us tax person. So you know, it's systems are similar around the world, but specifics deep are specifics vary.

So you know, you have to keep that in mind. But but yeah. So if anybody has any questions they want to hit real quick, otherwise I have some people who wrote in ahead of time, I hit up some of my, some of my mastermind groups that we did. Some, we did some Biden tax changes. And so here is here's a good one debit card, refunds, stimulus payments.

So debit card refunds. In us tax, you can get your refund a couple different ways. You can get a check in the mail, you can get direct deposit to your bank account. There are some, there are various intermediaries that can kind of tweak this a bit where like they get the direct deposit and then they front you alone.

It's going to refinish refund into the patient loan, or they can give you a debit card or whatever drawn on there, their balance of your refund. But the other way is you can get a debit card straight from the IRS. And this is craziness craziness, because this, like, when you, when you find people or you see news stories, they tried out a few every year where it's like, Oh, you know, we, we found this tech scammer who's stolen all these people's identities.

And you would found like 200. Tax returns, you know, in their home. That's because of the debit cards. So the debit cards, you know, if you get a debit card in the mail, that's it, that money is spendable, right? There's no tracking. There's no nothing on those. So these scammers, they steal people's identities.

And I wasn't, like I said, I was in South Florida. I was in Boca Raton for years and years and years and the South Florida's number one in the country for identity theft. Because of the medical offices that are around there. And then these scammers would file fake tax returns and they would get some crazy refund, you know and they would get them as these debit cards because once the debit card is issued, it's gone, you know, they can, they can sell the debit card.

They can just go to another common element of the scheme was they would go to a Publix in the grocery store and they were, they would actually buy other gift cards or Or you know, money orders or things like that. And so, so this is a major source of the fraud that the, that is perpetrated by on the IRS.

But the IRS keeps doing it. And with the stimulus payments, they, they came out with a post or a press release a couple days ago saying that, you know, some people are getting direct deposit. I already got mine direct deposit. Some people get checks, but some people will get these debit cards. And you got to know that a good portion of that stimulus money is just going right out the window to these scammers.

So this is infuriating to me and it's been going on for years and years. And, and, you know, like I said, every, every tax season, there's a new story or twos. Oh, we caught this ring of scammers and they had so many so many you know tax fraud and all this kind of stuff. And You know, but so, okay.

They caught this ring that had like 200, 500, whatever the IRS spends, billions, billions every year on, on, on tax fraud, scams of through identity theft and they, Oh, you know, they recouped, you know, a million. Okay, congratulations. But you're not really making a serious dent in the problem. So that is, that was the steamy scam, some kind of scam inception.

And scaredy cat says, get that debit card so they can load your unemployment money, food, stamp, money, anything else you can qualify for? And don't get scammed yet. Miami is a financial fraud, capital of the U S, which is true, but down to and see all the stuff that's going on there. Oh man. But I guess that is the end of the first show here.

We've got five seconds left. So I want to thank everybody for, for coming in and we'll be back here every week. Yeah, we'll do more of the same.

Posted Using LeoFinance Beta

There's a lot of stuff covered here.

But what stuck to my mind was the inheritance tax example. Having to pay capital gains on the difference between the original purchasing price of a house and the price at which you sell a house you inherited is brutal.

Posted Using LeoFinance Beta

Yep. It puts middle class wealth right in the crosshairs.

Posted Using LeoFinance Beta

OMG :D The number of words on your video transcript. How long did it take to type that out?

Posted Using LeoFinance Beta

Approximately 0 minutes. Software is a wonderful thing.

Posted Using LeoFinance Beta

I did not think of that 😇 My bad. Cheers.

this could be interesting. not that i have anything with US taxes but the stories will most probably be fun.