I saw this article today, titled:

Gold outperforms Bitcoin as a store of value as BTC drops below $40K

And it got me thinking...

Is Bitcoin a store of value like Gold?

Or is Bitcoin more like a technology stock?

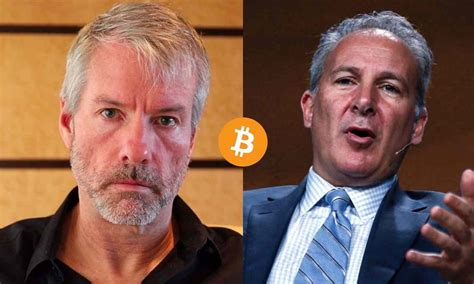

You have the Michael Saylor's vs the Peter Schiff's.

Just observing the past year, Bitcoin has blown up and cratered in line with the stock market. It's acted more like a technology stock.

Earlier this month, JPMorgan said Bitcoin's fair value is ~$38k, which is where it's been sitting at lately. Could this be a correct assessment?

Maybe? For now? But in the future?

Perhaps, Bitcoin was overvalued over the past year, but its fundamentals will always stay intact.

There won't be anymore than a total of 21 million coins. You can always print more money, and you can always find new sources of gold and oil, but you won't be able to create more Bitcoin.

Perhaps, we're too early to call Bitcoin a store of value. Perhaps in over 10 years time, when all the Bitcoin is mined, and the supply is so low on exchanges - that people can't leverage 100x on their Bitcoin - then maybe, just maybe... Bitcoin will be Gold's and precious metals' competitor.

This is controversial, but to me, for now, Bitcoin is synonymous with a risky asset, and that is why I will be selling at the next peak.

Call me "paper-hands", but I'm not waiting for that $100k.

Posted Using LeoFinance Beta