I thought I would start a discussion, hopefully we can get some comments going.

I was thinking about CUB liquidity pools, and there are currently two pools:

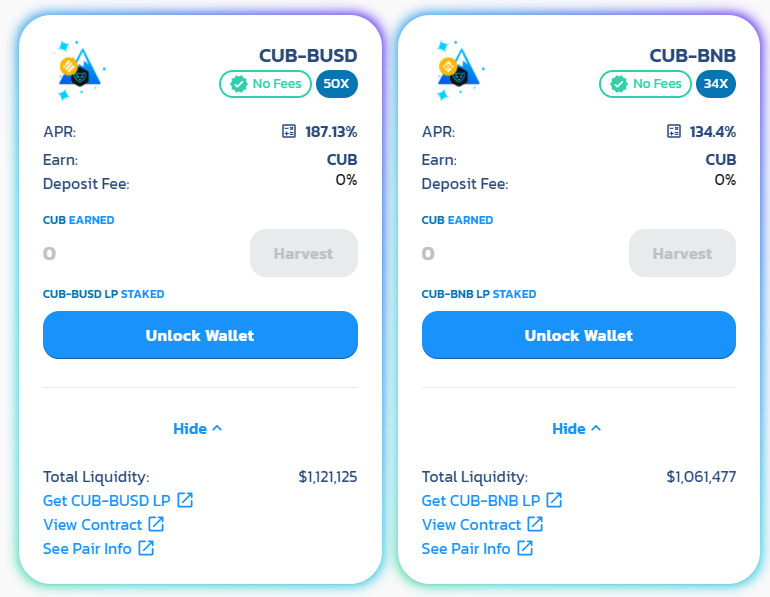

- CUB-BUSD (CUB multiplier 50X) - TVL $1.1m

- CUB-BNB (CUB multiplier 34X) - TVL $1.1m

As you can see two pools splits the liquidity, and soaks up a fair bit of CUB inflation.

So do we need two liquidity pools?

A couple of things to think about when commenting your views:

- Pancakeswap router, will automatically route through other pools to get the best price, so if you just had a CUB-BNB pool, it would use a pancakeswap BNB-BUSD pool to make up a second leg of the transaction for those wanting to move BUSD into CUB

- The higher liquidity, the lower the slippage and price impact of trades

- liquidity providers might prefer to be only exposed to CUB, rather than BNB movements as well?

- Is there a possibility to free up some multiplier for the CUB kingdom? (perhaps not because to maintain the yields on a larger liquidity pool, the multiplier would need to rise at current prices)

- There are costs of moving pools for liquidity providers, namely gas fees, but these might be incurred anyway when migrating to Pancakeswap V2.

So given all these thoughts above, I am sitting on the fence on this one, I think this is a great discussion, I am probably leaning towards having a larger single liquidity pool, but can see the advantages of the current approach too.

What are your views? comment below

Posted Using LeoFinance Beta

I think a lot of people like the idea of a stable coin. Pooling two tokens that are both (relatively) volatile might seem too risky. Hedging your bet with just one token and then a stable might feel more secure to them.

Posted Using LeoFinance Beta

Yes so I guess it comes down to attracting capital for the liquidity pools, some just prefer stable coins.

Posted Using LeoFinance Beta

I have been moving more into stable coins lately. It just feels safer to me even though I know it probably isn't.

Posted Using LeoFinance Beta

i don't think it is profitable

Thanks for your comment, I am just curious what aspect you think isn't profitable? investing in liquidity pools in general? or having two pools splitting the earnings between two pools?

Posted Using LeoFinance Beta