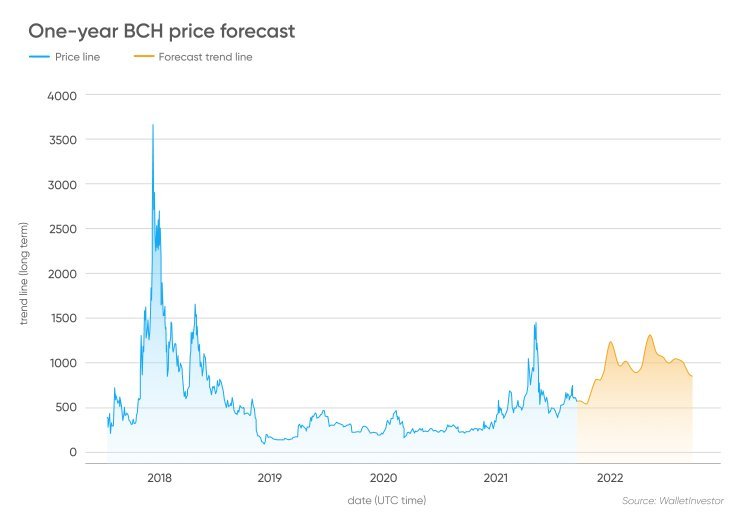

Bitcoin cash (BCH) continues to fall in value - the price of cryptocurrency has dropped another 4% this week, a significant drop of 51% since the jump in November 2021. Currently, the digital coin ranks 27th with a market capitalization of $ 6.77 billion. Will the bitcoin cash price be able to make up for the earlier drops?

- Bitcoin cash is a hard fork from the bitcoin blockchain that occurred on August 1, 2017

- As with bitcoin, the supply of BCH is limited to 21 million coins

- Wallet Investor's forecast is bullish and predicts the average price could hit $ 596 a year

Bitcoin Cash targets high transaction volumes

Bitcoin cash is a hard fork from the bitcoin blockchain that occurred on August 1, 2017. The split came as a result of a disagreement between the bitcoin community, which was unable to reach a consensus on a proposal to increase network bandwidth to allow for more transactions.

Everyone who owned bitcoin at the time received bitcoin cash, which also has a higher maximum block size. The protocol initially increased the block size from 1MB to 8MB, and now supports blocks up to 32MB in size. The developers are thus exploring the possibility of "huge increases in the future".

The higher block size enables bitcoin cash to process much more transactions per second (TPS) while keeping fees low - a solution to payment delays and high fees experienced by some bitcoin users.

A BCH hard fork occurred in November 2018 as there was still disagreement in the community about the maximum block size for transactions, resulting in bitcoin SV (BSV). The block size limit is unlimited and can scale in response to the market. In August, the maximum block size quickly increased from 1GB to 2GB - it is believed to be the largest block that has been mined on a public blockchain to date.

As with bitcoin, the supply of BCH is limited to 21 million coins. There are currently 18.95 million coins in circulation, according to CoinMarketCap. The constant supply aims to contain inflation and make bitcoin cash a solid store of value.

Bitcoin cash developers claim that the cryptocurrency is closer to the original bitcoin ideal (BTC). Currently, both digital coins are struggling with a slump in quotations as a result of a reversal in investor sentiment. According to a report on Capital.com, bitcoin has dropped below 40% of the total value of the cryptocurrency market - by comparison, its market share was still 70% a year ago.

Can the weakening influence of bitcoin also be an opportunity for BCH?

According to CoinCodex, the short-term sentiment for BCH is bearish. There are currently 5 bullish technical analysis indicators and 28 bearish technical analysis indicators. The 5-200-day simple (SMA) and exponential moving averages (EMA) show sell signals, while the moving average divergence (MACD) is neutral, while the Relative Strength Index (RSI) remains bullish.

Meanwhile, Wallet Investor's forecast is bullish and predicts the median price could hit $ 596.

DigitalCoin's BCH price forecast predicts that the price could average $ 503 in 2022 and then continue to rise to an average of $ 763 in 2025 and $ 1,021 in 2028.

The forecast for bitcoin cash from Price Prediction is the most bullish as it suggests the digital coin has the potential to climb from an average of $ 55 in 2022 to $ 2,429 in 2026, and then to $ 10,311 in 2030.