Bitcoin was born when Satoshi Nakamoto used the blockchain, a distributed encrypted database, to create a decentralized currency whose transactions are cryptographically verified by miners getting paid in said-currency for their service, which he called “Bitcoin”.

Shortly after, Ethereum was created under the impulsion of Vitalik Buterin, a teenager who had been banned from World of Warcraft and understood the value of a decentralized distributed system to avoid abuse of power.

The industry grew and people started creating crypto exchanges, crypto payment gateways, physical crypto wallets, and even crypto ETFs (although that took a few years).

VCs raised hundreds of billions to invest in crypto companies and we saw the rise of giants like Coinbase and Binance, the rise and fall of scams like FTX, and Bitcoin even became legal tender in El Salvador (abandoned in 2025).

While the industry may appear successful, the vision that Satoshi laid out in his 2008 white paper remains unfulfilled (to say the least): crypto has still no use cases, besides speculative investment, tax evasion, and scams.

The latter, which began circa 2017, has been popping up again and again and always consists of the same process.

A creator (usually someone selling courses or OF pics) creates a new cryptocurrency, gets fans to invest in it, then sells their share when the currency peaks in value, thereby “rug-pulling” all of the investors who lose their money.

Thousands of such stories have animated the Internet in the last 10 years, the latest one being the Hawk-Tuah girl who rug pulled for $50 million.

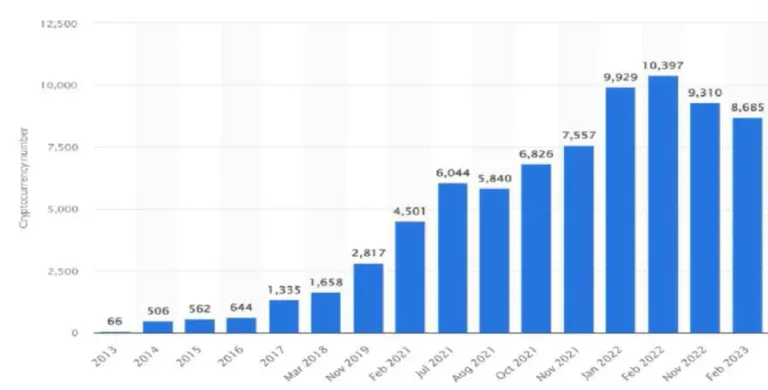

Since 2008, an estimated 25,000 cryptocurrencies have been created although the numbers vary greatly considering what source you consult.

So, what’s the function of all of these cryptos?

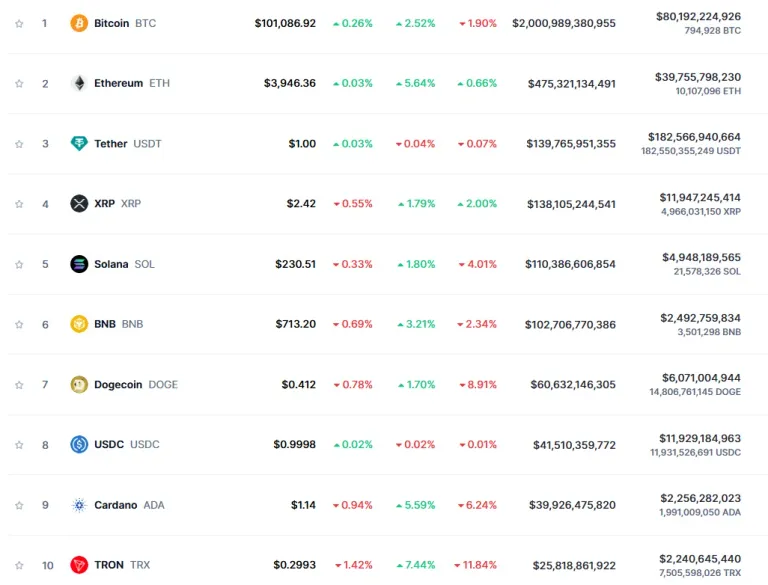

At the time of this writing, the top ten currencies per market cap define themselves as changemakers, innovators and visionaries to bring about positive global change (Cardano), to become a global platform for decentralized applications (ETH), or to provide decentralized finance (Solana).

Practically though, none of these are enabling anyone to do anything with them, and most of the ones that are still trading are pure speculative instruments.

No physical businesses and very few online businesses are accepting crypto payments, no one is getting paid in crypto, and those who are use it to evade taxes. Investments in cryptos remain extremely low on a global scale with only 562 million people (or 6.8% of the world population) owning some form of cryptocurrencies.

Some see those low numbers as a sign that the industry is still in its early days. The alternative story is that cryptos have no practical use cases (except making creators and early adopters rich), hence, very few adopters.

The market is now established enough that it’s unlikely to change in the future.

In the mid-term, we can expect the value of Bitcoin to keep climbing.

In the long term though, it’s likely that the block chain will be made redundant by a superior technology that will be able to break it.

Its nature as an investment product can be compared to that of a Picasso painting: useless but unique, highly considered by industry specialists, beyond the preoccupations of the average citizen, whose value equals what people are ready to pay for.

In light of this metaphor, it’s worth wondering whether the impact of the crypto industry has been positive or negative.

Originally designed to become a sovereign form of money whose value wouldn’t depend on an external centralized entity, the issues it suffered (a lack of price stability, poor security, high-cost usage, and lack of practical application) have transformed them into a speculative vehicle and a scam instrument.

Posted Using INLEO