If you are new to Hive and new to crypto, one thing you absolutely needs to know is the concept of money supply in an economy. You need to know this because, in terms of long term value of the tokens, and crypto market as a whole, the total money supply will affect their value.

Simply put, when there is lots of money supply in the economy, inflation increase, and more money gets invested in the various market, including the crypto market. That is why we see a bull market in the crypto space.

What you need to learn are the definitions of M0, M1, and M2 money!

Let's go.

M0, M1, and M2 are different classifications used to measure the money supply in an economy. M0 is the most limited and represents the monetary base, which includes physical currency like notes and coins in circulation as well as bank deposits held at the central bank. M1 is a broader category that encompasses all of M0's components and includes the most liquid forms of money, such as demand deposits that allow instant access to funds. M2 is the most comprehensive classification that takes into account all of M1's components and adds less liquid forms of money, such as time deposits held in savings accounts or certificates of deposit.

Typically, inflation increases with the expansion of the money supply, while deflation can occur when the money supply contracts. Central banks employ various monetary policy strategies to manage the money supply and stabilize prices while promoting economic growth.

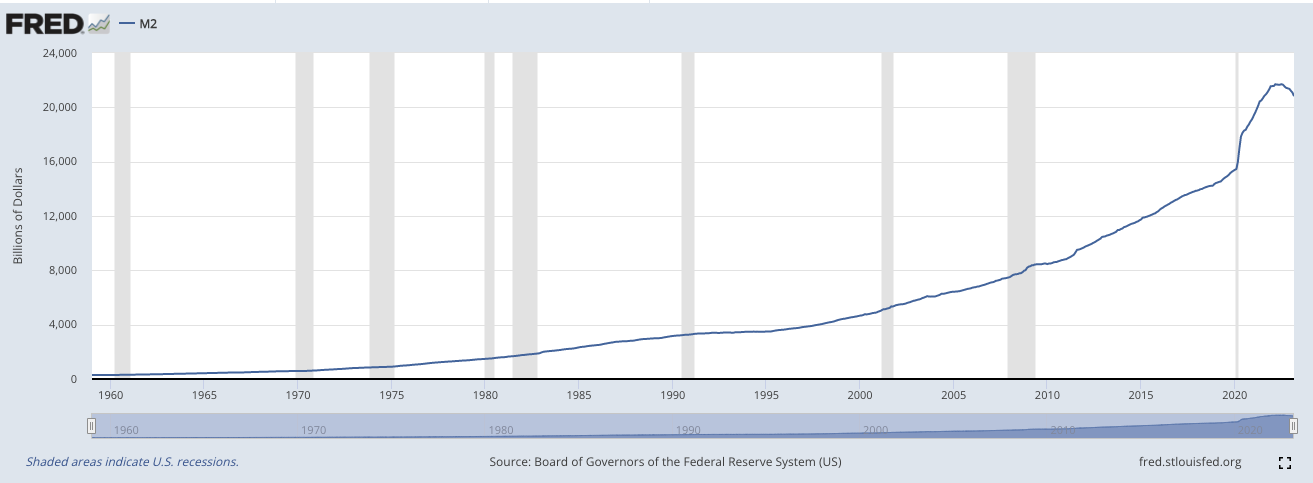

The graph below depicts the M2 money across time, where you can see that there was a sharp decline in 2020. There seem a downturn of late.

You can access the data on this website: https://fred.stlouisfed.org/series/M2SL

Feel like you need to learn more? This Khan Academy video should be a good start.

P/S: Nothing offered here constitute financial advice. Always do your own research.

Posted Using LeoFinance Beta