We've already had a COVID19 crisis.

And now, the stock market is booming to the point where I don't even remember when the KOSPI hit 1400 (just 10 months ago).

In March, it held several large-cap stocks.

In fear of KOSPI falling to 1400, he just stayed still because he didn't want to taste the fixed loss.

No, I actually didn't know what to do.

I thought it would go up someday because they are companies that will not fail.

All I had to do was look at my helpless loss account like this.

When the accounts recovered after a few months, I thought to myself that I did a great job.

I didn't sell anything, and I thought I didn't lose anything in the end.

However, as time went by, I realized that I lost a lot in terms of opportunity cost.

I wasted my time and missed the opportunity to buy many stocks at a good price.

In the next crisis, I'm going to act a little differently.

I summarize the content hoping to gain another experience, another lesson, and a greater wealth.

In capitalism, panic is bound to come.

It is only a matter of timing, but it is also a necessary fate. Therefore, we must prepare and prepare for what will happen.

There are three reasons why panic and boom are repeated in capitalism. ( The reasons for panic and boom are the same. )

(Greed)

(Optimism)

(Herd mentality)

Nothing bothers me more than watching a friend who seems no different from me become rich.

Like this, greed is conceived in comparison. Once you have a desire, you will continue to be greedy.

The fund manager, who predicted dot-comble in 2000, was fired from the company for not buying stocks.

Since dot-comble occurred, I succeeded in predicting, but I did not get a job again.

A pessimist is not appropriate as a fund manager.

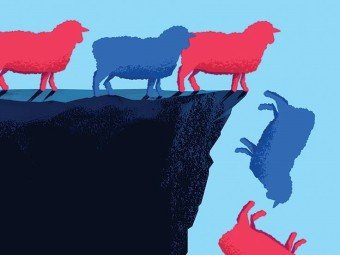

How would a deer that was grazing act when they heard a rumbling sound in the grass? First, run away.

It's because everyone else runs. Herd mentality.

If there was a lion behind the grass, the deer would be prey.

However, deer that do not run cannot spread genes in this world.

Quoteirrational exuberance

This is a famous quote that Chairman Alan Greenspan left at a meeting on the evening of December 5, 1996.

Despite the innovative productivity improvement caused by computers, it meant that it could not rise endlessly.

And in 2000, dot-comble broke out.

- The process by which investors' assets are decreasing

If you fall in fear, you sell it, if you go up, you buy it because you think of the money, and if you fall down again, you sell it in fear and repeat the accident.

In this process, assets decrease rapidly. You can even lose all your assets.

- The panic is not a crisis, it's an opportunity.

When the panic strikes, the dollar exits and the exchange rate rises.

At this time, people who do business are in the biggest trouble.

Businessmen would have taken out dollar and yen loans,

and it is worth dying to see dollar prices rise and interest rates rise together due to rising exchange rates.

So they sell their real estate.

Real estate cannot be dealt with in the face of panic.

Without selling, high leverage acts as a poison, causing the worst situation in which all property is lost in an instant.

Therefore, when a panic occurs, the person who owns the property does not earn money,

but the person who does not own the property makes money.

Once the panic began, it took a year to end, and the dot-com bubble in 2000 took three years.

Cash should not be left to sleep during this period.

Change the dollar to won and then to dollar again after the panic.

Or buy U.S. government bonds in dollars and buy stocks again after the crisis.

If you have U.S. stocks when the panic comes, you have a chance to be rich.

Because it is dollar asset.

It's safer if you have American blue-chip stocks.

Even if you're good at investing, When you encounter a panic, all your property evaporates like gasoline in an instant.

If there is no currency exchangeability in investment, everything collapses in a period of panic that comes every 10 years.

Therefore, the most important thing in finance is the 'liquidity'.

Panic is no longer a panic if it penetrates the attributes of highly liquidity U.S. stocks and U.S. bonds.

Finally, the crisis turns into a place of opportunity.

The Investment Method of Artificial Intelligence

Artificial intelligence buys continuously and raises stock prices, and when it starts selling once, it shakes off all its supplies.

Therefore, it rises constantly when climbing and falls constantly when falling.

So if there is a panic in the future, -3% will be more definitely due to artificial intelligence.

Posted Using LeoFinance Beta