Have you heard that Monday blues is gone because of stocks these days?

Everyone starts trading stocks and waits for Monday when the stock market opens.

Rather, some even say that they have a "weekend disease" because they suffered from weekends when the stock market was not open.

Reflecting this popularity of stock investment, On January 25, the KOSPI surpassed the 3,200-point mark for the first time in history.,

The KOSDAQ has surpassed the 1,000 mark for the first time in more than 20 years..

Fad words that reflect the world in which everyone participates in stock investment are also popular.

"Maybe I'm the only one who's gonna miss the chance."

It's spreading to Fear Of Missing Out and FOMO, attracting individuals who weren't interested in stocks.

On the 11th, stock accounts surged 175,456 in a day, the highest in about six years since 2015.

There's a lot of disagreement over the continued overheating of the stock market.

While the Buffett index, which determines the level of overheating in the stock market based on 100%, has exceeded 130% for the last six consecutive trading days, it is clear that the "exchange overheating" is clear.

Some say that the Buffy index cannot be trusted unconditionally due to the change in Korea's industrial structure.

The prevailing analysis in the stock market is that the upward trend will continue until the first quarter.

Wait here! Before you diagnose bubbles, there's something you shouldn't miss.

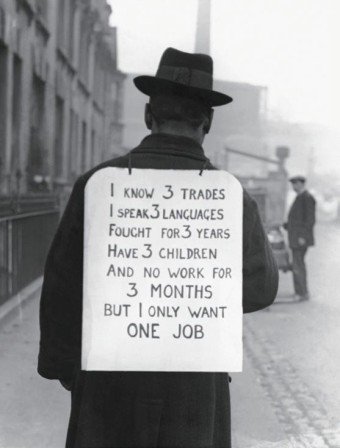

Last November, more than 20,000 people flocked to Texas ahead of Thanksgiving Day.

To go see your family? No, to go to a food bank in Texas.

Americans who are hungry after Corona are increasing rapidly day by day.

In just four months, 60 million jobs disappeared, and only 32% of retail workers succeeded in paying rent.

The situation in Korea is not that different. Business closures continue one after another, and the unemployment rate hit a 10-year high.

The stock market has been on the rise day after day, so why is this happening?

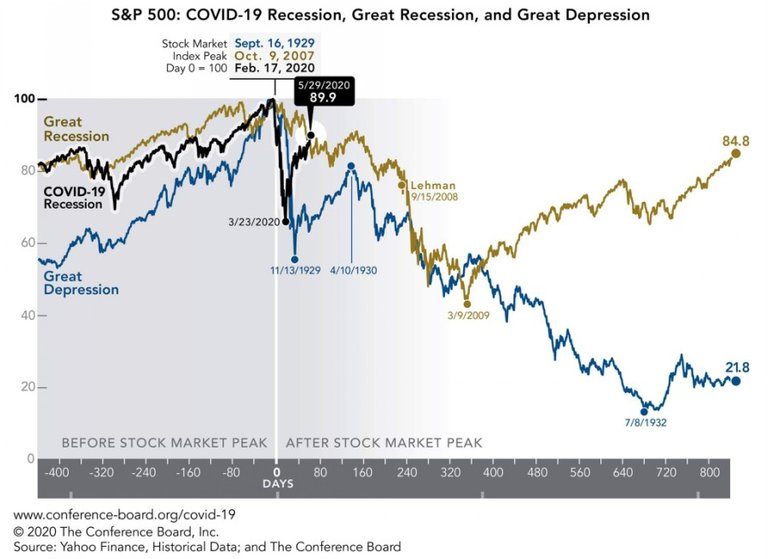

Major stock index is different from real economy

The U.S. S&P 500 Index consists of 500 stocks among listed companies in the U.S.

Amazon, Apple, Microsoft, Netflix, etc. are representative.

They are all less affected by Corona 19 Pandemic.

It's like Samsung Electronics achieved the highest price even when the self-employed are falling and tightening their belts.

Major blue-chip stock indexes roll regardless of the real economy.

On the contrary, they enjoy a boom with the fear factor of covid-19 fandemic on their backs.

Those who couldn't find the right place to invest in the non-face-to-face era turned to stocks and real estate.

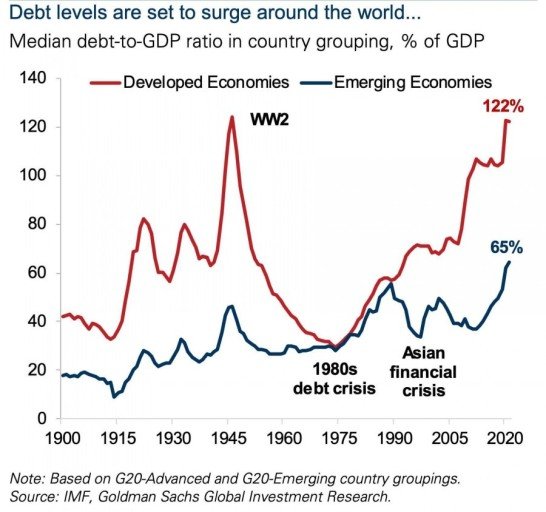

Governments are constantly printing money to mitigate the impact of COVID 19.

The greatest crisis in history, The New Great Depression is coming.

In other words, considering the recovery of the stock market as an economic recovery is a conclusion that the special situation of the Covid-19 Pandemic has not been considered.

The stock market, which consists mainly of large companies, tells nothing about the sinking economic growth rate and the collapsing government flow.

Top U.S. financial expert James Ricards warns.

"Even the Great Depression of the 1930s is not as serious as what is going to happen."

"The Great Depression has come before us. Right now, the stock market won't agree with that, but eventually you'll admit it.

If the first unemployment occurred indiscriminately on the weakened economic base, the second round would be systematically carried out according to a more careful plan.

If the first mass layoff was centered on low-wage workers, it would take place in high-income professions such as lawyers, accountants, bankers, nurses, real estate agents, middle managers, civil servants, and developers.

Some are the result of a decrease in service demand. Unemployment reduces the demand for restaurants and sports facilities, and the industries are in greater financial difficulties.

This vicious circle is the point that distinguishes recession from simple recession.

Set up a portfolio of assets suitable for post-fandemic.

Mass layoffs, the fall of self-employed people, and the worst unemployment rate. It's clear why the Great Depression, which will begin in the aftermath of Corona 19, will be worse than the Great Depression of the 1930s.

There was no epidemic during the Great Depression.

Investors should not simply focus on the recovery of the stock market at the same time as the two crises of pandemics and recession.

We need the wisdom to organize assets such as cash, gold, and real estate according to the Pandemic situation.

Posted Using LeoFinance Beta