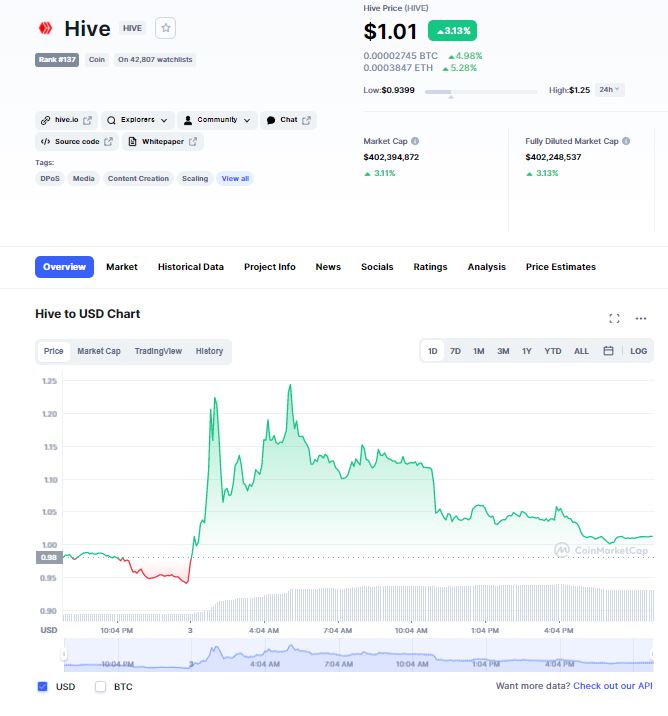

Spike up to 1.25 USD

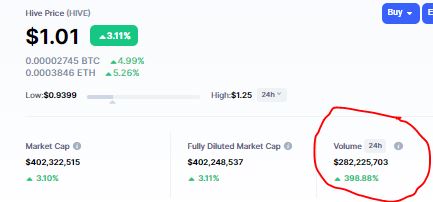

Hive spiked up to 1.25 USD today, and is now back just above one dollar. Nothing bad with that, fluctuations of 25 % are kind of normal in the crypto sphere. But what happened today, is something that doesn't happen every day, and certainly not with every coin. The spike was accomplished with volume of over 400 million dollars worth of Hive at a certain moment. Yep that is correct! There is only roughly 200 million Hive that is liquid, and definitely not all of that is at exchanges. So that means the same Hive have been trade multiple times in a very short amount of time, or there has been traded with 'virtual' coins. Coins that weren't actually there, but were supplied by an exchange, in their trading software, but not actually in the hard wallet of that exchange. That happens, of course, but for such volume? That is very dangerous play, in my opinion.

Koreans

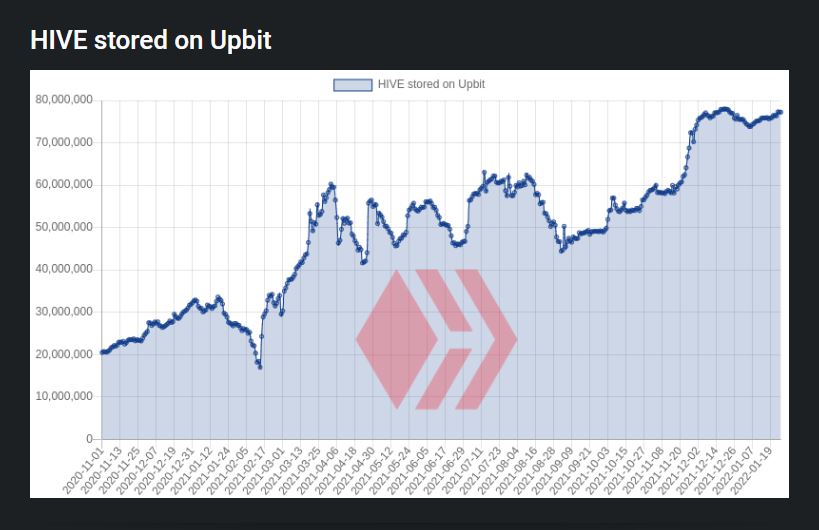

The exchange where 75 % of the volume was traded today, is Upbit, and all in the Hive/KRW trading couple. So, it is safe to say that the pump was inspired by Koreans. The big question is, how much Hive is stored in the hard wallet of Upbit? Well, that is quite disappointing actually, according to the most recent post by @penguinpablo about that, around 70 million Hive is on the hard wallet of Probit.

You can say what you want, but is impossible to create a volume of 300 million dollars with only 70 million Hive. Because, for obvious reasons not all that Hive is for sale at that time. How much is for sale is hard to say, but a lot is in wallets of hodlers. And that brings us to an issue why so many people have joined cryptocurrencies. They are tired of the banking system, with the fractional reserve banking. For then to notice, that an exchange is doing the very same thing on a very large scale. This is just not what cryptocurrencies were created for, and is really not how it should be done, in my opinion.

The amount of Hive stored on Upbit, not the Hive "for sale", tnx to @penguinpablo

If someone wants to buy 100 million Hive at once, he has to buy them all from exchanges where they really are available. And then Hive price would have probably gone to 25 USD or more. To drop again of course, if he sold them. But, that is not the issue here. Such exchanges are a pain in the ass for the true crypto currency believers. And fractional reserve trading is certainly not a part of crypto in my opinion.

Why else would we have liquidity pools, diesel pools, etc...

Morale of this story, be careful where you store your Hive, do your due diligence about the exchanges you are using. And it's probably the smartest thing to just stake your Hive on the platform.

Sincerely,

Pele23

Posted Using LeoFinance Beta

Exchanges are just crypto banks.

Posted Using LeoFinance Beta

If you mean leverage procedure, it is very dangerous for investors.

Well, especially if the exchanges don’t even have the actual Hive in store!

I think people can also choose to buy HBD and then use the internal market or conversion to change them to HIVE. So I don't think they need to rely on just HIVE.

Of course the huge trading there seems to be quite weird. I think it might be just automated bots scraping off a fraction of a cents per token. If the volume is big enough, they make enough.

Posted Using LeoFinance Beta

my prediction for hive is that it can break the 2 dollar resistance, but bitcoin needs to exceed 50 thousand dollars