Poor financial planning can have disastrous consequences not just for individuals but for entire countries. Zimbabwe's experience with hyperinflation serves as a cautionary tale of what can happen when governments make poor economic decisions.

Let me tell you a story about Zimbabwe, a country once known as the breadbasket of Africa. Zimbabwe's economy was booming in the 1990s, and the country was a regional powerhouse. But things changed dramatically in the early 2000s when the country was hit by one of the worst cases of hyperinflation in modern history.

The story goes that in 2000, the government of Zimbabwe launched a program of land seizures. They redistributed land from white farmers to black Zimbabweans, in an attempt to address historical inequalities. However, it ended up disrupting the country's agricultural sector, which was a major contributor to the economy.

This led to a decline in agricultural output, which in turn led to a shortage of foreign currency. Zimbabwe had to import more food to make up for the shortfall, which led to the government printing more money. They wanted to address the shortage, but they ended up increasing the money supply rapidly, causing hyperinflation.

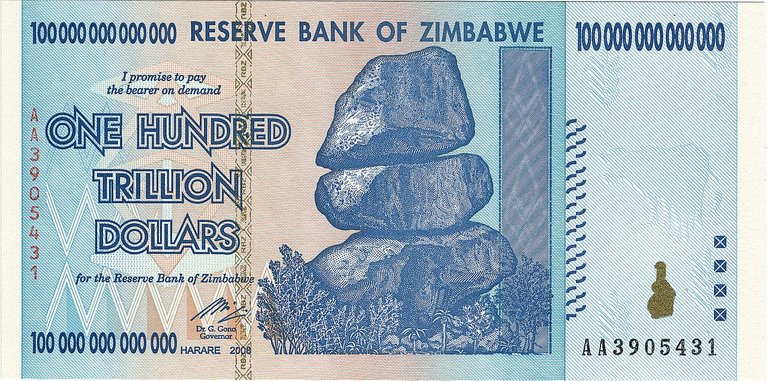

Imagine prices doubling every 24 hours! People had to carry suitcases of cash just to buy basic necessities like bread and milk. The Zimbabwean dollar became worthless, and the government had to abandon it as the country's official currency.

As you can imagine, the economy spiraled out of control, and Zimbabweans struggled to make ends meet. Unemployment soared, and many people turned to the black market to survive. The government tried to impose price controls to curb inflation, but this only led to shortages and more chaos.

Finally, in 2009, the government introduced a new currency, the US dollar, as the country's official currency. This brought some stability to the economy, but the damage had already been done. Many Zimbabweans had lost their life savings, and the country's infrastructure had been severely damaged.

Today, Zimbabwe is still recovering from the effects of hyperinflation. While the economy has stabilized to some extent, unemployment remains high, and the country is still heavily dependent on foreign aid.

The legacy of hyperinflation is a stark reminder of the dangers of economic mismanagement and the importance of sound economic policies. It's a story that we can all learn from, and a reminder that we need to be careful with our money and our economies.

The story of hyperinflation in Zimbabwe is a stark reminder of the dangers of inflation and how it can wreak havoc on an economy. The lesson here is that governments need to be careful with their economic policies, and that drastic measures should be taken to prevent inflation from spiraling out of control.

Hyperinflation can happen in other countries too, as we've seen in places like Venezuela, where the inflation rate has soared to more than a million percent. These situations can cause untold hardship for ordinary citizens, who are left struggling to make ends meet.

To avoid such situations, governments must prioritize sound economic policies, and make sure they have competent economic advisors. It's also important for individuals to be financially literate, so that they can make informed decisions and protect themselves from the effects of inflation.

In conclusion, Zimbabwe's experience with hyperinflation serves as a warning to all countries about the dangers of poor economic policies. By learning from their mistakes, we can avoid similar situations and build stronger, more stable economies for ourselves and future generations.

Posted Using LeoFinance Beta