One detail that captures imagination this past week has to do with the bonds market. Before I enter this space, tariffs have been the spell of the financial market all over the world.

If you are in the US, the message has a significance to understand we run a trade deficit and it needs to be addressed.

If you are elsewhere, it differs from the approach.

Many countries got hit with a minimum tariff of 10%.

Let's go back to bonds. A bond is a certificate that a government or a corporate created to borrow money from an investor.

Depending on the country you are living, you can expect a steady and consistent rapport between bonds holders and the market.

Usually United States have been steady with its bonds market.

Some other countries with inflation or other motives can wreck an investor within the bond market.

If you see a bond from a country with a high return, you need to be careful. High risk, high reward.

Somehow the tariffs made a pressure on the bonds market. According to analysis, it should not be the case cause the underlying reason for the tariff, is to balance the debt and deficit in the long run.

It seems the uncertainty in the market dropping for the past couple days forced the market liquidity to a low point. If there is no liquidity, there is no business around.

It has forced the hand of bonds holders to find liquidity elsewhere. The US dollar is the main vehicle of the world market.

While we are trying to wrap around this shaky intervention, I looked at crypto with a different eye. Everything went down.

Crypto managed to stay within its resistance.

You may wonder to calculate if this is the moment we are transitioning from fiat currency to crypto currency. If it is not the time, it has to be the beginning of the interaction where the focus to make a move is relevant.

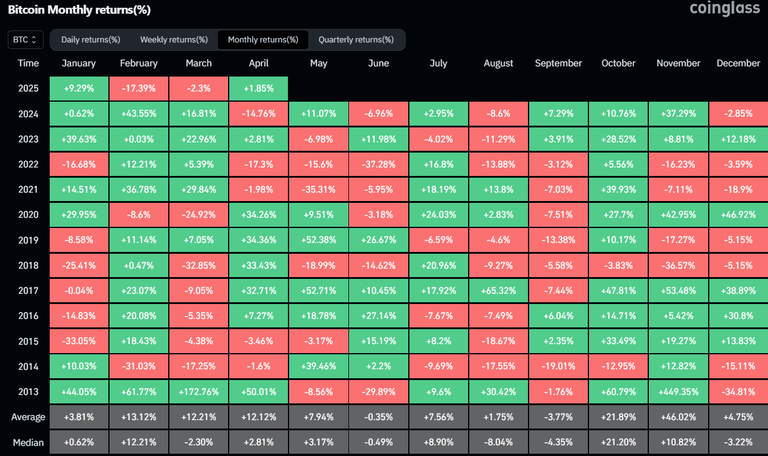

Many start asking question about crypto. The growth tends to be measured. Hard to predict the price of $BTC. The amount of available crypto in the market is an exclamation point away to show there are value where you look for.

I think this year can provide the clue where crypto is heading.

Many think dollarization is an easy task where a country could easily walk away from the dollar.

It is not so malleable to happen. A country may not trade directly with the US but others are. This is the most liquidated currency on the planet where you can trade.

Crypto needs adoption. It will get it in due time.

Regulation will clarify and fill the gap.

Depending where you stand, it is a valuable lesson to seek and manage your portfolio. Since 1930 the US dollar lost 93% of its value. Most fiat currencies tend to bounce like crazy. Your bills and expenses tends to grow every passing month to rob you later. Blame inflation.

In the meantime you need dollar to run your everyday life the comprehensive way possible.

Holding some crypto means you are diversifying against all odds around the clock.

It is getting clearer that #BTC has the capacity to run the show very soon.

It is true that things seem quite different and changed this year, but we had seen that six months is a long time, but for this season, it can happen this year and things have been changed so that people cannot make more profits.

There will be opportunity for profit due to high velocity of the market.

Supply and demand are the engine. Be on the right side at the right time.

Discord Server.This post has been manually curated by @steemflow from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited.

"Interesting take on the crypto transition—do you think regulatory clarity alone is enough to drive mainstream adoption, or is there more needed to build real trust?"

There will always be a niche of folks going after crypto.

Regulation will help businesses to offer service with crypto payments.

Mainstream somehow will follow suit when this is the only way to go. Most people react to #fomo.

I like to see how stablecoins play in such a volatile scenario.