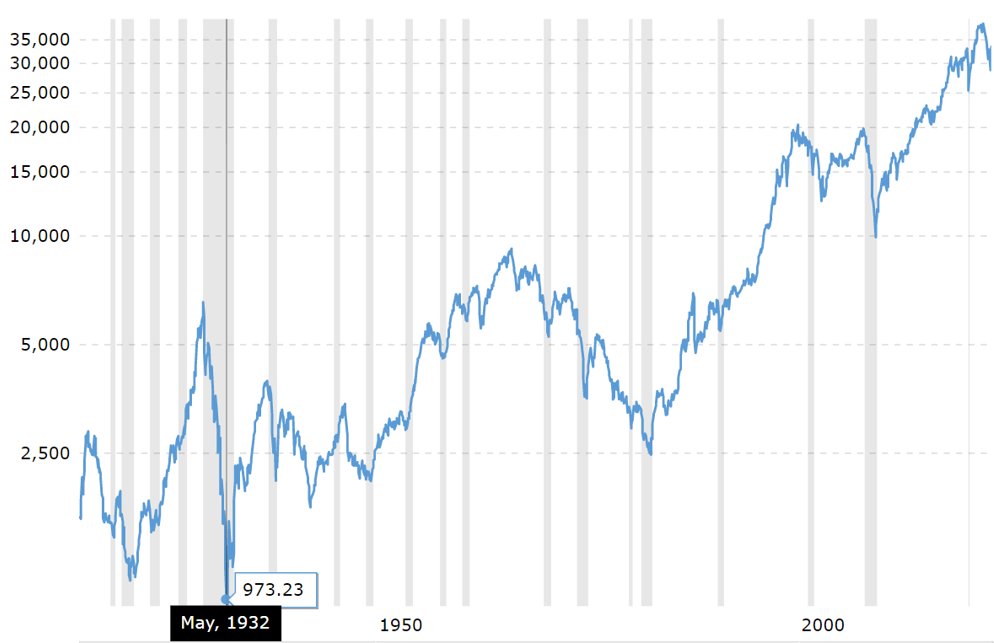

God, I hope we are at 1932 in this analogy! Back when the US stock market was at the lowest of the low. But who knows, right? are we in 1919? 1943? 1970? I have no clue, but I am happy to pretend I do! :)

This is as good a time as any for me to issue my fearless prediction for the Crypto Market. I predict... bad. Very bad.

That makes me exactly as smart and brave and prescient as almost everyone else out there. Who is really predicting that this Crypto Winter will resolve quickly? No one I know. I guess, then, in order to add some value to the doom and gloom, I need to (a) be even more doomy and gloomy and (b) provide some reflections on why I think this way.

First, as you should already know, this is not financial advice. It's not even financial. Or advice. It is just some contextualization from a semi-seasoned crypto hobbyist who doesn't know a single other person in my real life who is not stunned at how stupid I am to be in this space. I have lots of friends who range from sitting on several million USD in real estate and equity assets to those who have had to take out home equity lines of credit to pay for private school for their kids. Right there, you probably already can guess I am in the USA, where for some reason both the religious right and big business both insist that we make sure our populace is undereducated. Hmmm, I wonder why lol. Anyway, topic for another day.

My point here is that I know people across a wide range of educational and economic backgrounds, from C-Suite suits to entrepreneurs to PhDs/MDs/JDs to quiet small business owners to successful writers to teachers to 9-to-5'ers with a high school degree. Other than one guy I know who only has a high school degree, but who also has several semi-automatic guns, no one thinks being in crypto WAS a good idea or IS a good idea. (The guy with guns sees how impossible it can be to get ahead or feel secure in our Darwinist nightmare economy and chases many hopeful ways to get out of the downward spiral.)

This is a big problem.

These are people who I tried to get into crypto in January of 2020. It was probably the best time to become excited about crypto ever! Charts went only up, innovations were rolling out everywhere (P2E, DeFi, SoFi, Dex, DAOs, LPs, other stuff I forget), it was in the news, Wall St welcomed Coinbase and started crypto funds. If you tripped and spilled $10 into a coin, it became $20 in a week.

"It's a scam."

"It's a Ponzi scheme"

"Tulip bubble, idiot"

"There is no underlying asset value."

"You can't use it in the real world."

"Only the mafia, doomsday preppers, and Russian oligarchs use this crap"

"I don't believe in crypto for the same reason I don't believe in Lizard People, secret global illuminati, or other crazy person conspiracy fable"

I heard all of these... The most enthusiastic statement I got about crypto - and this was from the person I sent 6.7 BTC to back in 2013ish as $100 payment for web services - was "It's kind of fun." This was in reference to Upland and Gods Unchained.

Imagine. People gave me all those rejections when crypto was booming and mainstream!!

Now they read something like this:

SO MANY THINGS have gone wrong with crypto.

I got into it for 2 reasons.

- It was the pandemic and I needed a new hobby. Not lying. I heard a radio story about BTC, ETH, and XRP and thought I should look into it.

- I live in the USA where "Violent Apocalyptic Maniac" seems to be a dream job and rich people treat us the same way the robots treated the humans in The Matrix...squeeze us dry and keep us bamboozled. I don't trust our economy and it would be nice to see what it is like to live in a country with fewer guns than people. I wanted to put some of my savings into assets that might resist inflation and could come with me wherever I roamed.

Where am I going with all this?

Among the things crypto has failed spectacularly with so far is #2. Once crypto charts started tracking US stock market charts, the dream of an inflation hedge, a Federal Reserve-proof haven, or a dollar-peg-free magic money fountain more or less seemed to die with it.

The reason why crypto failed to break free of other risky growth-focused assets probably, according to me, is because risk-tolerant growth-minded people were the ones who pumped up the last bull. Either that or desperate people did, who might not like risk but have to tolerate it because there seems to be no other way out of their financial circumstances. The psychology of crypto - because of its success in attracting wider adoption - became the psychology of penny stocks and high risk investment vehicles.

So, we had most people either thinking crypto is a scam, or waiting a bit longer on the fence before jumping in.

These people watched from the sidelines and are very happy they did not jump in!

We had the next biggest group of people looking to crypto as a risky, but high-growth asset class. The sophisticated ones figured out the system and knew how to hedge their risk and take good profits.

These people still have money to invest and might be moving money across asset classes, or swapping crypto back and forth between each other, or are wringing profits from the dwindling wallets of us shrimps who are still floating around stunned

The rest of us, who were just getting our heads on straight before the bubble burst, are feeling burned, or are out of investment liquidity, or feel the experiment failed, or are forced to look elsewhere for an edge in this global economy.

I am one of these people. I know, I know, Not Your Keys, DYR, etc. I did my best, my dude. And still. Not counting failing to Hodl or failing to time trades better, here are all the ways I lost money in crypto over the past 18 months:

- bought in and never took profits until the crash (my bad for sure!)

- chased high ROI and got pumped n dumped (didn't risk much, but "There Be Scammers!")

- missed airdrops because assets were in wrong kind of wallet (this shit is complicated!)

- had transactions mysteriously fail on DEX, on wallet-based, and on CEX (this is when you discover that "customer service" is mostly a myth in crypto)

- made my own errors in sending and withdrawing assets

- lost money when devs abandoned NFT or game projects with no warning

- lost money when devs kept trying but other people's money moved on

In response, I tried to get more legit and stop gambling with less reputable entities. So that helped me to the four biggest losses yet!

- Did not see the Celsius bankruptcy coming (15% of portfolio in limbo)

- Was not fast enough to escape BlockFI (25% of portfolio in limbo)

- Did not appreciate how unbelievably deflationary Splinterlands ever-nerfing treatment of low power players would be, especially my painstakingly collected card deck (25% of my portfolio gone for good)

People like me, well, we are either stuck, or can't walk away from losses, or have found something hobby-like that we still enjoy regardless of losses. We might be here to stay

Those of us who are still here are hearing from experienced crypto peeps that crypto winter is long, difficult, but a great time to build for the future. No one can say how long we will have for building before the future is here, but as I see it there are only 3 main ways for building on Hive (my first choice) or anywhere else will pay off:

- Those who are left move to Hive from other chains (maybe)

- The whales come back, and hopefully just the stupid ones, like Justin Bieber haha! The smart whales will beat us every time, they have leverage, influence, and call the shots in everything from CeFi to DAOs, so I would be fine if they stay in copper or Krodor or Bulova or whatever they do with their endless wealth. I want the whales who are dumber than me to come in with their money and just spread the love (probably this will happen, right?)

- The crypto market cap grows again from non-crypto outside investor, desperate, or hobbyist wallets.

Number 3 is exactly what I think is highly unlikely to happen for a long time. In a sense, all the scammers, and liars, and hype-buckets, and bankruptcies, and well-intentioned but under-resourced devs, and greedy flipping whales all combined to kill the golden goose just when it started laying golden eggs. Millions of new people, like me, and like poor, poor El Salvador, came aboard and took a shot while the rest of the world watched, wondering if they should come aboard, too.

What they saw was every bias, rumor, ignorance, and truth about crypto come true in awful wave after awful wave.

I don't think they are coming back this year. Or in 2023. Or in 2024. I am acting on the assumption that the market cap of crypto won't get much above $1 trillion again until 2025. Whatever shrunken crypto I still have and whatever those fartholes at Celsius and BlockFi will give back to me...I am not planning to have anything to show for it until 2025.

And you can bet I WILL take profits then!

If you think the are coming back next year, well, I'll sell my entire Splinterlands card collection to you for the $1382 USD it was worth in the Summer of 2022! Let's call it an even 1300 HBD. Call me!

Posted Using LeoFinance Beta

really read the whole article! I can feel your pain and am really a bit amused by your societal analysis.

always thought about moving to the US, but it does not really sound that nice, these days.

!PGM !PIZZA

Thanks mate! Didn't mean for it to feel painful. Mostly I am just trying to get a read on what made crypto boom so much and then fizzle again. I don't think there will be a wave of people coming back into crypto for awhile, so many people tried and failed or watched others get cleaned out. I guess that is all I was going for.

But man, it is easy to lose money here haha!

!PGM

I lost 95% of my investments in crypto but I believe there is light at the end of the tunnel

Dang, so sorry to hear that! The losses I listed above, with splinterlands leading the way to oblivion, are about a 55% loss of my total portfolio, assuming I get nothing back from Celsius or BlockFi. Other than that, I had another 15% in WAX games, 20% in Hive stuff, and another 10% in cool coins like AVAX, SOL, etc. That last 10% is way down of course, with the rest of the market. My total number of WAX and Hive held is up quite a lot from P2E or LPs, but the USD value fell like everyone else's. But I don't mind that. I do see light at the end of the tunnel, too! I have kind of given up on seeing normal crypto make me money (like AVAX, BTC, etc) but I am looking at my Wax and Hive as their own little worlds. As long as I have more Wax and more Hive next week than I did this week, then I don't care what the USD value is. Does that make sense? I hope so! Thank for reading, BTW!

!PIZZA

I gifted $PIZZA slices here:

(3/5) @pregosauce tipped @doxdod (x1)

Send $PIZZA tips in Discord via tip.cc!